1/ Thread: My presentation for Bangladeshi startups

North South University (NSU), a Bangladeshi university, invited me today to talk about financial modeling for the startups they are incubating. I started with a disclaimer that I never built any model for any startup...

North South University (NSU), a Bangladeshi university, invited me today to talk about financial modeling for the startups they are incubating. I started with a disclaimer that I never built any model for any startup...

2/ So my presentation was largely more qualitative than quantitative.

Here are my slides.

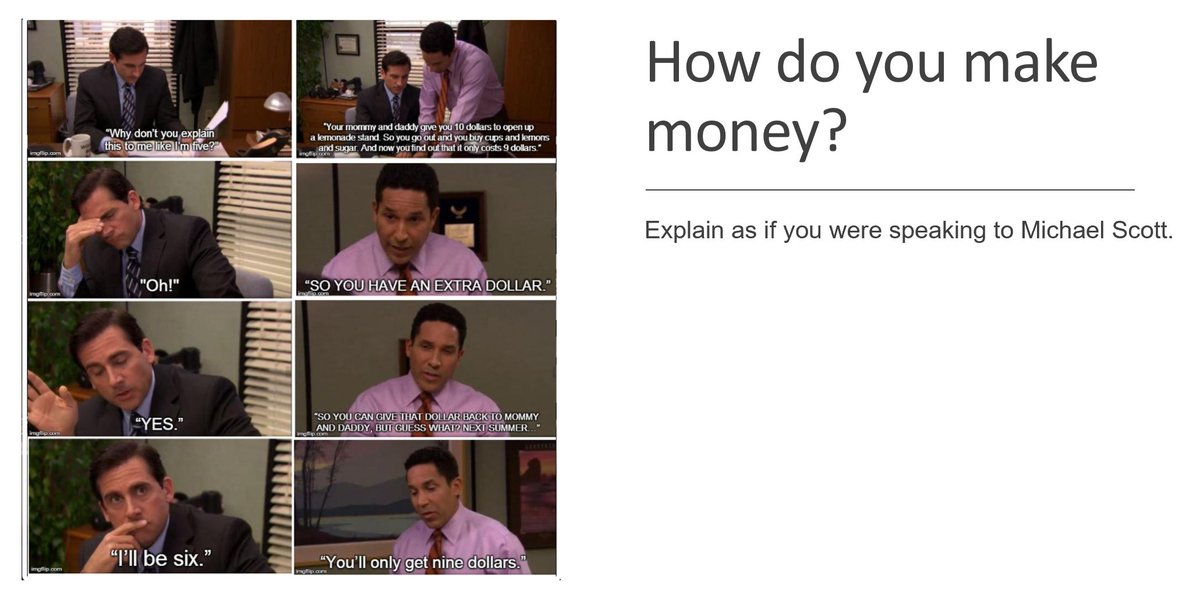

5 questions any business should ask.

Here are my slides.

5 questions any business should ask.

4/ How do you know you have product market fit?

Relevant link: review.firstround.com/how-superhuman…

Relevant link: review.firstround.com/how-superhuman…

7/ Why can't others do what you do?

Relevant links:

Innovator's dilemma: amazon.com/Innovators-Dil…

Do things that don't scale: paulgraham.com/ds.html

Relevant links:

Innovator's dilemma: amazon.com/Innovators-Dil…

Do things that don't scale: paulgraham.com/ds.html

10/ Some benchmarks (general rule of thumb; not recommended to be indiscriminately used)

Relevant links:

BVP: bvp.com/atlas/scaling-…

The source of the table is not available online.

Relevant links:

BVP: bvp.com/atlas/scaling-…

The source of the table is not available online.

End/ All my twitter threads can be found here: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh