Hello Space Twitter. As 2021 s coming to a close, I am looking back at my tweet history, and thought it would be interesting to share the most significant threads I published in 2021. I have gathered them by themes in this thread of threads. 1/

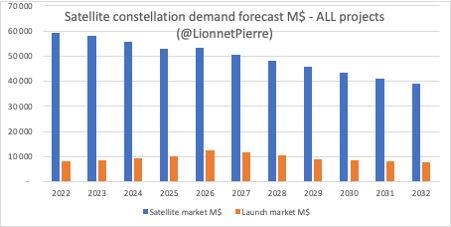

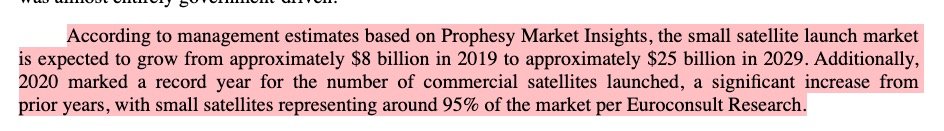

About launch markets and launch costs 2/

https://twitter.com/LionnetPierre/status/1423634748866433028

https://twitter.com/LionnetPierre/status/1430497863306465286

https://twitter.com/LionnetPierre/status/1433536407625035781

https://twitter.com/LionnetPierre/status/1434127960810954757

https://twitter.com/LionnetPierre/status/1464773668714733576

https://twitter.com/LionnetPierre/status/1470220337732374534

https://twitter.com/LionnetPierre/status/1470920285960478721

About #LEO #constellations markets 3/

https://twitter.com/LionnetPierre/status/1448677218566250501

https://twitter.com/LionnetPierre/status/1448678082609664005

https://twitter.com/LionnetPierre/status/1458803552311201796

https://twitter.com/LionnetPierre/status/1473068541087731716

About the economics of the #Newspace 4/

threader.app/thread/1403310…

https://twitter.com/LionnetPierre/status/1403310850572800011

https://twitter.com/LionnetPierre/status/1428439653468749826

https://twitter.com/LionnetPierre/status/1431144646982393859

https://twitter.com/LionnetPierre/status/1435971129362030595

threader.app/thread/1403310…

About satellite markets 5/

https://twitter.com/LionnetPierre/status/1422275082307657729

https://twitter.com/LionnetPierre/status/1441463359988195330

https://twitter.com/LionnetPierre/status/1461725722255540229

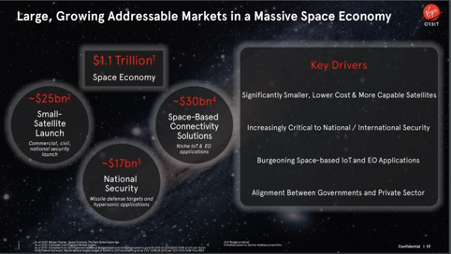

About the #spaceeconomy in general 6/

linkedin.com/feed/update/ur…

https://twitter.com/LionnetPierre/status/1429754668616503305

https://twitter.com/LionnetPierre/status/1471060902090842116

linkedin.com/feed/update/ur…

About #SpaceX and #Starlink 7/

https://twitter.com/LionnetPierre/status/1435165744560582662

https://twitter.com/LionnetPierre/status/1443276350895403011

https://twitter.com/LionnetPierre/status/1447558185758433280

https://twitter.com/LionnetPierre/status/1453376295728001034

https://twitter.com/LionnetPierre/status/1465631869047869443

About @Astra $ASTR (and @Kemp) 8/

https://twitter.com/LionnetPierre/status/1456543991298727942

https://twitter.com/LionnetPierre/status/1472279570518847492

About @momentusspace $MNTS 9/

https://twitter.com/LionnetPierre/status/1472032827441135619

https://twitter.com/LionnetPierre/status/1472201708918956033

• • •

Missing some Tweet in this thread? You can try to

force a refresh