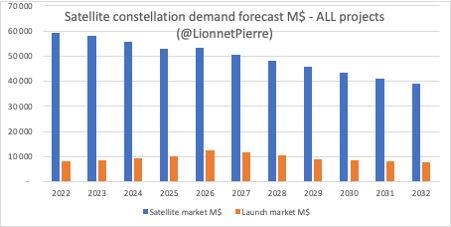

After seeing so many "artistic" space market forecasts lying around, and considering that this art form seems not so difficult, I decided to try my hand at it with a forecast on constellations markets. Here is my step by step tutorial applied to real data. 1/

But first the key findings. If ALL constellations announced today eventually secure the funding to deploy in full, the total (additional) satellite demand would be between 40 and 60 B$/year, and the launch demand would be 8B$/year. There would be >16000 sats launched per year. 2/

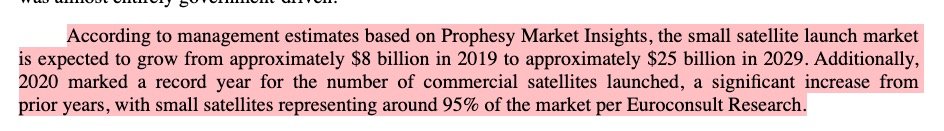

In other words if ALL the announced constellations eventually happen the total launch market value would double in the next decade, and the value of the satellite market would increase by 50-70%. But is this a credible prediction? 3/

Of course not, some projects will never get funded, and some (a lot) will technically fail (others will deploy then go bankrupt). So I have given each project a probability of deployment (from 0 to 100%) based on its design readiness and funding level. 4/

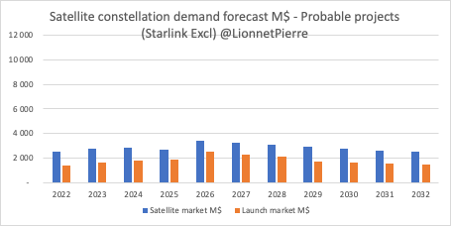

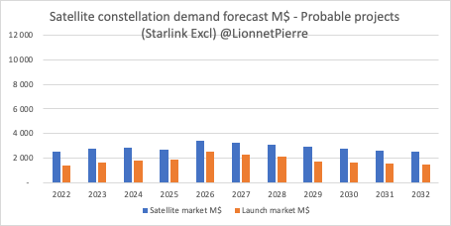

Using a probabilistic approach the value of the satellite constellation market in the next decade decreases by a factor 5, to an average 8 to 10B$ (additional) demand per year, and worth 6 to 7B$ for the launch service. But is this a reliable information of the future market? 5/

Well no. The forecast is a probabilistic vision of the future based on a current present state. To understand how this can turn into an actual market, and how it could represent an opportunity for suppliers, we need to understand how it is made and the underlying data.

6/

6/

In particular I wish to highlight that Starlink represents >60% of the total constellation activity in the forecast. The forecast, without Starlink is thus much lower.

7/

7/

So here is my 101 tutorial on constellations market forecasting, and a step by step guide to create these charts. Keep scrolling. 8/

Step 1 - make a list of all constellation announced. This is easy because there are a few lists online. I do maintain my own list since 2016, and I have now almost 300 entries (including many cancelled and dead projects). 9/

mdpi.com/2226-4310/7/9/…

newspace.im

mdpi.com/2226-4310/7/9/…

newspace.im

Step 2 - do some additional research to populate the list with information on satellite mass and constellation numbers (and to refresh the data). This is important because mass will enable to derive market values for satellite manufacturing and launch markets.

10/

10/

Step 3 - Give each constellation project a probabilistic value of achievement. I have created the following set of criteria that I apply to my list. As you can see I am quite generous. 11/

Step 4 - Determine the potential lifetime of the satellites involved in the constellation, to build a probable sequence for deployment/renewal. I applied lifetime expectancies ranging from 2 to 7 years depending on the projects. 12/

Step 5 - Determine for each project the initial deployment date so you know when to start putting data in your model. 13/

Step 6 - Create a value model for both satellites and launch services. You can do it like me, with separate value segments (e.g. where broadband satellites are cheaper than observation, and with different pricing by launcher families) or just apply a global average. 14/

Step 7 - Create the evolution profile of your value model: i.e. the evolution of the price structures in time. I have assumed that with massification of production the costs for launch and manufacturing would decrease by between 3 and 8% per year depending on segments. 15/

Step 9 - Render the charts.

The probable scenario indicates that constellations may create 4000 to 7000 additional satellite to launch every year in the next decade. This is globally consistent with the projections made by NSR, Euroconsult and the other usual suspects etc. 17/

The probable scenario indicates that constellations may create 4000 to 7000 additional satellite to launch every year in the next decade. This is globally consistent with the projections made by NSR, Euroconsult and the other usual suspects etc. 17/

Step 10 - do some sensitivity analysis. For instance, what happens if launch and satellite costs are reduced more drastically? See below the "probable" scenario if I assume a rate of cost reduction >10% year, and lower launch costs averages in 2021. 18/

Step 11 - Do some data analysis. Because when you have compiled everything you MUST have realised a strong peculiarity of this market. It is the overwhelming pre-eminence of a single player in the global assessment: Starlink/SpaceX is worth >60% of the forecasted mass. 19/

This means, simply put, that if you remove SpaceX your forecast is not the same anymore. What originally seemed an exciting business perspective becomes what it really is: a mere few % growth over an otherwise flat market trend associated to high risks of not happening. 20/

What is left is almost only composed of Kuiper, Lighspeed and the two Chinese projects (Geely and GuoWang). All the other hundreds of constellations have almost no impact on the future market, because they are very small and use small satellites (and are still improbable). 21/

These 4 projects are also associated to relatively low probability (25 to 50%) for the time being, and the forecast will change as soon as (and if) they start deploying, so these histograms may double in size some time in the future. Or disappear completely.

22/

22/

And now I ask myself whether the deployment of Kuiper, Lightspeed, Geely and GuoWang justifies any investment at all in additional launch capability? This is why I am so skeptical with the usual narrative of a booming launch demand (not to mention the small launcher case). 23/

I also ask myself if any prospect for expansive growth in space business, driven by constellations, makes sense. Whatever angle I look at the future of constellations I come to the same conclusion: it can't be a big business. 24/

https://twitter.com/LionnetPierre/status/1448677218566250501

https://twitter.com/LionnetPierre/status/1448678082609664005

So here are my key takeaways on constellations market forecasting (and this is the last tweet because 25 is the maximum allowed in a thread by twitter). 25/

• • •

Missing some Tweet in this thread? You can try to

force a refresh