1/10

We are in a strange time in the bond market. Lots misreading of its message and what the market is pricing what seems to be an outlier.

Let me try and explain.

@TheStalwart @DavidBeckworth @M_C_Klein @dandolfa

bloomberg.com/news/articles/…

We are in a strange time in the bond market. Lots misreading of its message and what the market is pricing what seems to be an outlier.

Let me try and explain.

@TheStalwart @DavidBeckworth @M_C_Klein @dandolfa

bloomberg.com/news/articles/…

2/10

Daly and Waller are making news talking about a March hike. Why? That is what is already priced in!

Hikes are now priced for March, June and Dec.

3rd hike in Nov (47%) and a 4th hike in Feb 23 (40%) are close.

Daly and Waller are making news talking about a March hike. Why? That is what is already priced in!

Hikes are now priced for March, June and Dec.

3rd hike in Nov (47%) and a 4th hike in Feb 23 (40%) are close.

3/10

This is a rare period that the table above is not the middle of the consensus, but instead an outlier.

The consensus continues to argue/rationalize why this hiking schedule is too aggressive.

My view the market gets what it wants, one way or another.

This is a rare period that the table above is not the middle of the consensus, but instead an outlier.

The consensus continues to argue/rationalize why this hiking schedule is too aggressive.

My view the market gets what it wants, one way or another.

4/10

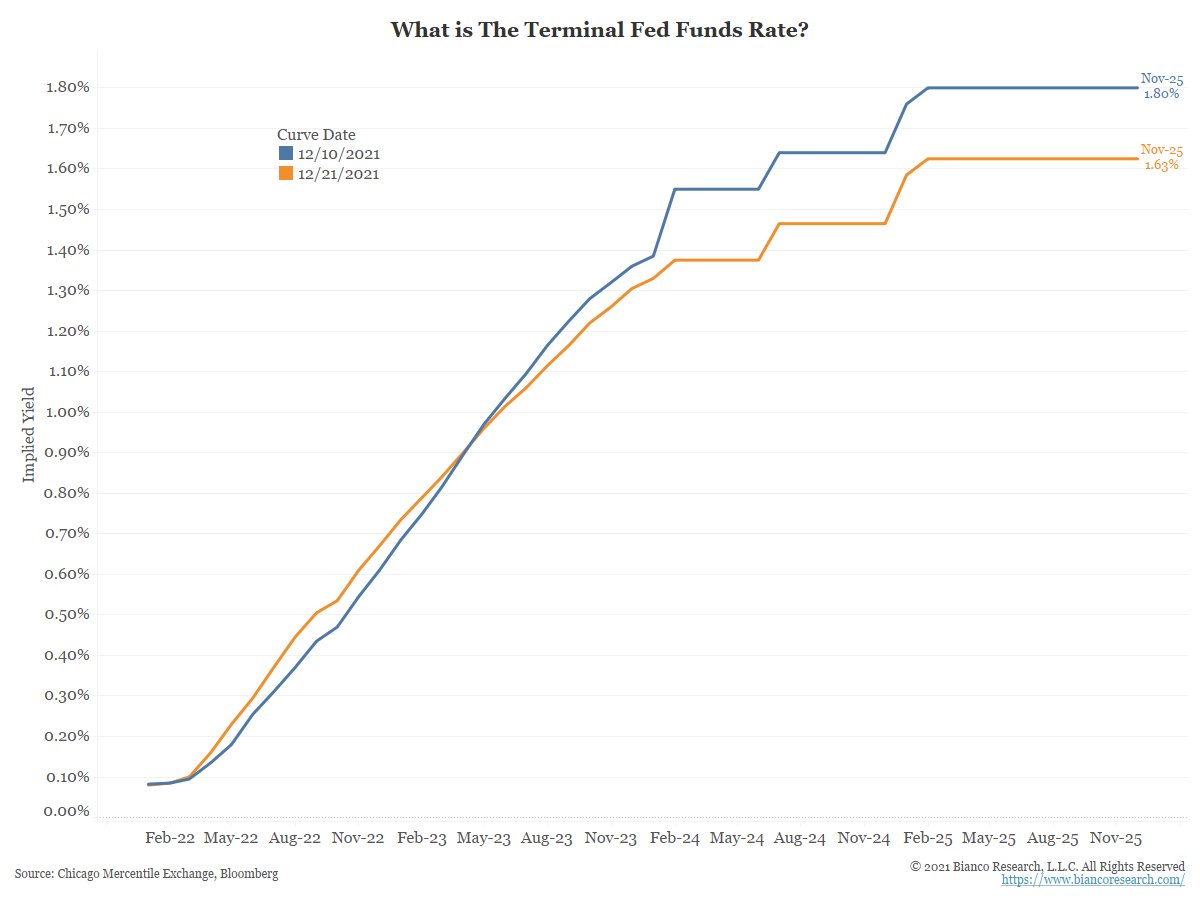

Another misread is the terminal funds rate. The mkt is putting it around 1.75%

The Fed is good at hiking too much until something breaks.

What this table above and this chart say is the 4 rate hikes expected in the next 14 months might be enough to start breaking things.

Another misread is the terminal funds rate. The mkt is putting it around 1.75%

The Fed is good at hiking too much until something breaks.

What this table above and this chart say is the 4 rate hikes expected in the next 14 months might be enough to start breaking things.

5/10

Regarding the 10-year yield not rising, it is not an inflation signal, never has been. It is a "break something" signal, always has been.

Let's go back to 2004 - 2006. The Fed hiked 17 times in 17 meetings. 10-year was unchanged over this period and the curve inverted.

Regarding the 10-year yield not rising, it is not an inflation signal, never has been. It is a "break something" signal, always has been.

Let's go back to 2004 - 2006. The Fed hiked 17 times in 17 meetings. 10-year was unchanged over this period and the curve inverted.

6/10

The market correctly saw the Fed was going to go too far and break something. When the curve inverted, it signaled "now too far."

A few months later, home prices peaked and a year later the GFC followed.

It "only" took a funds rate of 5.5% to break things.

The market correctly saw the Fed was going to go too far and break something. When the curve inverted, it signaled "now too far."

A few months later, home prices peaked and a year later the GFC followed.

It "only" took a funds rate of 5.5% to break things.

7/10

1998 - 2000 again the Fed was hiking, and 10-year rates went sideways.

Greenspan was honest, goal was to "break" the stock market bubble. Mission accomplished, and a recession in Mar 01.

Hikes started at 20 bps curve, only took 4 rate hikes to invert and signal "break."

1998 - 2000 again the Fed was hiking, and 10-year rates went sideways.

Greenspan was honest, goal was to "break" the stock market bubble. Mission accomplished, and a recession in Mar 01.

Hikes started at 20 bps curve, only took 4 rate hikes to invert and signal "break."

8/10

The last hiking cycle was more of the same, the Fed hiked to 2.38%, 10-yr went sideways, the Fed went too far and broke the repo market in Sept 2019.

The curve inverted to signal "too far." Only took, 2.38%.

A recession followed but, yes, we don't know the counterfactual.

The last hiking cycle was more of the same, the Fed hiked to 2.38%, 10-yr went sideways, the Fed went too far and broke the repo market in Sept 2019.

The curve inverted to signal "too far." Only took, 2.38%.

A recession followed but, yes, we don't know the counterfactual.

9/10

10-yr signals the breaking point, not inflation. The yield curve is what matters, inversion means too far.

The curve is very flat before the first hike, and the lowest ever mkt priced terminal rate (1.75%)

Message, 4 or so hikes (to 1.75%-ish) should break something.

10-yr signals the breaking point, not inflation. The yield curve is what matters, inversion means too far.

The curve is very flat before the first hike, and the lowest ever mkt priced terminal rate (1.75%)

Message, 4 or so hikes (to 1.75%-ish) should break something.

10/10

The Fed does not have a choice, inflation is out the bag, and is killing the majority party (D). They have to respond, and they will go too far and break something. This is the market message.

I did an entire thread on why (last 6 tweets)

The Fed does not have a choice, inflation is out the bag, and is killing the majority party (D). They have to respond, and they will go too far and break something. This is the market message.

I did an entire thread on why (last 6 tweets)

https://twitter.com/biancoresearch/status/1469722658023559170

Bonus #1

The public think inflation is problem #1, ahead of COVID.

Fed said they have the tools to remove unwanted inflation. Have to use them.

foxnews.com/politics/voter…

The public think inflation is problem #1, ahead of COVID.

Fed said they have the tools to remove unwanted inflation. Have to use them.

foxnews.com/politics/voter…

Bonus #2

For the first time since Jimmy Carter was in the White House a political party is demanding the Fed get hawkish.

What would cause a politician to demand higher rates?

Object panic over what inflation does to the 2022 midterms.

ft.com/content/1ae49b…

For the first time since Jimmy Carter was in the White House a political party is demanding the Fed get hawkish.

What would cause a politician to demand higher rates?

Object panic over what inflation does to the 2022 midterms.

ft.com/content/1ae49b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh