Here’s one article for the ages. Will prove to be a victory lap taken at the top just prior to its implosion.

#cryptocrash news.bitcoin.com/the-crypto-eco…

#cryptocrash news.bitcoin.com/the-crypto-eco…

So looking at the articles on the size and inflows of the crypto ecosystem it seems like this year will see ~$10b inflows, up from ~$7b last year. But the ‘value’ of all the coins in the system is said to have hit $3T. Even if we say total inflows in history have been $100b

It would mean that this ecosystem total market value is 30x its total historical cash inflow.

Or there is at best 3.3% actual cash in the system vs it’s market cap.

But, we know this number is likely way over stated. It’s not a $100b of total inflows over the last 12 years

Or there is at best 3.3% actual cash in the system vs it’s market cap.

But, we know this number is likely way over stated. It’s not a $100b of total inflows over the last 12 years

The crypto industry itself has consumed much of those dollars. The far majority of coins are just digital fiat with no backing. The stable coins are unaudited unregulated untrustworthy coins with very questionable holdings. Tether holdings being the biggest and most questionable

Here’s an example of a ‘stable coin’ blow up. Went from $60 to $0 in hours and surprised a noticeable billionaire investment influencer

cnbc.com/2021/06/24/why…

cnbc.com/2021/06/24/why…

Tether holdings got scammed a few years back by Crytpo Capital Corp.

coinsunveiled.com/2021/12/tether…

coinsunveiled.com/2021/12/tether…

Estimates where that that huge $850mm loss likely took its cash reserves down to 27% at the time and it engaged in some swaps and loans or what ever to pretend it still had 1 to 1 backing. (Has been found guilty of this in recent court case)

But fast forward to today…

But fast forward to today…

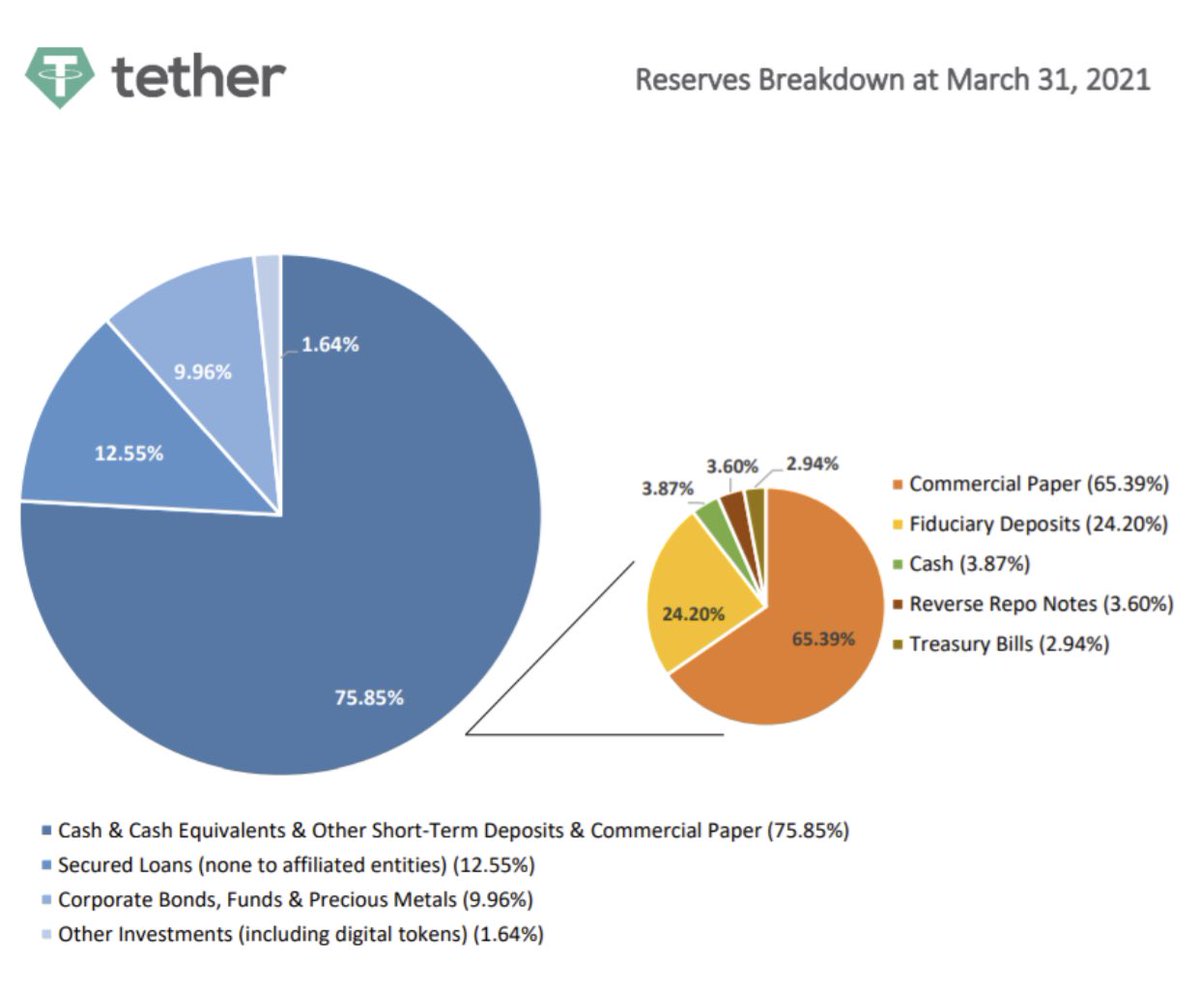

This is the extent of what we get in disclosures from Tether. 3/4 of assets are said to be commercial paper making them one of the largest owners of commercial paper in the world

Only problem is that no traders of commercial paper have ever heard of them or done business with them. The common belief is much of their holdings has come via swap arrangements. Basically like me giving you a billion ‘Kevin coins’ and you giving me ‘promissory note’ for $1b

Can even include some language in the note arrangement saying that if my ‘Kevin coins’ fall to below $1 the loan obligation is proportionately reduced.

Most seem to believe that lots of these Comercial paper swaps were done with crytpo exchanges and market makers / traders

Most seem to believe that lots of these Comercial paper swaps were done with crytpo exchanges and market makers / traders

So here’s how I and others believe the money has flowed in and out of the crypto ecosystem.

Someone new to crypto wants to open an account. So they register online with with one of the crypto exchanges / brokers. They fire up a PayPal account or wire money to fund the account

Someone new to crypto wants to open an account. So they register online with with one of the crypto exchanges / brokers. They fire up a PayPal account or wire money to fund the account

As the funds arrive they decide where to start and often times especially up to mid this year they would choose Tethers USTC ‘stable coins’ as there base crypto currency and open an investment in Bitcoin or other crypto coin.

But the base or the start is a Tether USTC coin.

The first step though is the digital wallet provider sells their customer the Tether coin in exchange for their USD.

Then on the exchange someone is willing to sell a Bitcoin and lists it as a ‘Bitcoin Tether Pair’

The first step though is the digital wallet provider sells their customer the Tether coin in exchange for their USD.

Then on the exchange someone is willing to sell a Bitcoin and lists it as a ‘Bitcoin Tether Pair’

So they offer out a Bitcoin in exchange for an amount of tether USTC coins. The new accounts freshly purchased tether coins are transferred to the Bitcoin seller and the new account now has Bitcoin

The exchange / coin broker now has their cash

The exchange / coin broker now has their cash

So continuing on with the follow the money exercise here. The exchange/broker has that Comercial paper agreement with Tether and likely starts paying Tether interest on that loan. So, some of the cash that came from the client goes to tether in the form of interest payments

What about the rest of that cash? Well it’s on the balance sheet of the unregulated, unaudited, coin broker / crypto exchange private company in some tax haven country.

It’s now their cash to use as they see fit. The likely buy some tbills or make other investments.

It’s now their cash to use as they see fit. The likely buy some tbills or make other investments.

As far as they are concerned it’s there money cause they borrowed the tether coins and sold them to their client. This arrangement then provides them with cash for advertising there exchange. Paying salaries, buying computers, the rent, electricity, maybe some company cars

Maybe an office building in the caymans. Maybe a lot of things. Private plane, hotels, dinners, wine etc. But trust me. I bet these sorts have been having a great time with all those billions that flowed in.

So what’s also likely happened…

So what’s also likely happened…

They decided that they should invest in some coins and help the market. Cause when Bitcoin and other coins go up it attracts money from greedy naive investors. And typically young males. So they do splashy ads featuring beautiful woman promoting how Bitcoin is going up .

All the brokers / exchanges have to do is call up Tether and engage in more swaps. Like we say last weekend. I think $3b of tether coins issues over a few days and boom. Bitcoin bounced…

My bet is the exchanges/coin brokers panicked when the say the crypto market crashing.

My bet is the exchanges/coin brokers panicked when the say the crypto market crashing.

So they called up tether and got $1bln in new coins and just bought Bitcoin on their balance sheet with the new tether coins.

How long has this shit been going on? Hard to say. How much of this Comercial paper is really just swaps between Tether and coin brokers? Hard to say.

How long has this shit been going on? Hard to say. How much of this Comercial paper is really just swaps between Tether and coin brokers? Hard to say.

How levered are the exchanges balance sheets? Who knows? Unregulated, unaudited, untrustworthy. Unfucking believable!

So to wrap this up… I’m thinking that the total inflows of actual US Dollar or other currency that has entered the ecosystem is under $100b.

So to wrap this up… I’m thinking that the total inflows of actual US Dollar or other currency that has entered the ecosystem is under $100b.

My bet is that the majority of that $100b has gone out of the system via exchange/coin broker balance sheet spending and out to tether executives and partners.

The $3T of imaginary wealth in the Crypto ecosystem is like I backed by 100 to 1 or less. 1% is my guess.

The $3T of imaginary wealth in the Crypto ecosystem is like I backed by 100 to 1 or less. 1% is my guess.

I’d be shocked if there’s more than $30b in actual cash on the balance sheets of all the exchanges and brokers combined in the crypto ecosystem but their ponzi participants like to pretend.. to ‘imagine’ they collectively have $3T.

This is going to end very very badly for them

This is going to end very very badly for them

Hope some of you found this helpful to understand how fucked this ponzi is. Truly fascinating and it’s gonna make a hell of a Netflix series. Would be a fun hobby to work on that with a producer/director.

Have a good one..

Have a good one..

• • •

Missing some Tweet in this thread? You can try to

force a refresh