So glad to release the World #InequalityReport 2022 today! It's been quite an adventure working on it, in the midst of a pandemics. The report comes with a wealth of data & its own website: wir2022.wid.world -check it out! If you're in a rush, here's what you need to know⬇️

A word on the pandemics: it has exacerbated global inequalities at the top and the bottom. Billionaires’ wealth rose by more than €3.6 trillion during the pandemics while more than 100 million people are in extreme poverty because of the crisis.

In 2021, we find that the global top 10% captures 52% of global income, while the poorest half captures only 8.5% of the total. Wealth is much more concentrated than income: the top 10% captures 76% of all wealth and the global bottom 50%, just 2% of it (see the video).

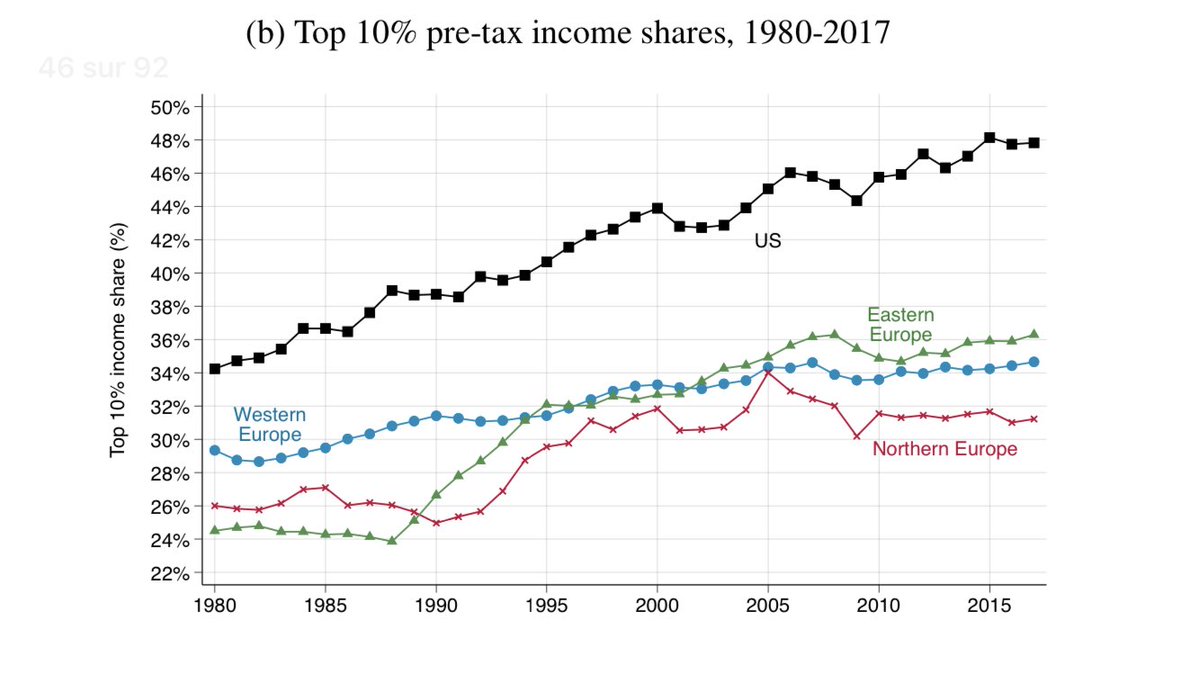

We observe a diversity of inequality regimes across the world. The top 10% income share varies between 35% (Europe) and 60% (MENA, S. S. Africa). The poorest half of the population earns 15-20% of incomes (Europe, East Asia) vs. less than 5-10% in the most unequal regions.

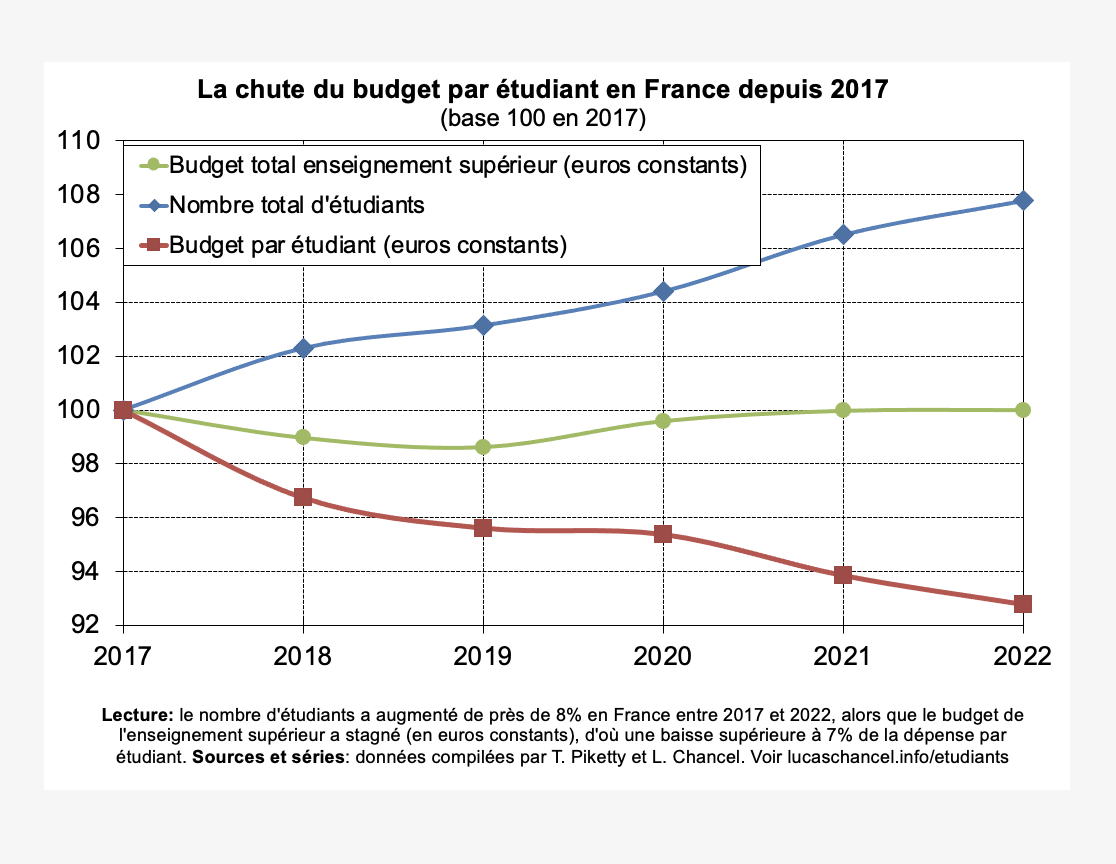

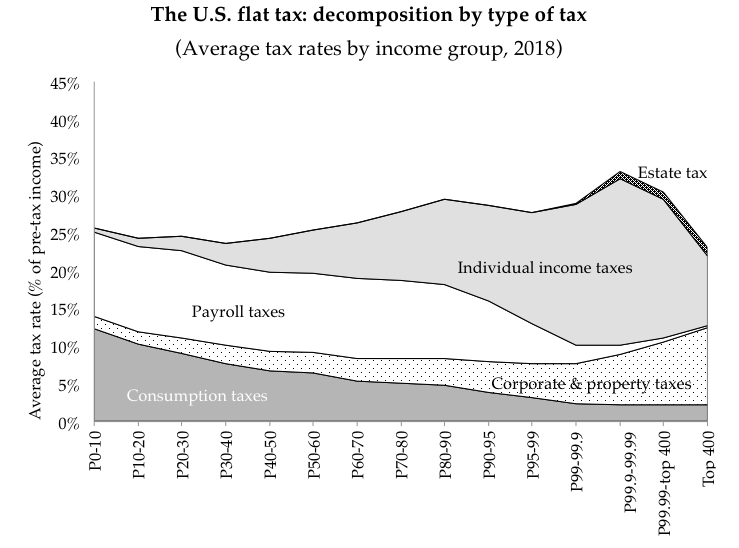

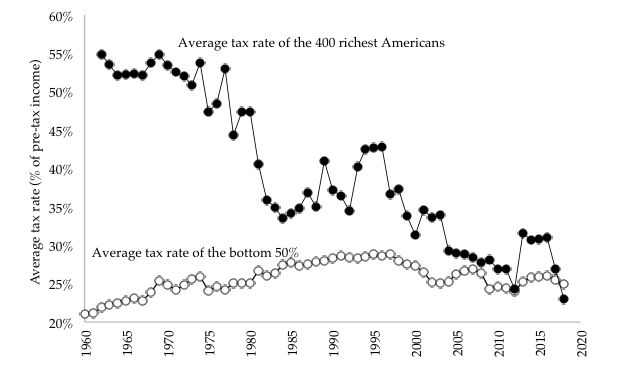

Most of the differences in income inequality levels measured after taxes can be explained by differences in inequality before taxes. This highlights the key role of social policies to tackle inequality (i.e. access to public services like health, education or labor regulations)

Indeed, social services need to be financed. Countries with low levels of inequality before taxes have large social states financed by taxes which represent 30-50% of GDP. In developing countries, taxes represent 5-20% of GDP. More on taxes below.

Here’s a striking & new result: while some countries do better than others to contain income inequality, all countries are very bad at limiting wealth inequality. Look for yourself: the bottom 50% wealth share is always below 5%. Half of the population almost doesn't own anything

At the global level, wealth creation has been very unequal over the past 25 years. The top 1% captured 38% of total wealth growth, the bottom 50% just 2% of it. The graph shows avg. annual growth rates across the world population. Growth rates were v. high for the v. wealthy.

The good news is that there is no fatality to inequality. The graph below shows that Europe & the US were able to reduce top 1% shares over the 20th century, thanks to policies & not just wars. A lot has been done... & there is still a lot to do (especially on wealth inequality)

From a historical perspective, *global* inequality remains as high today as at the peak of Western imperialism in the early 20th century. In other words, we still haven't fully exited the extremely unequal economic hierarchies created then.

The key novelty is the return of inequality within countries. While inequality between countries remain very large (think about the US vs. India), inequality within countries are even larger today (see graph below): there are super rich Indians and poor Americans...

New dimension of the report: global gender inequality. @asrobilliard & @ThereFeen show that women earn just 35% of labor incomes worldwide. Men make the remaining 65%. Parity means reaching 50% and, at current rates, it takes the world about a hundred years to get there.

Another new dimension: global carbon inequality. Climate change intensifies global inequalities between rich & poor nations & between rich & poor individuals within countries. In the report, we also document very large inequalities in contribution to climate change (see below).

There are indeed high emitters in poor countries, and low emitters in rich countries. We stress that accelerating the energy transition will be hard without significant redistribution of income & wealth from high polluters to low polluters within countries (and globally...).

Many more insights at wir2022.wid.world. Check it out - and if you like it, share it !

• • •

Missing some Tweet in this thread? You can try to

force a refresh