Are u ready for some optimism for markets & just life in general? The RBA 🇦🇺, like its government, isn't worried about Omicron as it sees economic recovery even w/ Omicron. Well, bad for bonds but good for outlook! And Indonesia scrapped year-end curbs as vaccination picks up! 🇮🇩

https://twitter.com/Trinhnomics/status/1465895167928332296

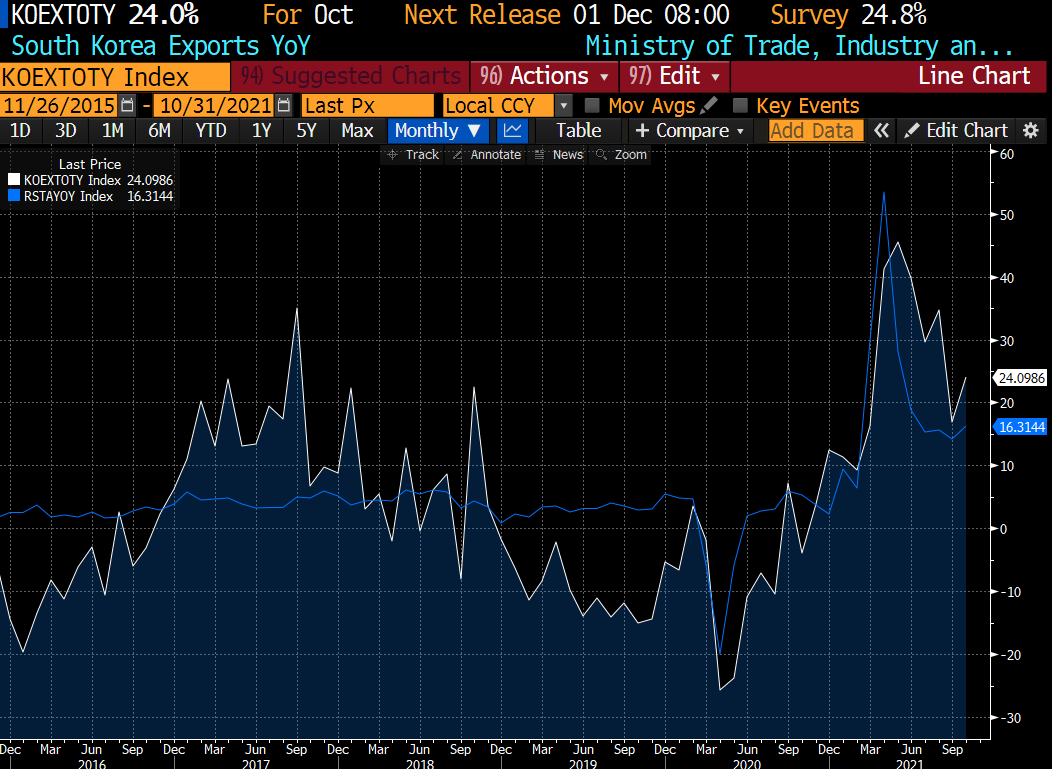

And there is another reason for optimism if u were Australian: China demand of commodity remains high, especially energy. Look at China imports from commodity exporters such as Australia, Brazil, Russia, Malaysia, Singapore, Indonesia, and the USA.

And?

And?

All of this commodity import is not just for domestic consumption but also to feed into its manufacturing exports, which continue to be in high demand globally in November.

Reiterating our @NatixisResearch @natixis call that the reaction function to Covid-19 has changed in EM Asia ex China and thus we have reasons to be optimistic about 2022 recovery. Indonesia just canceled year-end curbs!

wsj.com/articles/suppl…

wsj.com/articles/suppl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh