#environmental #Social #Governance

#Investment #Policy

A thread on Environmental Social and Corporate Governance (ESG) compliance ....

Chapter 1 Introduction:-

* Overview

* ESG criteria

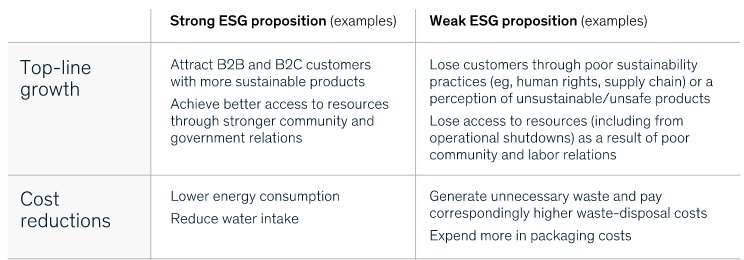

* Strong & Weak ESG Propositions

* Why ESG ?

#Investment #Policy

A thread on Environmental Social and Corporate Governance (ESG) compliance ....

Chapter 1 Introduction:-

* Overview

* ESG criteria

* Strong & Weak ESG Propositions

* Why ESG ?

*Overview -

History :- The concept arose in 2001, following the launch of the "FTSE4Good Index Series," with the goal of encouraging UK pension funds to consider social, ethical, or environmental (SSE) issues.

History :- The concept arose in 2001, following the launch of the "FTSE4Good Index Series," with the goal of encouraging UK pension funds to consider social, ethical, or environmental (SSE) issues.

In 2002, they implemented environmental management criteria, followed by human rights criteria in 2003 and supply chain labor standards in 2005. As a founding signatory, the FTSE4Good then introduced the United Nations Principles for Responsible Investment (PRI) in 2006.

The 2006 PRI report, composed of the Freshfield Report and Who Cares Wins, cited first of all ESG issues. ESG issues. For the first time, ESG criteria had to be incorporated in companies' financial assessments. The sustainable investment was a priority of this effort.

The ESG is an abbreviation comprising 3 major categories or topics of interest to what are known as 'socially responsible investors.' They are investors who feel it crucial that their beliefs and concerns (e.g environmental concerns) are included in their investment selection

rather than just analyzing the possible profitability and/or risk of an opportunity for investment. ESG is a common phrase used by investors in capital markets for the evaluation of company bereavement and the determination of future company financial performance.

Image source : corporatefinanceinstitute.com/resources/know…

Here is the little introduction about what is ESG?

* ESG Criteria :-

ESG Environmental - Environmental criteria include: renewable energy use by a company, its waste management programme, how the company handles the potential problems of air or water pollution resulting from its operations,

ESG Environmental - Environmental criteria include: renewable energy use by a company, its waste management programme, how the company handles the potential problems of air or water pollution resulting from its operations,

problems of deforestation (where appropriate) and the attitude and actions of the company in relation to climatic changes issues.

ESG Social - Social criteria cover a wide variety of potential problems. There are many different social aspects of ESG, but they are essentially social. One of the main connections for a business is the relationship of the company with its employees, from the point of view of

many socially responsible investors. This is a brief overview of only some of the problems that can be addressed when considering how a company handles its social relationships:

- Is employee pay reasonable, if not generous, when compared to comparable jobs or positions in the industry? What types of retirement plans are available to employees? Does the company contribute to the retirement plans of its employees?

What benefits or perks are provided to employees in addition to their basic wages or salary? With ESG-conscious investors, it can make a big difference in your company's evaluation if you do things like provide a free, very lavish buffet lunch for all employees every Friday or

provide other types of benefits that aren't exactly common at all workplaces, like an on-site fitness centre.

- Policies in the field of diversity, inclusion and prevention of sexual harassment are also common factors.

ESG :- Governance

The management of a firm in the top-level offices is essentially an issue of ESG governance. How well do the management and executive boards look at different stakeholders - employees, shareholders and clients – for the benefit of the company?

The management of a firm in the top-level offices is essentially an issue of ESG governance. How well do the management and executive boards look at different stakeholders - employees, shareholders and clients – for the benefit of the company?

Does the enterprise return to its location in the community?

Core elements of good corporate governance are often regarded as financial and accounting transparency and full and honest financial reporting.

Core elements of good corporate governance are often regarded as financial and accounting transparency and full and honest financial reporting.

Board members who act in a real fiduciary relationship with stockholders and are attentive to prevent any conflict of interest with this obligation are also of importance. Are members of the board and managers of companies a diverse and inclusive group?

Management compensation has been a key concern for many ESG investors who do not tend, for example, to favour multi-million dollar bonuses for management while for all other employees the company imposes salary freezes. Is additional compensation to managers appropriately bound

to increase the long-term value, viability and profitability of the company?

Why ESG ?

Environmental destruction and societal imbalances, not only harm corporations, but also all living creatures, including people.

Image source:- bondevalue.com/news/esg-bonds…

Environmental destruction and societal imbalances, not only harm corporations, but also all living creatures, including people.

Image source:- bondevalue.com/news/esg-bonds…

Climate change, global warming, resulting sea levels rising as well as droughts and floods commonly influence investors by disrupting economic activities and supply chains as well as adversely affecting human capital.

It is a vicious cycle; damage to the environment leads to global warming and in turn to further damage to the environment. It is easy to notice the extent of adverse effects on the environment.

3 billion animals in Australian bush fires have been destroyed. Changing weather patterns have caused floods, drought, and water level decreases. Erratic weather has ravaged the crop cycle, eventually affecting the food supply, jeopardizing everyone's life.

Therefore ESG cannot just be considered in conferences, research studies, and brilliant annual reports as three alphabets that are worthy of discussion in the English language.

If the human race is to survive and thrive, planet Earth must be preserved in its natural state. ESG must be ingrained in the DNA of corporations and businesses all over the world for this to happen, especially if the goal is to sustain business in the long run.

Businesses should adopt only practices that are environmentally friendly, socially responsible, and adhere to high governance standards. In order for ESG to be more than just a piece of literature or a decorative accent, it must be evaluated on a regular basis.

For such an evaluation to be effective, an evaluation framework along with benchmarks for three factors – environmental, social, and governance – must be established.

Life and safety are currently being disrupted all over the world as a result of COVID-19. so, Health and safety are important from an ESG perspective.

Chapter 2 :- ESG Framework

- What is an ESG Framework?

- Importance of ESG Framework

- Challenges when adopting ESG Framework

- Number of ESG Frameworks

- ESG Rating

- What is an ESG Framework?

- Importance of ESG Framework

- Challenges when adopting ESG Framework

- Number of ESG Frameworks

- ESG Rating

ESG frameworks provide logic to examine different ESG sub-categories, give them the weight to determine a percentile of ESG compliance for an entity based on their relevance and importance. The ESG rating for this entity is also measured using this percentile.

The Global Reporting Initiative (GRI) framework, for example, is one of the most widely used ESG frameworks. It is a set of standards responsible for environmental, social, economic, and governance conduct that covers a wide range of topics.

The GRI framework is used by 73 percent of the world's 250 largest companies to report on sustainability.

Importance of ESG framework:-

ESG frameworks assist businesses in making a positive impact on the world. Furthermore, reporting on ESG has been shown to have additional benefits for the organization.

As an example:-

ESG frameworks assist businesses in making a positive impact on the world. Furthermore, reporting on ESG has been shown to have additional benefits for the organization.

As an example:-

- Strong ESG policies can help businesses save money on energy, water, and waste while also driving more strategic resource allocation.

- Consumers are increasing their pressure on businesses to be more socially and environmentally responsible.

- Consumers are increasing their pressure on businesses to be more socially and environmentally responsible.

- ESG is becoming more important to investors as a standard component of the investment process.

Challenges when adopting ESG Frameworks:-

1. Various Methodologies and Scoring Systems

- ESG frameworks all follow a different approach, which lead to numerous scoring systems and data interpretations.

1. Various Methodologies and Scoring Systems

- ESG frameworks all follow a different approach, which lead to numerous scoring systems and data interpretations.

If you decide to use just one, it is crucial to determine the impact of every metric of your business and objectives.

-Notes could vary significantly among frameworks, thus, losing the value of their insight, as if we compared a baseball team's performance to a volleyball team.

-Notes could vary significantly among frameworks, thus, losing the value of their insight, as if we compared a baseball team's performance to a volleyball team.

2. Lack of Harmonization -

- The harmonized standards of ESG rating frameworks are clearly lacking, which may make it more difficult to operate on a global scale. Are special reporting requirements in a country where you operate attached to ESG?

- The harmonized standards of ESG rating frameworks are clearly lacking, which may make it more difficult to operate on a global scale. Are special reporting requirements in a country where you operate attached to ESG?

- To understand fully how ESG reporting can lead to problems, you must understand that if you decide to report, you are liable for your business. Even voluntary disclosures will be examined, questioned, or legally repercussion by becoming public.

Some popular ESG Frameworks include:

- CDP

- Climate Disclosure Standards Board (CDSB)

- Global Reporting Initiative (GRI)

- Science Based Targets initiative (SBTi)

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-related Financial Disclosures (TCFD)

- CDP

- Climate Disclosure Standards Board (CDSB)

- Global Reporting Initiative (GRI)

- Science Based Targets initiative (SBTi)

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-related Financial Disclosures (TCFD)

- UN Principles for Responsible Investment (PRI)

- World Economic Forum (WEF) Stakeholder Capitalism Metrics

- World Economic Forum (WEF) Stakeholder Capitalism Metrics

ESG Rating -

ESG ratings seek to assess a company's exposure to ESG risks, as well as how effectively those risks are managed.Unlike frameworks, which recommend what to report on and how to report it, ESG ratings assign a specific score to a company based on its ESG performance.

ESG ratings seek to assess a company's exposure to ESG risks, as well as how effectively those risks are managed.Unlike frameworks, which recommend what to report on and how to report it, ESG ratings assign a specific score to a company based on its ESG performance.

The ESG information would generally be used by investors, institutional institutions, etc, for investment decisions by means of ESG ratings provided by the ESG rating agencies.

The evaluation and measurement is often the basis for informal and shareholder proposal involvement of investors in ESG-related issues with companies. Given their impact and dependence on the environment and society,

ESG factors can provide valuable insights into current and future environmental and social risks and opportunities for corporations. These ESG problems, in turn, could have an impact on the profits and returns on investments directly or indirectly.

• • •

Missing some Tweet in this thread? You can try to

force a refresh