Home buyers tapping into late summer opportunities!

Even as inventory ticks up this week, prices are holding strong. Median home price in the US this week is $389,000, unchanged from a week ago.

Weekly @AltosResearch US real estate market data thread and video 🧵👇

1/6

Even as inventory ticks up this week, prices are holding strong. Median home price in the US this week is $389,000, unchanged from a week ago.

Weekly @AltosResearch US real estate market data thread and video 🧵👇

1/6

We're looking at 10% annual price gains as we wrap summer. You can see the market has cooled down from the insanity of April.

In a few months the lagging measures of home prices, like the Case Shiller will catch up with the Altos data here.

2/6

In a few months the lagging measures of home prices, like the Case Shiller will catch up with the Altos data here.

2/6

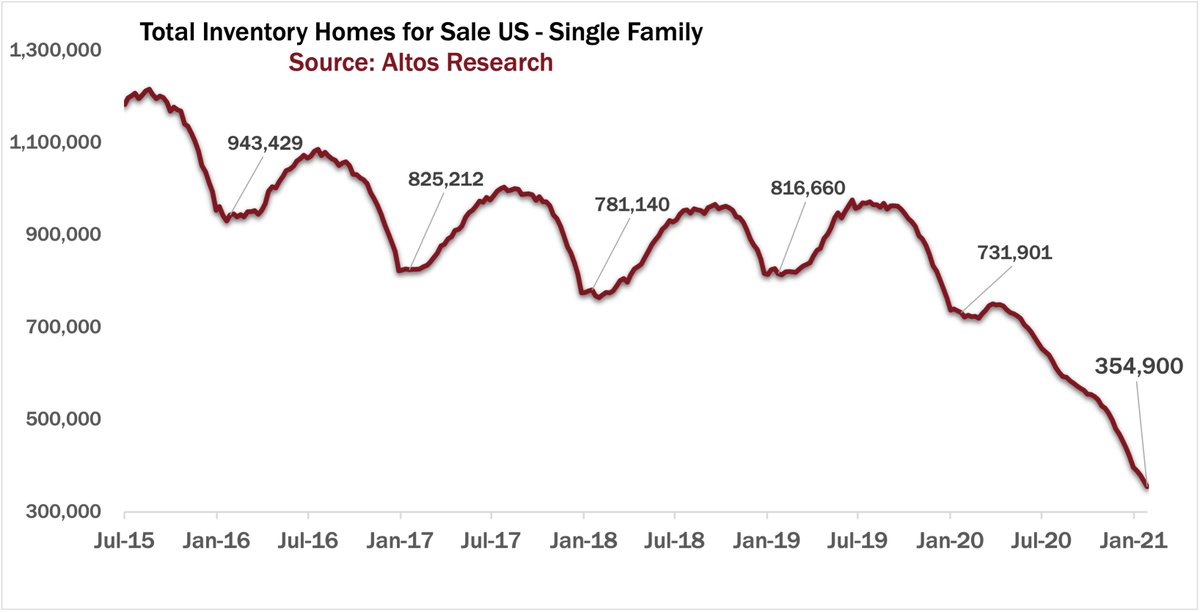

Inventory rose this week. Up 1.4% to 437,000 unsold single family homes. Even though the 2021 cycle has shifted later by a month, it's likely we're roughly at peak inventory.

Still 25% fewer homes available than last year, but up 42% from the bottom.

3/6

Still 25% fewer homes available than last year, but up 42% from the bottom.

3/6

Late summer buyer demand, as measured by our Immediate Sales tracker, is not abating.

About 24% of the homes that hit the market this week went into contract immediately.

No sign of any distressed inventory, but if it comes, buyers are waiting to pounce!

4/6

About 24% of the homes that hit the market this week went into contract immediately.

No sign of any distressed inventory, but if it comes, buyers are waiting to pounce!

4/6

Full details in this week's video.

"Home buyers take advantage of late summer opportunities"

Don't forget to subscribe to our Youtube channel to stay on top of the data each week!

5/6

"Home buyers take advantage of late summer opportunities"

Don't forget to subscribe to our Youtube channel to stay on top of the data each week!

5/6

Also - registrations are open for our full hour-long webinar September 9.

We dive deep in the data to see what we already know about the fall and winter housing markets. These fill up fast.

Register for Altos Webinar:

bit.ly/sep21-altos-we…

6/6

We dive deep in the data to see what we already know about the fall and winter housing markets. These fill up fast.

Register for Altos Webinar:

bit.ly/sep21-altos-we…

6/6

• • •

Missing some Tweet in this thread? You can try to

force a refresh