The power of quality over quantity never fails to amaze me. As some of u kno, ive been working on a little experiment lately (less time in front of screens, more time with family/friends, working out, hobbies etc). I 100% believed that my profits decrease during this experiment

But i was willing to pay that small price in exchange for more "balance" & a break from the "if i dont work 12-15hrs a day staring at screens then im not productive" mindset". Contrary to my expectations (that i would make LESS money), the OPPOSITE actually happened.

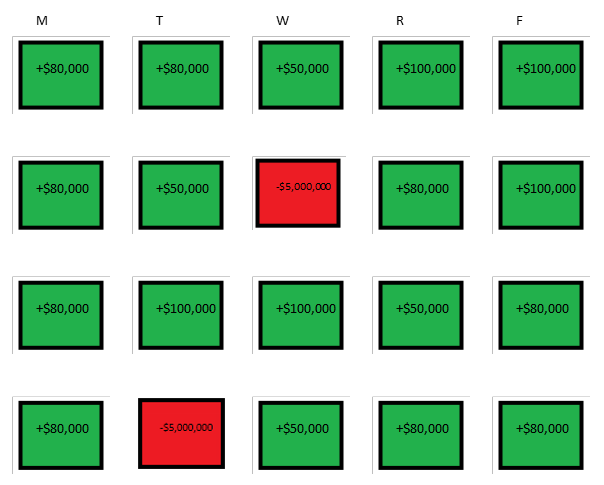

I reduced my "trading time" to just 3 hrs a day max (2.5 hrs in the AM to open/manage swings, and just 30min in the afternoon for market review + tracking + charts etc), and I actually made MORE money in the last few months than I did when I was spending almost ALL day on the cpu

And when I tracked my performance to see what were the MAIN things that changed (I wanted to make sure it wasn't just a shift in market environment), guess what the stats showed:

1) I took HIGHER quality trades

2) I took LESS impulsive trades

The result, bigger wins, smaller Ls

1) I took HIGHER quality trades

2) I took LESS impulsive trades

The result, bigger wins, smaller Ls

And in hindsight, it all makes sense.

#1 happened (more high quality trades) b/c since I knew I only had limited time to trade, I made sure to focus ONLY on the best. So all trades I took were ADF score 80% or higher (before, i would take <80% score trades & just lowered size)

#1 happened (more high quality trades) b/c since I knew I only had limited time to trade, I made sure to focus ONLY on the best. So all trades I took were ADF score 80% or higher (before, i would take <80% score trades & just lowered size)

but that mindset is so toxic because we all know what happens when we tell ourselves "this setup is not great, i ll just do small size or risk 1/2R only". we eventually get attached to the trade once we have skin in the game, and next thing u know we're risking 1R all over again.

Now over a few days, the losses from those "low quality trades" dont affect our performance much, but over a period of several weeks, all those tiny losses from shitty trades DO add up. I mean just imagine if u could go back in time & erase ALL of the low quality trades u took.

So in short, being forced to take HIGHER quality trades actually boosted my winrate (which idgaf about anyway if u know me), AND my R/R ratio since my winners were significantly larger than usual (that's the whole point of high quality trades, when they work, they work "bigly")

and for #2, since I had LESS time in front of screens, I also had less prefrontal cortex burnout, less decision fatigue, less brain fog, and therefore less opportunities to go "full retard" mode. it's common sense, less time on CPU = less chances of self-sabotaging ur cunty self

So that ALSO drastically reduced my losses.

And lastly, spending more time with family, my daughter, more time enjoying my hobbies (training, binging football 🏈, researching biology etc) actually made me HAPPIER overall, & we all know mental health is KEY to trading performance

And lastly, spending more time with family, my daughter, more time enjoying my hobbies (training, binging football 🏈, researching biology etc) actually made me HAPPIER overall, & we all know mental health is KEY to trading performance

Conclusion: The pareto principle (80/20 rule) still wins. Stop thinking that more work always means more profits. It's a logarithmic growth curve at best, and an inverted U curve at worst. Trading gets to a point where sometimes more work actually leads to less or equal profits.

So if u're a beginner, as i always say, work like a slave until u reach a decent level of proficiency. But as things start to click, slow down, FOCUS on your edge instead, and start prioritizing DISCIPLINE and BALANCE. Quality over quantity. Happy holidays folks

#BearTipOfTheDay

#BearTipOfTheDay

• • •

Missing some Tweet in this thread? You can try to

force a refresh