1./ At the moment we have $LUNA, $bLUNA, $LUNAx and $nLUNA. $yLUNA and $pLUNA are coming. What are all those different types of $LUNA?

Let's dive into the greatest asset ever existed, $LUNA!

A thread 🧵

Let's dive into the greatest asset ever existed, $LUNA!

A thread 🧵

2./ $LUNA is the token we all fell in love with. To mint $UST the equivalent dollar amount of $LUNA have to be burned. The more $UST is minted, the less $LUNA is circulating so the more value one $LUNA has.

3./ $LUNA is the basic version of the token, this is the token that's available on exchanges like @binance and @kucoincom. To get access to all those different types of $LUNA you need to send your $LUNA from the exchanges to a #Terrastation wallet.

4./ Let's begin with the one we're probably most familiar with: $bLUNA. In order to take out a loan in $UST on @anchor_protocol you need to provide collateral. This collateral needs to be deposited in the form of bonded assets. Currently you can choose for $ETH or $LUNA

5./ To take out the loan, you have to bond your $LUNA. By doing this you mint $bLUNA. Once you have this $bLUNA deposited as collateral you can now take out a loan in $UST. You can now invest with this $UST while still keeping your $LUNA.

6./ This is a very interesting option to use your $LUNA. If you want to do this, please be aware of the fact that you can be liquidated once the price of $LUNA drops.

7./ Next one: $LUNAx.

As we all know once you stake your $LUNA it is locked. You can't use it elsewhere. $LUNAx is made by @staderlabs to make liquid staking available.

As we all know once you stake your $LUNA it is locked. You can't use it elsewhere. $LUNAx is made by @staderlabs to make liquid staking available.

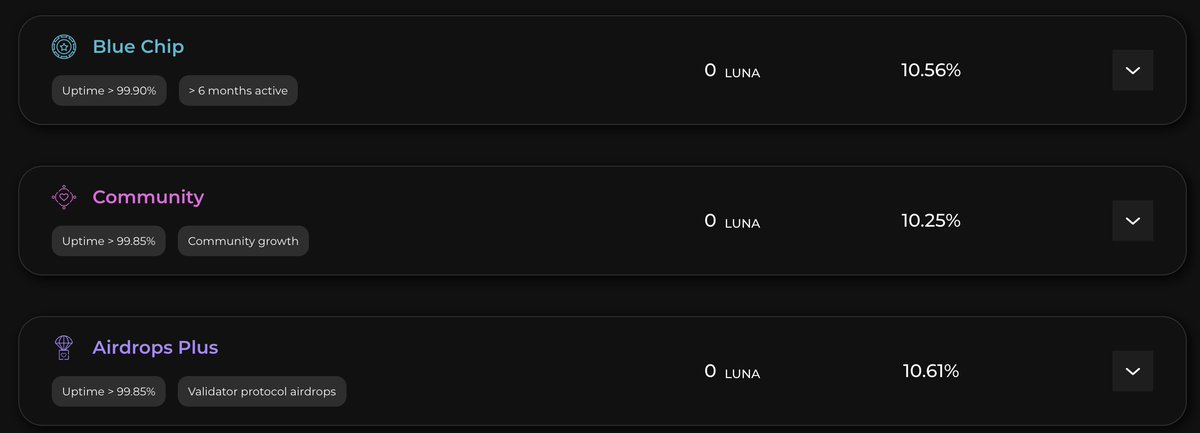

8./ If you do want to have the $LUNA staking rewards, I recommend you to stake at @staderlabs. If you use the liquid staking option, you'll get $LUNAx in return for staking your $LUNA. This $LUNAx can you use to provide liquidity which creates more capital efficiency.

9./ So what is $nLUNA?

As I just explained, when taking out a loan in @anchor_protocol there is a risk to get liquidated. Because many people face this risk, @NexusProtocol built an anti liquidation protocol.

As I just explained, when taking out a loan in @anchor_protocol there is a risk to get liquidated. Because many people face this risk, @NexusProtocol built an anti liquidation protocol.

10./ To use @NexusProtocol you have to deposit your $bLUNA in their dApp instead of in @anchor_protocol. Do you get the same loan? No. To be able to ensure you don't get liquidated the $UST loan is managed by @NexusProtocol. They make your $UST yield.

11./ By depositing your $bLUNA into @NexusProtocol $nLUNA is minted. You can use this $nLUNA to provide liquidity in a pool paired with $PSI, @NexusProtocol's token.

Why is this interesting?

Why is this interesting?

12./ Usually unbonding your $bLUNA takes 21 days. Now you can swap your $nLUNA against $PSI and swap your $PSI for $LUNA. This means you can almost instantly make your $bLUNA liquid again.

13./ These were the different types of $LUNA currently available. But there is more to come!

@prism_protocol will bring us $pLUNA and $yLUNA. So what are those?

@prism_protocol will bring us $pLUNA and $yLUNA. So what are those?

14./ @prism_protocol gives you the option to split $LUNA into a yield token, $yLUNA, and a principal token, $pLUNA.

By doing this, you can either go leverage on the price of $LUNA or on the yields of $LUNA without having the risk of being liquidated.

By doing this, you can either go leverage on the price of $LUNA or on the yields of $LUNA without having the risk of being liquidated.

15./ You're more interested in the yields? Split your $LUNA, sell your $pLUNA, buy more $yLUNA and you now are more exposed to the yield and less to the price. Of course you can also do this the other way around.

16./ You want both staking rewards and LP rewards? Stake your $yLUNA, provide liquidity with your $pLUNA and there you go! The options to use your $LUNA will explode once @prism_protocol launches.

17./ I'm sure this is only the beginning and I might even forget something that's already here or announced.

As you know, I think $LUNA is the greatest asset ever existed. With all these use cases, the demand will only increase.

As you know, I think $LUNA is the greatest asset ever existed. With all these use cases, the demand will only increase.

18./ Not even speaking about the decrease in $LUNA because the $UST minting.

$LUNA is just getting started. In a year we'll all be amazed by everything that's possible with $LUNA.

The future is beautiful. 🌕✨

$LUNA is just getting started. In a year we'll all be amazed by everything that's possible with $LUNA.

The future is beautiful. 🌕✨

• • •

Missing some Tweet in this thread? You can try to

force a refresh