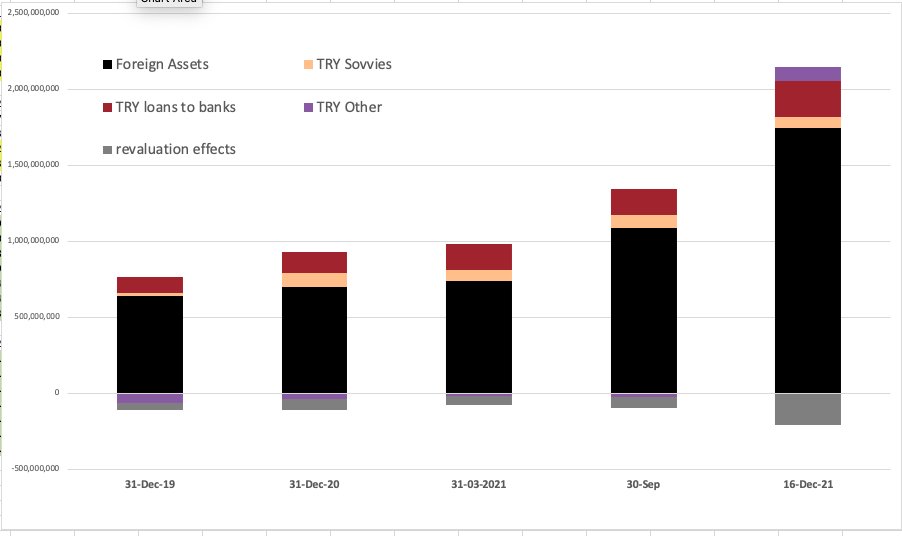

lowering interest rates and then burning through your hard cash is an interesting way of managing your exchange rate. #whateverittakesbutnocapitalcontrols

https://twitter.com/CentralBank_TR/status/1471795617852796936

historians of the global financial cycle will have a great time explaining Erdogan as inexplicably contrarian till the bitter end (30?50?)

guys, the analogy with China in the 80s is wrong not because of industrial policy, but because China was basically closed to capital flows, whereas Turkey stubbornly refuse to follow that path and impose capital controls.

London-based banker doesnt need Zimbabwe hyperbole - look at Eastern Europe after the collapse of central plan, massive exchange rate devaluations spiralling into prices and finishing in massive industrial contractions.

and to be clear - I've seen/lived through/studied speculative attacks enough to have some sympathy for 'speculators' discourse, but the Erdogan way wont defeat them. it kind of proves their point.

incidentally, one famous speculator that got himself fired by Romanian central bank governor in 2008 ended up being the most disastrous PM Romania ever had.

not sure what the lesson is, except ringfence politics from speculators :)?

not sure what the lesson is, except ringfence politics from speculators :)?

Romania cb bank response to 2008 speculative attack:

- spokes guy denouncing 'speculators from City in London' on TV

- starve interbank market to prevent locals from providing counterparty liq to foreigners, push rates up and stop publishing them

- spokes guy denouncing 'speculators from City in London' on TV

- starve interbank market to prevent locals from providing counterparty liq to foreigners, push rates up and stop publishing them

- finally, governor called local bank CEOs and got the clever guys providing counterparty liq to foreigners fired.

massive difference - in Romanian speculative attack the ego that mattered was the central bank governor's, and he resented the overturn of the nice social contract he had agreed w foreigners where carries were validated smilingly.

btw - massive subtweet - can we please stop invoking Zimbabwe as basket case for everything macrofinance under the sun, it says more about the peddler of hyperbole than about the point they are trying to make

the IMF wrote a great primer after East Asian 1997 on how to segment local interbank market so you can both restrict shorts and protect the economy from high interest rates

time to dust off the manual, not just for Turkey

time to dust off the manual, not just for Turkey

https://twitter.com/DanielaGabor/status/1291284721784233984?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh