Another big pop in available inventory this week.

Are these the distressed sellers everyone's been anticipating for over a year?

Here's this week's #altosresearch look at the US real estate market. Thread and video:

🧵👇

1/7

Are these the distressed sellers everyone's been anticipating for over a year?

Here's this week's #altosresearch look at the US real estate market. Thread and video:

🧵👇

1/7

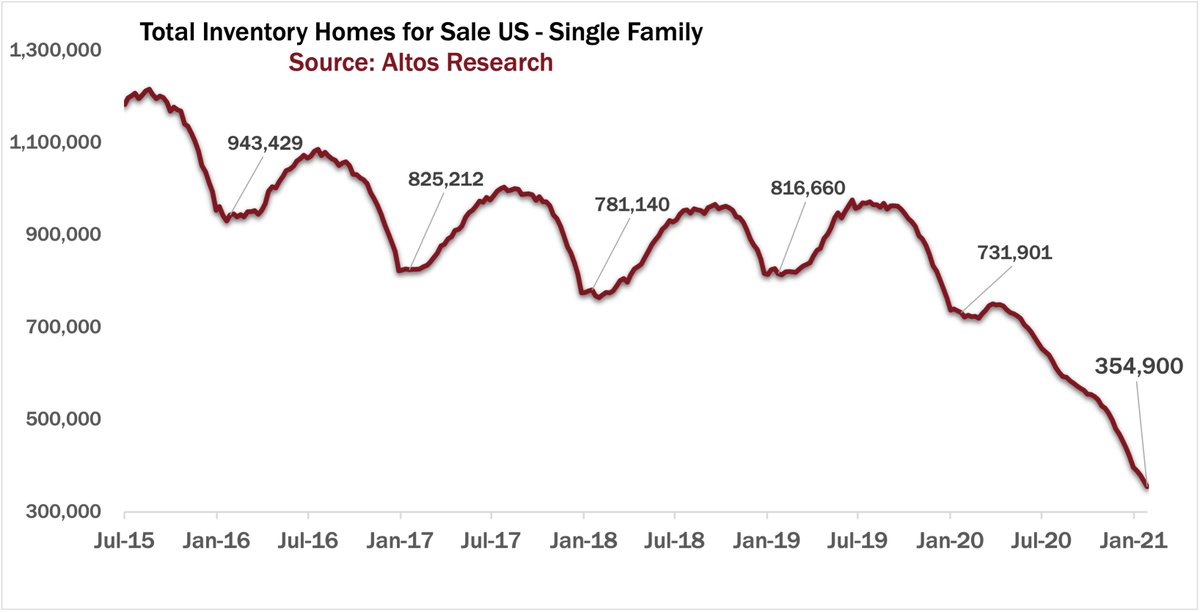

Inventory rose to 402,000 unsold single family homes. That's a 3.2% climb on top of last week's 4%.

Just last week I said we'd peak below 400k in August. Oops.

But - is it a surge of sellers or cooling buyers?

2/7

Just last week I said we'd peak below 400k in August. Oops.

But - is it a surge of sellers or cooling buyers?

2/7

Our Immediate Sales tracker has the insight. Of the 104,000 new listings this week. 21,000 of them sold immediately. That's the fewest in months, meaning more stayed unsold. Still crazy high, just slightly less crazy.

But, it's not a surge of distressed sellers.

3/7

But, it's not a surge of distressed sellers.

3/7

As a result prices staying stronger, longer in the year. Expect prices to start a pullback in August. Just tiny downticks as of yet this season.

Median home price is $398,900 this week. Down only $100 from last week.

4/7

Median home price is $398,900 this week. Down only $100 from last week.

4/7

If demand continues to weaken, or accelerates, we'll see it here in this leading indicator: properties with price cuts.

While only 22.6% have taken a cut, that jumped 1% from last week. Watch this number to see if it jumps even more quickly. (See the video for details)

5/7

While only 22.6% have taken a cut, that jumped 1% from last week. Watch this number to see if it jumps even more quickly. (See the video for details)

5/7

To understand demand in context, use our Market Action Index - at-a-glance "How's the market?"

At 57 this week, the MAI is still in record seller's market territory. This shows us that demand while cooling is still very very strong. No worries here at all.

6/7

At 57 this week, the MAI is still in record seller's market territory. This shows us that demand while cooling is still very very strong. No worries here at all.

6/7

If you're interested in the crazy US real estate market, maybe take 9 minutes with this week's @AltosResearch video. See it here first!

Inventory is climbing quickly - here's what's up:

7/7

Inventory is climbing quickly - here's what's up:

7/7

• • •

Missing some Tweet in this thread? You can try to

force a refresh