Why Indoco Remedies looks Interesting and why FY22-24 growth is likely to be stellar here?

Time for a thread🧵🧵🧵🧵

(Source for ophthalmics data:Nirmal Bang and rest is own work)

Time for a thread🧵🧵🧵🧵

(Source for ophthalmics data:Nirmal Bang and rest is own work)

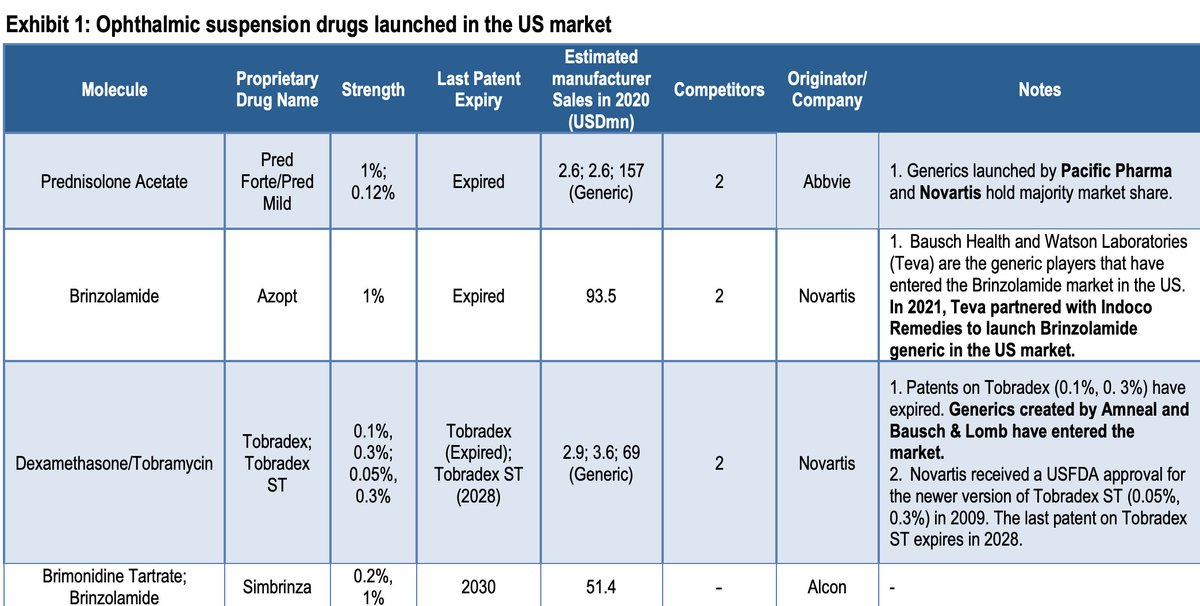

Looking at the incremental opportunity in Ophthalmics:-

Market size is not attractive for the Large Generic companies but for someone like Indoco which has a smalll base in exports business

Market size is not attractive for the Large Generic companies but for someone like Indoco which has a smalll base in exports business

As per the USFDA’s orange book, for Ophthalmic suspension drugs, only 3 out of 17 molecules have an active patent. Among the 14 molecules that are patent expired, 8 molecules are yet to see generic

competition.

competition.

Even for the one’s which have seen generic competition, the competitive intensity is very low and there is space for an additional entrant.. Entrenched players like Novartis, Bausch & Lomb and Abbvie have dominated this market with legacy products for decades.

Indoco Remedies and Sun Pharma are the only Indian generic manufacturers to have successfully won approvals for generic version of Ophthalmic suspensions in the US market. Indoco Remedies has recently launched generic version of Azopt (brinozolamide)

while Sun Pharma also only recently received approval for gLotemax (loteprednol suspension). A break up of the ophthalmic Products launched in the market:

As you can see there are very few generic players in the market due to complexity of manufacturing and small size of the industry

Thesis entails:

1. Strong recovery in Domestic Heavy Acute Portfolio.

2. Hiring a Chief Marketing officer which indicates to something+Changing the logo (signalling)

3. UK & US exports will show disproportionate growth this year due to regulatory issues being solved

1. Strong recovery in Domestic Heavy Acute Portfolio.

2. Hiring a Chief Marketing officer which indicates to something+Changing the logo (signalling)

3. UK & US exports will show disproportionate growth this year due to regulatory issues being solved

4. MR productivity is horribly low, 2.7 lakhs. This can easily go above 3-3.5 Lakhs.

5. Indoco is the fastest growing domestic pharma business this year and they are targeting Sub-Chronic therapy launches.

6. Un-utlised gross block as the company

5. Indoco is the fastest growing domestic pharma business this year and they are targeting Sub-Chronic therapy launches.

6. Un-utlised gross block as the company

did capex but couldn't utilize it due to regulatory issues b/w 2017-2019.

7. Co is sitting on substantial operating leverage, and has the potential to do 24%+ ebitda margins in my view. First Q this year they already did 22%.

8. Management guiding to double the Ebitda in next 3

7. Co is sitting on substantial operating leverage, and has the potential to do 24%+ ebitda margins in my view. First Q this year they already did 22%.

8. Management guiding to double the Ebitda in next 3

years and tax rate reducing to normal corporate tax rate (26%).

Conclusion-co is changing the ROCE and the earnings profile going forward. Hope this thread adds value 🙏

Disc: invested from lower levels.

Watch our video to learn more🔗:

Conclusion-co is changing the ROCE and the earnings profile going forward. Hope this thread adds value 🙏

Disc: invested from lower levels.

Watch our video to learn more🔗:

Q2FY22: Export biz performance

European business suffered QoQ due to container issues. These dispatches would get bunched up and delivered in next 2 quarters.

US Business is very healthy, we will recover in Q3 & Q4. Profit share comes on receipt, its a long cycle (will come)

European business suffered QoQ due to container issues. These dispatches would get bunched up and delivered in next 2 quarters.

US Business is very healthy, we will recover in Q3 & Q4. Profit share comes on receipt, its a long cycle (will come)

India Business:- growth aided by strong season and subdued base last year. Seeing upside on Opthal basket as we focused on this during the lockdown.

Selling 10 products in US, and going to launch 3-4 more from ophthalmics basket.

On track in my view. Scarcity of containers

Selling 10 products in US, and going to launch 3-4 more from ophthalmics basket.

On track in my view. Scarcity of containers

From next year tax base will go from 36% to 25%.

MR Productivity is currently 2.6 Lakhs, not hiring new MR's. Expect it to keep increasing. Sticking by the guidance given at the beginning of the year:

• • •

Missing some Tweet in this thread? You can try to

force a refresh