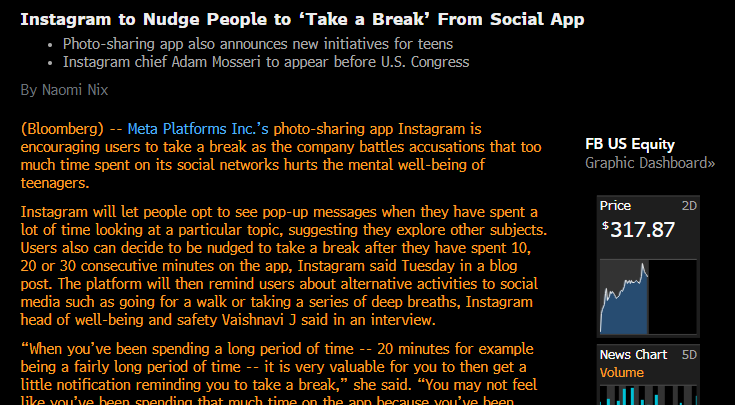

This news is interesting of Instagram, which is toxic for eve, especially to young girls, as it feeds people sociopathic tendencies - narcissism. Why u say? Well, if Meta acknowledges that it creates toxic content & also has algos to keep people addicted, then the solution is...

We all know what the solution is: JUST TURN IT OFF. Like stop using the very thing that makes you sad, waste a bunch of time and basically turn you into a worse person because let's face it, taking selfies all day long is rather a sad activity.

But no, it's nudging for a break.

But no, it's nudging for a break.

But not a real break is it? It says to look at something else on Instagram.

I mean, if you love your children, turn off their social media, that includes Instagram, Facebook, Snapchat, Tiktok. Have you seen what they do to little girls & what they do to feel validated?

I mean, if you love your children, turn off their social media, that includes Instagram, Facebook, Snapchat, Tiktok. Have you seen what they do to little girls & what they do to feel validated?

Have u ever tried to quit something rather addictive? Try it. Just make up your mind one day u will stop & do it. The easiest is to get rid of apps on ur phone. Second is to say, well, I'll just not do it. And then u stop caring & stop giving someone/thing power over ur life/time

Whether it is a bad person u're dating that makes u sad or an app that makes u feel worse seeing others so happy, the best way to GAIN BACK POWER U LOST is to NOT GIVE IT AWAY.

To stop saying yes & start saying NO. Like, no. Delete that app. They admit it's toxic themselves.

To stop saying yes & start saying NO. Like, no. Delete that app. They admit it's toxic themselves.

Saying NO to most things is the best way to say YES to what you really need & want in life.

People that say YES to everything & everyone & every app that comes out to take them away from real life ultimately say NO TO THEMSELVES.

Start deleting/editing your life aggressively.

People that say YES to everything & everyone & every app that comes out to take them away from real life ultimately say NO TO THEMSELVES.

Start deleting/editing your life aggressively.

• • •

Missing some Tweet in this thread? You can try to

force a refresh