1/4

Incredible admission by the CDC today on the devastation they inflicted on the country.

Incredible admission by the CDC today on the devastation they inflicted on the country.

https://twitter.com/ABC/status/1476189028982702080?s=20

2/4

Who did this hurt the last 21-months?

Not the "wealthy" working from home chortling on twitter about their stock portfolio rocketing higher.

It was the "poor," the 40% of the country that rents and has less than $1,000 in savings, that was devastated by this policy.

Who did this hurt the last 21-months?

Not the "wealthy" working from home chortling on twitter about their stock portfolio rocketing higher.

It was the "poor," the 40% of the country that rents and has less than $1,000 in savings, that was devastated by this policy.

3/4

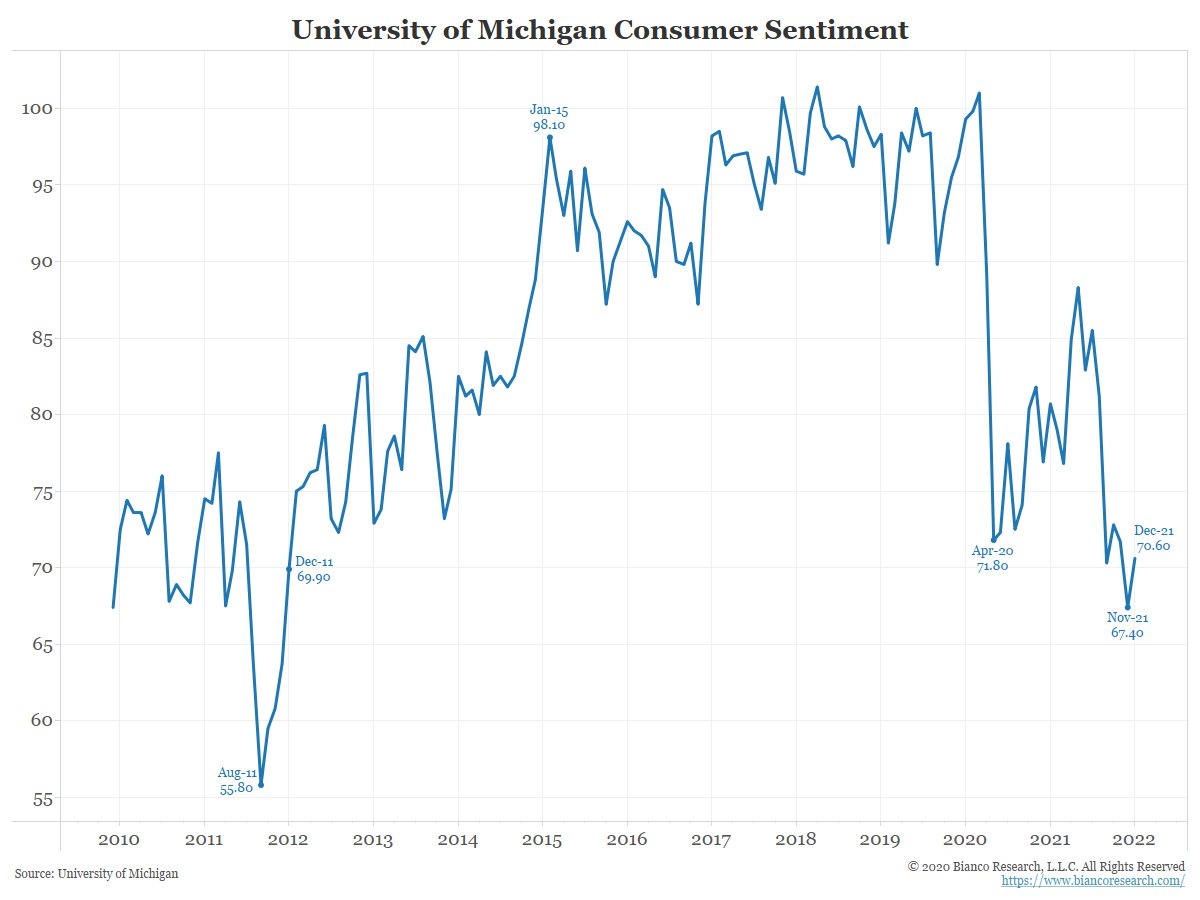

Meanwhile, in other news, economists still cannot figure out why consumer confidence is at a 10-year low, and still worse than the April 2020 lockdown readings.

Meanwhile, in other news, economists still cannot figure out why consumer confidence is at a 10-year low, and still worse than the April 2020 lockdown readings.

4/4

Also, I'm sure this had nothing whatsoever to do with bad PCR tests telling the poor they had to stay isolated for an additional 12-weeks.

spiked-online.com/2021/12/09/the…

Also, I'm sure this had nothing whatsoever to do with bad PCR tests telling the poor they had to stay isolated for an additional 12-weeks.

spiked-online.com/2021/12/09/the…

• • •

Missing some Tweet in this thread? You can try to

force a refresh