The Art of asking smart questions | When do you really graduate as an investor?

Time for a thread🧵🧵🧵🧵🧵

Retweet for Max reach!!

Time for a thread🧵🧵🧵🧵🧵

Retweet for Max reach!!

You graduate as an investor when you start asking things like the quality of revenue, incremental quality of earnings and the competitive landscape. Eg:- One API player will grow earnings because of shortage in market for those

APIs but the other one which will grow because of being the lowest cost producer. The markets often give higher Valuations to the latter player.

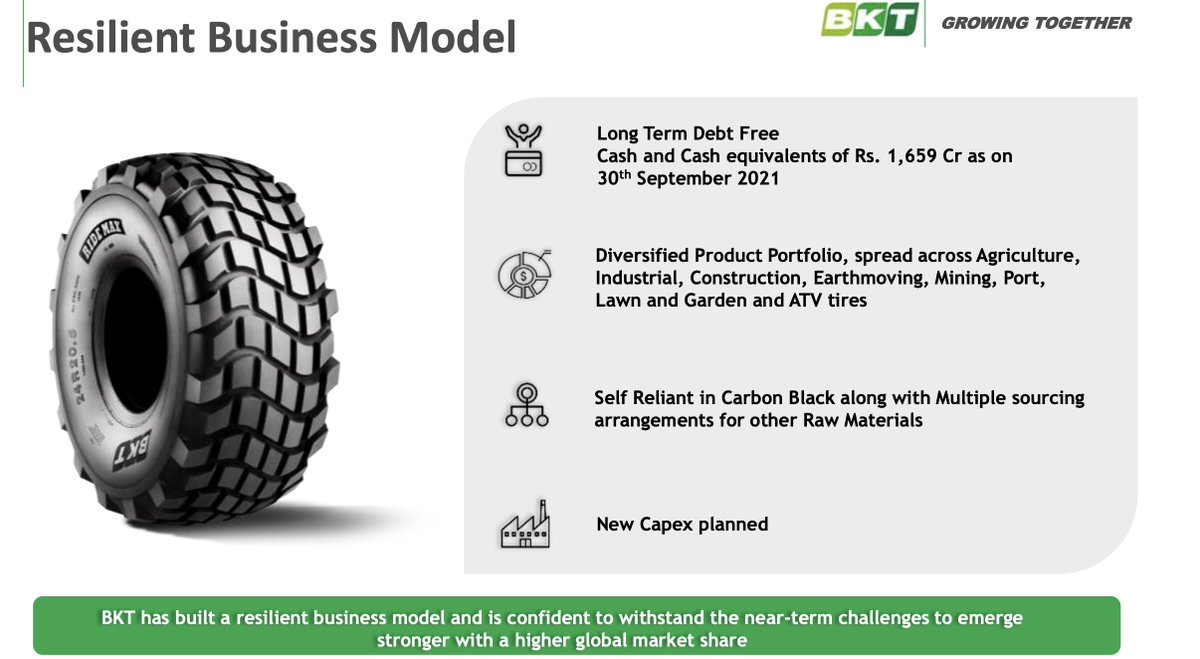

Another example that comes to mind is Balkrishna Industries vs other tyre players.🚜🚜

Another example that comes to mind is Balkrishna Industries vs other tyre players.🚜🚜

Given the fact that it is the lowest cost producer and has the highest margins. It always gets a premium to the other players in the tyre space. Whether at peak or at trough.

One more example is that of APL Apollo, same business got low valuations during the last cycle and collapsed by 50%+ when their EBITDA per tonne reduced. In this cycle, the value added proportion has increased.

The company is entering products with EBITDA per tonne of Rs. 20,000 vs their average EBITDA per tonne of Rs.3500-4000.

If they do this successfully, this will become a much more stable and structural business, thereby killing the shallow cyclicality in margins permanently.

If they do this successfully, this will become a much more stable and structural business, thereby killing the shallow cyclicality in margins permanently.

Some structures improve over a period of time.

Your real graduation as an investor comes when you do 2-3 steps deeper than plain vanilla analysis.

Always start with why and think about the second and third order consequences.

Your real graduation as an investor comes when you do 2-3 steps deeper than plain vanilla analysis.

Always start with why and think about the second and third order consequences.

2 case studies where markets are rightly circumspect!

PI Industries has been trying to get into the pharma adjacency since early 2013. Yet, they haven’t been able to do it.

The company recently raised equity and even tried to acquire IndSwift Labs.

PI Industries has been trying to get into the pharma adjacency since early 2013. Yet, they haven’t been able to do it.

The company recently raised equity and even tried to acquire IndSwift Labs.

One major question that comes to mind:- Why will PI go into Pharma? Simple answer is “size of opportunity”.

Size of the market for Agro CRAMS is $6 Billion and PI is already doing almost 4000 crores (saturated market?) of sales.

Size of the market for Agro CRAMS is $6 Billion and PI is already doing almost 4000 crores (saturated market?) of sales.

To keep growing in size and to continue with the past growth rates, PI has to expand the Total Addressable Market size (TAM).

Stock will remain in consolidation range in my view, till the business is able to digest a Pharma asset and deliver earnings.

Stock will remain in consolidation range in my view, till the business is able to digest a Pharma asset and deliver earnings.

Suven Pharma, ever since the co announced the 600 crore maintenance capex. Just imagine the 2nd, 3rd and 4th order consequences.

First order consequence:- Free cash flow generation reduces

2nd order consequence:- Depreciation increases,

3rd order consequence PAT growth🔽🔽

First order consequence:- Free cash flow generation reduces

2nd order consequence:- Depreciation increases,

3rd order consequence PAT growth🔽🔽

4th order consequence Capital employed increases without any effect on the numerator.

Final consequence, ROCE takes a dip. Always start with Why and then what (post an action)

Final consequence, ROCE takes a dip. Always start with Why and then what (post an action)

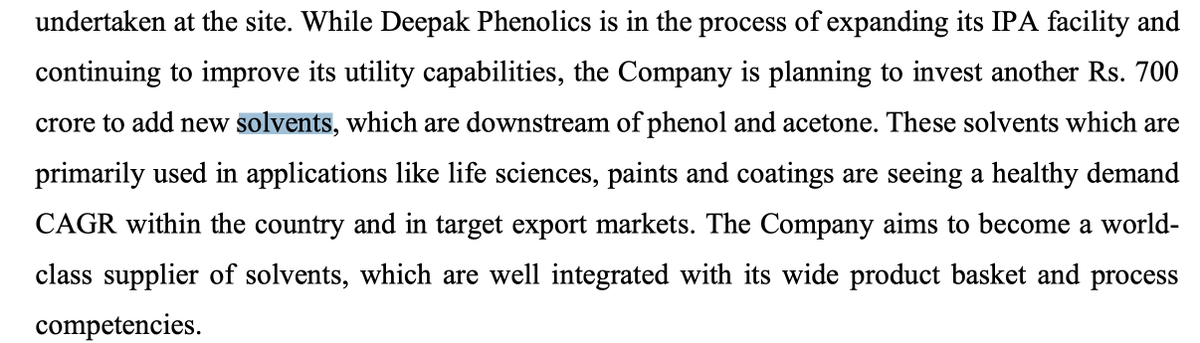

Finally we come to Deepak Nitrite. This example will help you to understand why it is important to read annual reports as an investor.

In 2016 Deepak Announced this mammoth capex for a Phenol plant, lets see what they wrote in the annual report:-

In 2016 Deepak Announced this mammoth capex for a Phenol plant, lets see what they wrote in the annual report:-

‘While initially Phenol & Acetone would be filling imports gap as bulk commodities, in the long run they will support specialities for markets such as perfumeries, plastic additions and decorative laminates.

A major contribution from phenol segment would be in offering a range

A major contribution from phenol segment would be in offering a range

of solvents for the pharma industry.’

Ever since then the game plan was clear if you read between the lines,

First Part=Bulk chemicals i.e. import substitution = x

Ever since then the game plan was clear if you read between the lines,

First Part=Bulk chemicals i.e. import substitution = x

2nd Part- Backwards integration for downstream for Higher margin products

Final stage, Fully integrated value chain of Phenol & Acetone⚗️⚗️

Let’s look at the recent capex announcements 5 years post that :-

Final stage, Fully integrated value chain of Phenol & Acetone⚗️⚗️

Let’s look at the recent capex announcements 5 years post that :-

These are some examples which can help you to graduate as a business analyst. Always think about tomorrow and the consequences of the management's actions today!

Observe, think deeper and always stay 2 steps ahead of Mr. Market. Know your business inside out :)

Observe, think deeper and always stay 2 steps ahead of Mr. Market. Know your business inside out :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh