Copper - the metal that conducts electricity & heat best - is high in demand & short in supply.

Yet, the macro concern is all about China's property slowdown.

Let's give a go at that. Short thread

Yet, the macro concern is all about China's property slowdown.

Let's give a go at that. Short thread

First, what is copper used (not "consumed", but "used" in durable goods & recycled thereafter) for?

Answer: for everything. But "building construction" is 28% of global copper use. Likely 50% of that is China construction related (hard to precise), say 4.1mtpa.

2/..

Answer: for everything. But "building construction" is 28% of global copper use. Likely 50% of that is China construction related (hard to precise), say 4.1mtpa.

2/..

Of those 4.1mtpa however, a part is infrastructure construction related, which China does not slow down for now. Say, "building construction" related is 2-3mtpa - an unknown known.

3/..

3/..

Here is the concern: China's property sector is 29% of GDP and 4.5% of global GDP. About 66% of Chinese wealth is property related. These numbers are not healthy and need correction, certainly because much of it is debt fuelled.

4/..

reuters.com/world/china/ch…

4/..

reuters.com/world/china/ch…

In the US, housing contributes 15-18% to total GDP, most of which is "consumption spending on housing services". So China indeed must reduce is property construction spending big time, for years, if not decades to come.

5/..

nahb.org/news-and-econo…

5/..

nahb.org/news-and-econo…

Going forward, China's copper use therefore may well reduce by 0.5-1.5mtpa in the building construction sector. Such a loss has to be permanent. The key question however is: will China and/or the world use this copper elsewhere to compensate the loss?

6/...

6/...

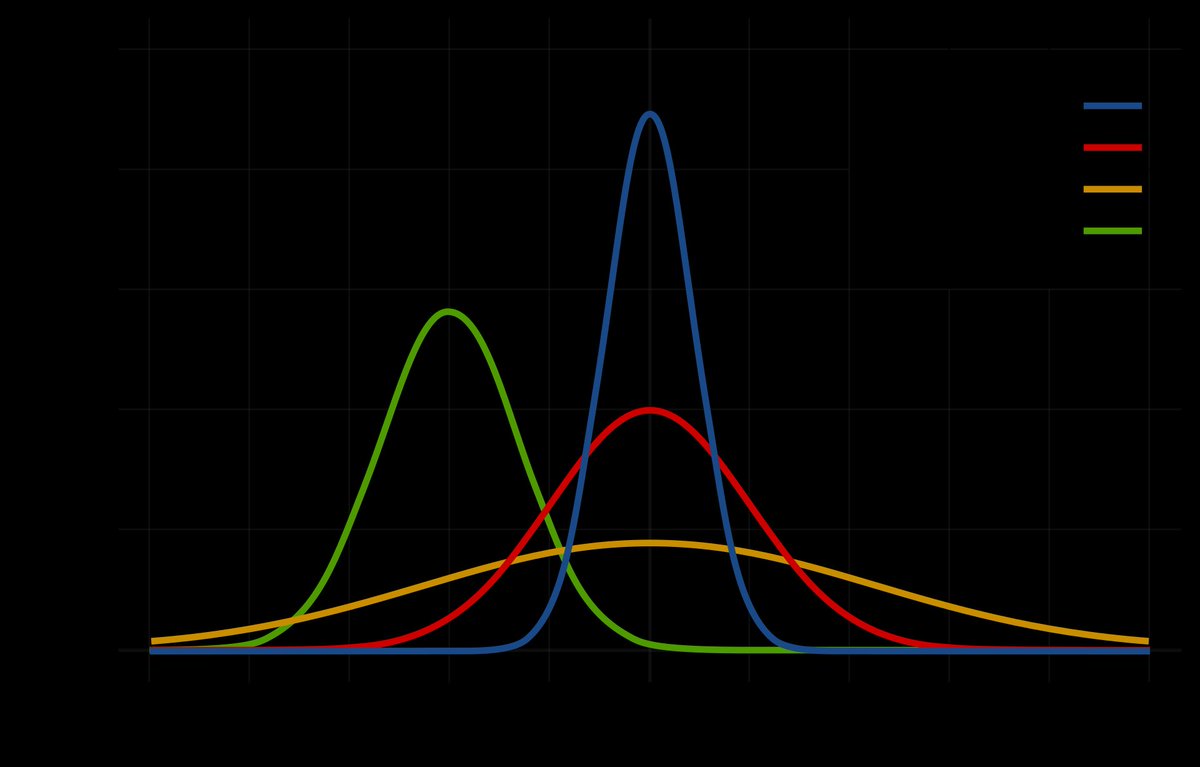

The source of compensation is the green shift, away from ICE cars to BEVs; away from coal to wind/solar; etc. The "greenification" requires the electrification of everything - a lot of copper!

For perspective: "green" investments the size of 6x US GDP 2020 over 30 years!

7/..

For perspective: "green" investments the size of 6x US GDP 2020 over 30 years!

7/..

As importantly, the GDP direction of China may not help to understand a single commodity. Rather, China's massive economic imbalances matter to forecast "winners and losers" in commodities land due to China.

8/...

8/...

https://twitter.com/BurggrabenH/status/1468003734231736327?s=20

For instance, China's property sector is likely in "hard landing" right now while its GDP must therefore contract (were China to report truthfully).

Yet, China needs more (NOT less) commodities: Diesel, coal, metals etc.

9/..

Yet, China needs more (NOT less) commodities: Diesel, coal, metals etc.

9/..

https://twitter.com/BurggrabenH/status/1468744474461360136?s=20

Meanwhile, China is serious about renewables. Last week the CCP requested provinces to submit solar projects - each >1 GWh (!). This is one way to illustrate that China's commodity consumption/use cannot be understood by its GDP direction alone.

10/..

10/..

https://twitter.com/BurggrabenH/status/1467786232495284225?s=20

Meanwhile, Xi awaits re-election and the Winter Olympics. This is why it is likely that China eases credit slowdown & allows for a new impulse instead.

11/...

11/...

https://twitter.com/BurggrabenH/status/1468959097269587976?s=20

Goldman goes one step further & increases total Chinese copper use yoy for 2022 and beyond due to various factors.

12/..

12/..

Goldman also argues: "Moreover, should the property sector overshoot to the downside, copper demand holds a 'policy put', in our view. Indeed, this incremental demand protection has begun in recent weeks, for example the RRR cut at December's Politburo meeting."

13/...

13/...

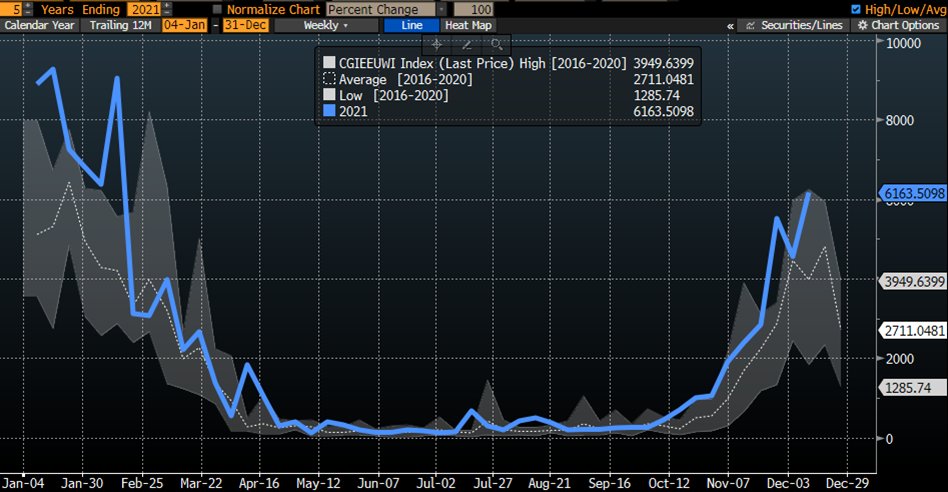

Overall, Goldman continues to see a structural deficit for the copper sector for years to come.

14/...

14/...

The above view is fundamental & potentially wrong or irrelevant for the market. DYOH & never underestimate the macro-regime a market is in. The best processes, such as @KeithMcCullough from @Hedgeye, support you in understanding this force. Thx coach.

15/...

15/...

For instance, @MacroAlf offers a rather bearish outlook for the metal in the short term based on his macro regime outlook. Accept.

16/...

16/...

https://twitter.com/MacroAlf/status/1471214563253272586?s=20

Finally, do not mix up copper with copper equities. The latter carry high beta and may well go down while copper continues to trade in a tight range. For a clue on copper price, here is some insight...

17/...thx, pls share

17/...thx, pls share

https://twitter.com/BurggrabenH/status/1398098074493456385?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh