A thread on wrapping your head around valuation in the #crypto space👇

Price to earnings: #Ethereum at a Price to earnings of 30 while growing at ~200% per year is insanely cheap. @solana and @avalancheavax have a p/e of ~2000 and 300 respectively via @tokenterminal For perspective Apple has a p/e of ~30 and historically has grown at ~30%

Coin market cap: @Bitcoin ~$900b, @ethereum ~$450b, @solana ~$50b, @Cardano $40b @Polkadot ~$25b @avalancheavax ~$20b via @CoinMarketCap. @apple is worth $3T, @Microsoft $2.5T, @Google $2T. If one of these provides the value of even one of these companies still a long way to run

Asset class market cap: #Crypto is $2.1T. Global value of all stocks is $100T, bonds and real estate similar. If this is a new asset class then we have 50x to go. You can pick plenty of losers and still win by finding a winner or two. h/t @RealVision for this mental model

Quantity Theory of Money: MV = PT

Where:

M is the money supply

V is the velocity of money in a given time period

P is the price level

T is the transaction volume in a given time period

h/t @LynAldenContact

Where:

M is the money supply

V is the velocity of money in a given time period

P is the price level

T is the transaction volume in a given time period

h/t @LynAldenContact

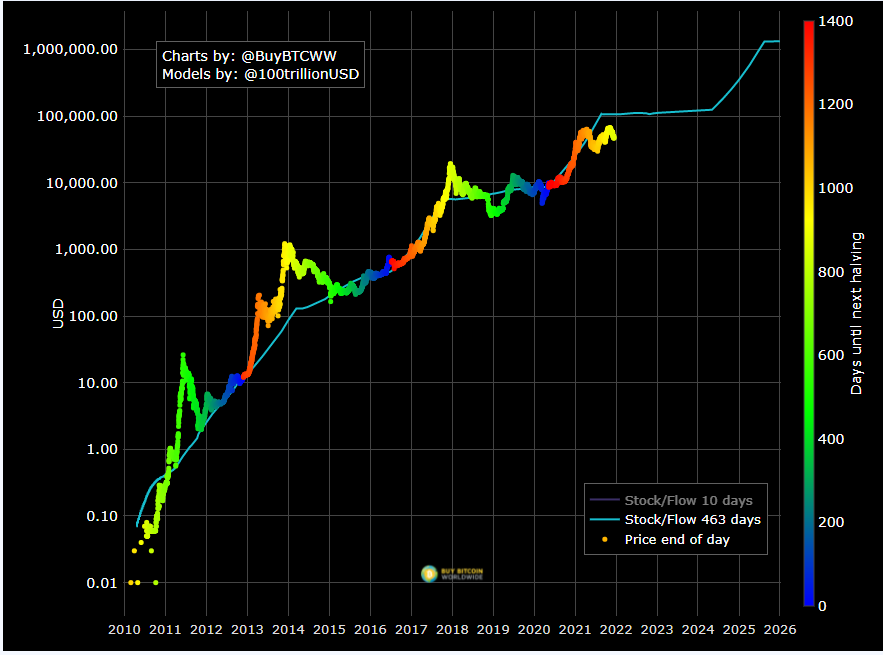

Flows: Made famous for BTC via @100trillionUSD this approach attempts to value BTC in a way similar to other assets like gold. Its basic concept is commodities aren’t good stores of value bc new supply is always coming online. But only small amounts of new BTC, gld and slv are

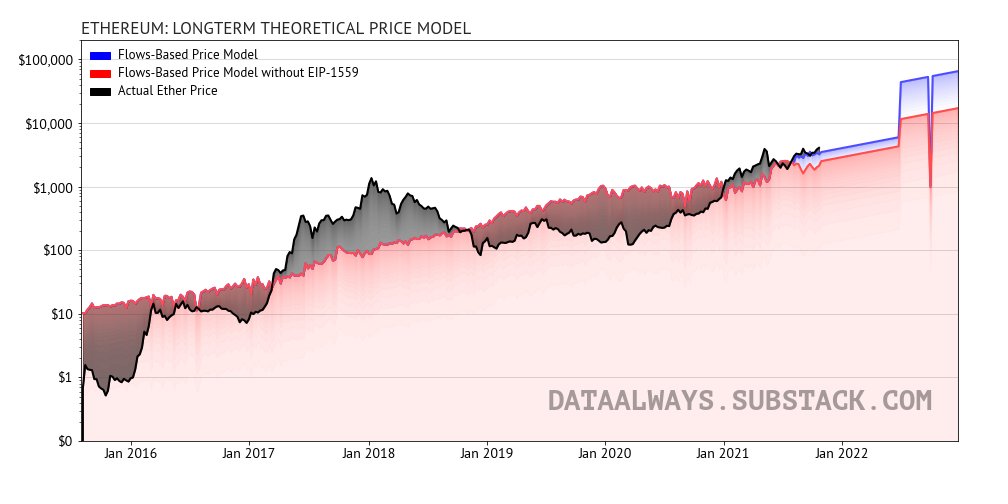

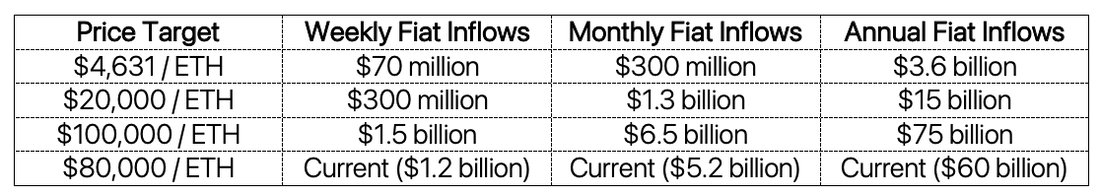

Flows for Eth: introduced by @Data_Always

• • •

Missing some Tweet in this thread? You can try to

force a refresh