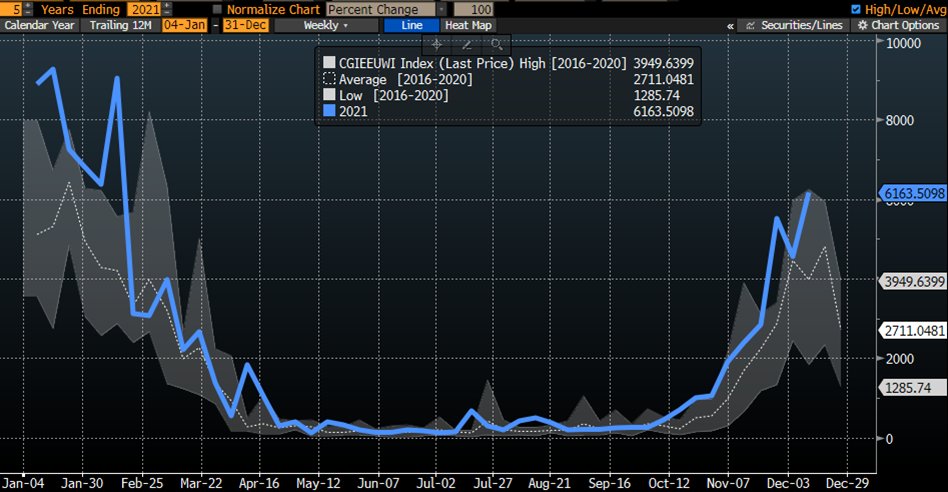

In Europe, US$ 200/boe hydrocarbon prices arrived as the EU gas hub price TTF is going vertical.

Note: €102/MWh = US$33.8/MMBtu (or $33.8/Mcf) = US$ 203/boe (barrel of oil equivalent)

Why?

1/4 @OKalleklev @NachoTrust

Note: €102/MWh = US$33.8/MMBtu (or $33.8/Mcf) = US$ 203/boe (barrel of oil equivalent)

Why?

1/4 @OKalleklev @NachoTrust

Because the EU continues to withdraw gas at a record pace when compared to its 5-year averages due to colder than average weather.

2/...

2/...

All this on the back of very low gas storage levels as the winter months are ahead.

If we want to learn more why EU energy security increasingly becomes a prayer, not a policy, please read the thread below.

4/4

If we want to learn more why EU energy security increasingly becomes a prayer, not a policy, please read the thread below.

4/4

https://twitter.com/BurggrabenH/status/1463568920158289934?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh