@FinTelegram

Just read your article on optionsxo fintelegram.com/tag/optionsxo/

I concur with your thoughts on #tomerlevi he was central to these scams

Just read your article on optionsxo fintelegram.com/tag/optionsxo/

I concur with your thoughts on #tomerlevi he was central to these scams

https://twitter.com/intel_jakal/status/1299368607776874496?t=CrlSBXjbiPUbzrzTKxTjeg&s=19

#tomerlevi was named as the owner in court filing against #toromedia #binaryoptions #scam

en.globes.co.il/en/article-isr…

en.globes.co.il/en/article-isr…

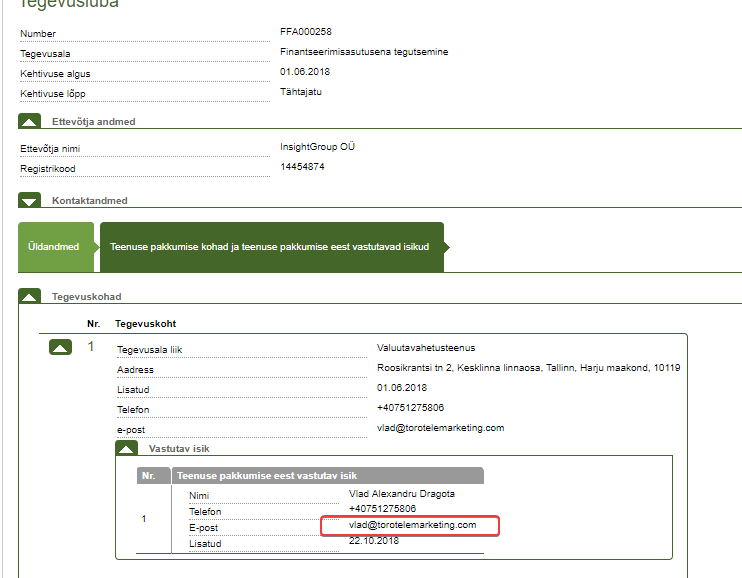

I came across these thieves while looking at $isx customer Insightgroup OU. #isignthis was (I guess still is) seeking $1.6m damages from @ASX why? apparently #insightgroup was so infuriated by the "false" #ASX claims against #isignthis it terminated its services. @FinTelegram

What a great storyline for a comedy #scammer terminates its contract with serviceco due to alleged #falseclaims (including accusations of servicing scam clients) and associated negative press.

upset serviceco sues for $1.6m in lost income from #scammer gets more negative press including a couple of rippers by @mrjoeaston including bit.ly/3oKLhvC and https://t.co/JN3HNk5AU6

The comedy doesn't really kick in until #isignthis #lemmings upset of anyone pointing out the obvious stupidity of making a claim for damages for lost revenue from an obvious #shitbox scammer.

Best was being called out by $isx's big swinging dick himself. @intel_jakal full of BS.....why? apparently his 'customer' was the "good" #olympicmarkets brand and had nothing to do with the "scammer" group.

Rationale? his customer domain olympusmarketss.com had an extra "s" where the scammer group olympusmarkets.com only had one "s" and they were registered to different jurisdictions. The argument appeared to be sufficient for some #lemmings

a) Scammers never ever setup shitbox shells in different jurisdictions. b) its common strategy when a brand name and domain are already being used to differentiate by adding an extra "s" .... I mean no where in history has a "SS" ever represented anything but good.

In the event that any of my hypothesis prove not to pan out. I'm not too up my own ass to front up and cop it on the chin. But in this case the prize of 'useful idiot' really goes to $isx king dickwad himself.

As its absolutely 100% without doubt insightgroup OU was part of the larger scam network run by #tomerlevi that I covered at the time.

Now that the criminal case in Austria is in full swing I'm looking forward to seeing what else I was right about...be interesting to see what other $isx customers might be identified as part of this and associated scam networks.

h/t to @FinTelegram. I recommend following and reading fintelegram.com

unroll @threadreaderapp

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh