Chelsea’s 2020/21 accounts cover a season when they won the Champions League, finished 4th in the Premier League and reached the FA Cup final. Head coach Frank Lampard replaced by Thomas Tuchel in January. Financials significantly impacted by COVID. Some thoughts follow #CFC

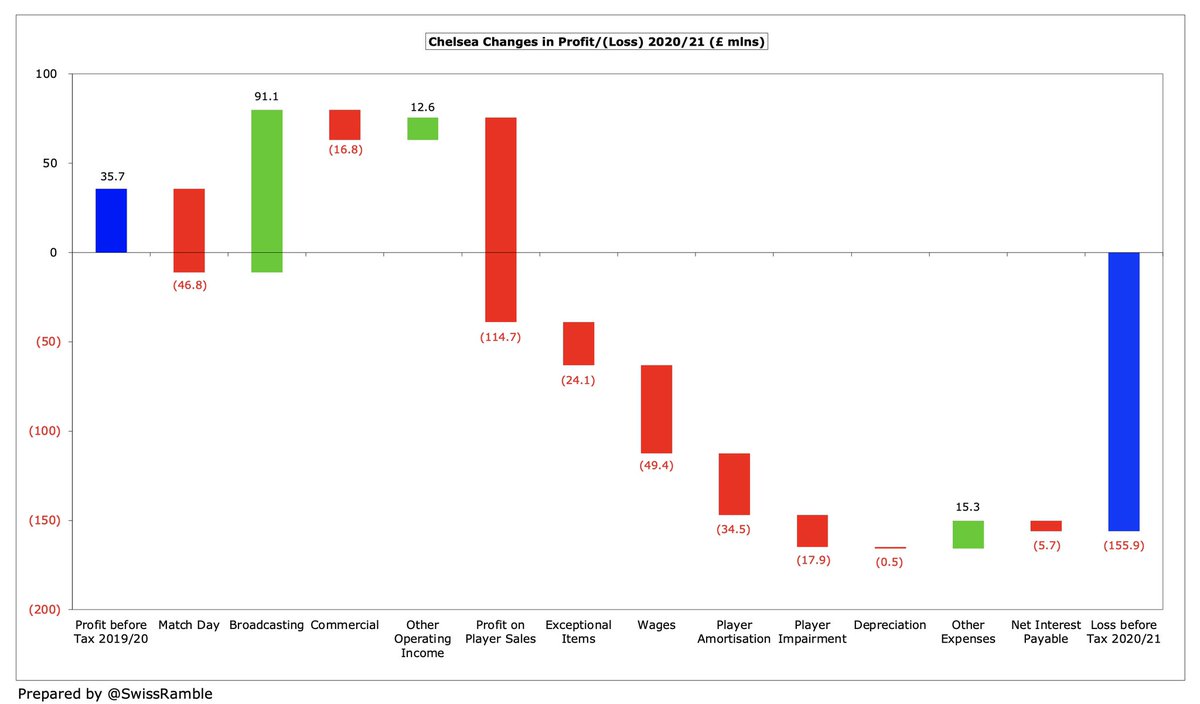

#CFC pre-tax tax loss widened from £36m to £156m (£153m after tax), mainly due to profit on player sales falling £115m from £143m to £28m, though revenue rose £28m (7%) from £407m to £435m, while there was £13m other operating income. Total expenses shot up £117m (23%) to £631m.

The main reason that #CFC revenue rose 7% was £91m (50%) increase in broadcasting from £183m to £274m, mainly due to deferred revenue from 2019/20, which offset COVID driven reductions in match day, down £47m (86%) to £8m, and commercial, down £17m (10%) to £154m.

Significant #CFC cost growth: wages rose £49m (17%) to £333m, player amortisation up £35m (27%) to £162m (plus £18m impairment), £24m for “ongoing legal matters” and a £6m flip to £1m interest payable. Other expenses cut £15m (16%) to £81m, including lower match day costs.

#CFC £156m pre-tax loss is the largest reported to date in the 2020/21 Premier League, higher than #THFC £80m and #MUFC £24m. However, there were plenty of big losses already reported in 2019/20 and other clubs will be worse with a full year of the pandemic reflected.

Clearly #CFC revenue was significantly impacted by COVID. I have estimated the revenue loss as £96m in 2020/21 (match day £66m, commercial £26m and broadcasting £4m). Added to the £31m shortfall in 2019/20, that would give a total of £128m lost in the last 2 years

Of course, all football clubs have been significantly hit by the effects of the pandemic, so (incredibly) #CFC £153m loss after tax is by no means the largest in Europe. In fact, it is “beaten” by Inter £215m, Juventus £184m, Roma £163m and especially Barcelona £422m.

#CFC profit on player sales slumped from £143m to £28m, mainly from Victor Moses to Spartak Moscow and Nathan to Atletico Mineiro. Nevertheless, this is still highest to date in the 2020/21 Premier League, while few clubs will make big money in the restrained transfer market.

#CFC have posted profits in 3 of the last 5 years, though still had a £139m net deficit in this period, due to large losses in 2019 and 2021. Last season’s £156m loss is actually the second largest in Premier League history with Chelsea responsible for 10 of the top 25 losses.

#CFC bottom line has often been adversely impacted by exceptional charges, amounting to £258m since 2005, including management changes £96m, early termination of shirt sponsors £93m and player impairment £46m. Last year included £24m for unspecified legal matters.

#CFC business model is far more reliant on player sales than any other major English club. In the 5 years up to 2020, Chelsea made an astonishing £434m from this activity, which was almost as much as the next highest clubs combined (#LFC £276m and #EFC £208m).

To underline how well #CFC have monetised their “assets”, they have generated six of the 20 largest profits in England from player trading, including the highest ever of £143m in 2019/20. Accounts note £104m already made this season (Abraham, Zouma, Tomori, Guéhi and Zappacosta).

#CFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £27m to £33m. This is not bad, though worse than the other clubs that have published 2020/21 accounts, #MUFC and #THFC, who both had £95m.

#CFC operating loss (excluding player sales & exceptional items) widened from £112m to £159m, one of the worst in the Premier League. In fairness, very few clubs make operating profits, while Chelsea have consistently posted operating losses, offset by high player sales.

#CFC have managed to restrict revenue reduction from 2019 pre-pandemic £447m to only 3% (£12m), despite significant falls in match day, down £59m (89%), and commercial, down £26m (15%), as broadcasting rose £73m (37%), partly due to deferred revenue from 2019/20.

That said, #CFC £106m revenue growth in the past 5 years has been significantly outpaced by #LFC £188m (2019/20 figure) and #THFC £151m. On the other hand, both #MUFC and #AFC have seen their revenue fall in this period, by £21m and £7m (2019/20) respectively.

#CFC £435m revenue is fourth highest in the Premier League, though only 3 of the Big Six clubs have published 2020/21 accounts. For this period, Chelsea are a fair way behind #MUFC £494m, but are well ahead of #THFC £360m, so retain the title of highest revenue in London.

In 2019/20 #CFC climbed one place to 8th in the Deloitte Money League, which ranks clubs globally by revenue, though substantial £62m gap to the next club, PSG £474m. Long way below the Spanish giants, Barcelona and Real Madrid, £627m, but revenue is only one aspect of finances.

#CFC broadcasting income rose £91m (950%) from £183m to £274m, due to revenue from 10 games deferred to 2020/21 (played after end-June accounting close) and more prize money for winning the Champions League. Highest ever recorded in the Premier League for this revenue stream.

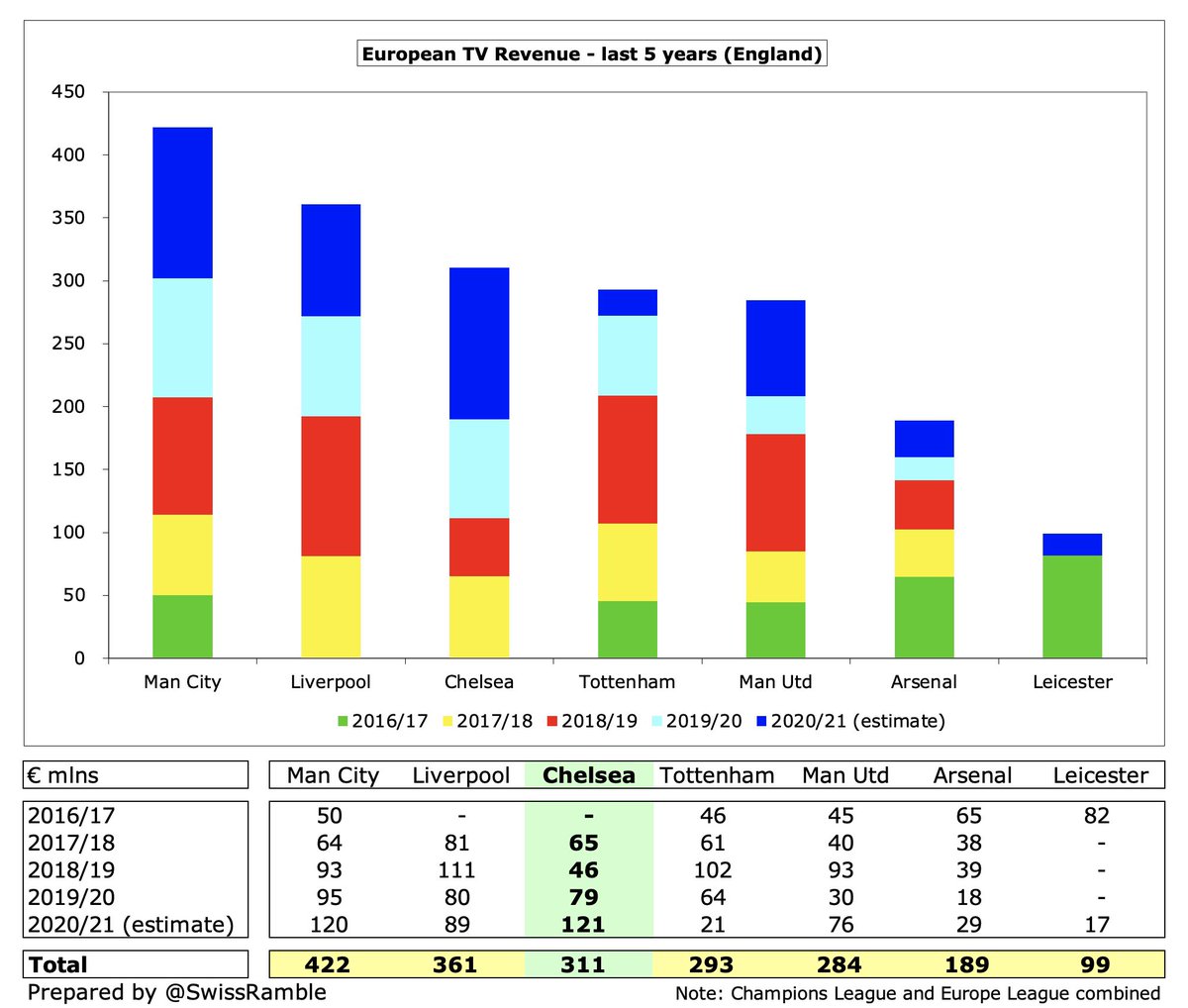

I estimate that #CFC earned €121m for winning the Champions League, just ahead of fellow finalists #MCFC €120m. Much more than prior season’s €79m for reaching the last 16. Difference with Europa League is stark, as semi-finalists #AFC only received €29m.

Despite not qualifying for Europe in 2016/17, #CFC have earned an impressive €311m from Europe in the last five years (winning both the Champions League and Europa League in this time), though still a fair way behind #MCFC €422m and #LFC €361m.

#CFC commercial revenue fell £16m (10%) from £170m to £154m, due to closure of non match day activities for the majority of the year, lower pre-season income and decrease in player loans, partly offset by higher sponsorship. Dropped £26m (15%) since pre-pandemic £180m peak.

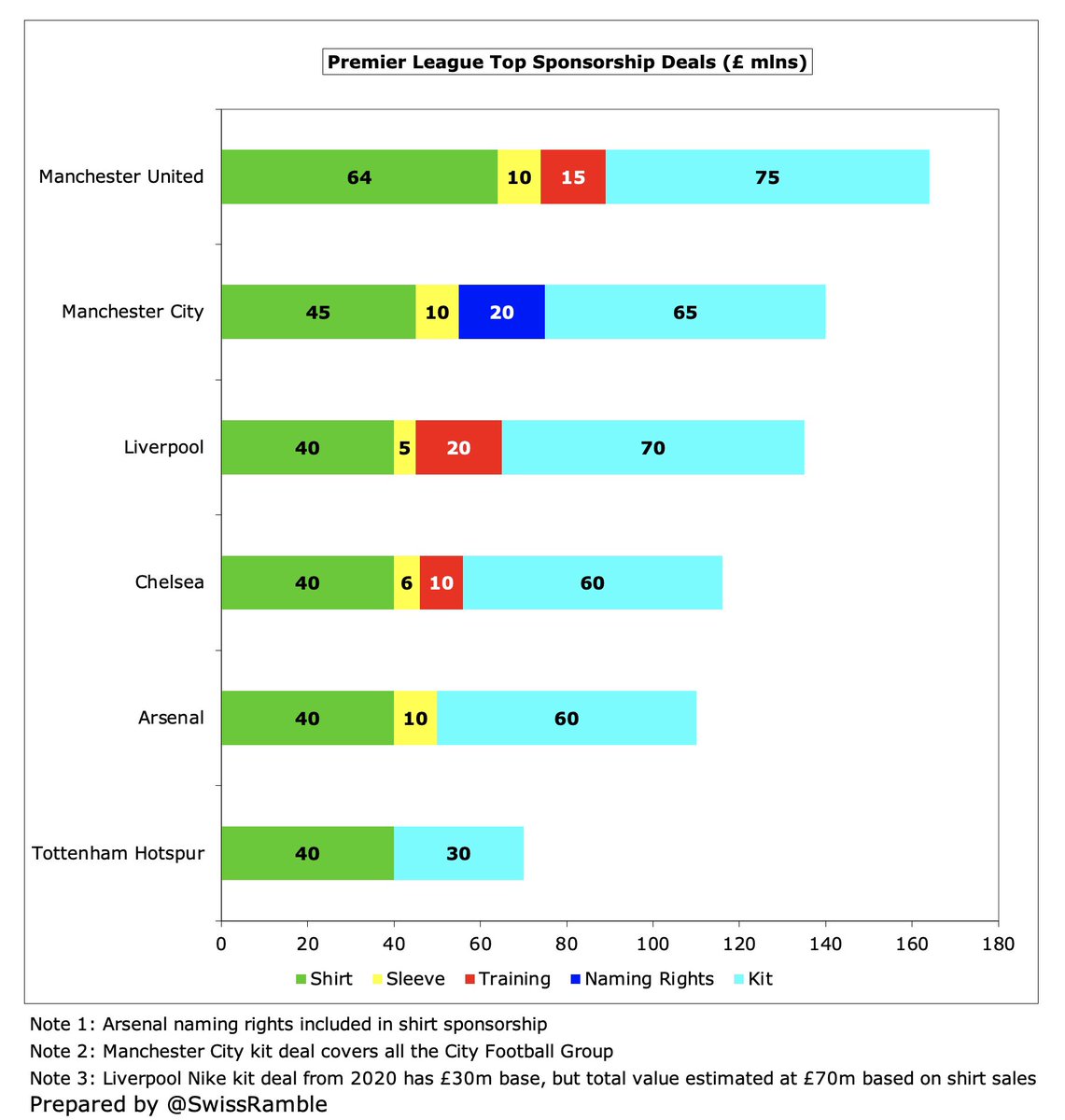

Following the decrease, #CFC £154m commercial revenue is only just ahead of #THFC £152m. It remains the 4th highest in the Premier League, though a long way below the top 3 clubs: #MCFC £246m, #MUFC £232m (also fell in 2021, by £47m) and #LFC £217m.

#CFC have a long-term kit deal with Nike £60m (£900m over 15 years), but Three UK replaced Yokohama as shirt sponsor in 3-year deal from 2020/21, reportedly for same amount of £40m. Hyundai sleeve sponsor £6m from 2018/19, while Trivago added for training kit from 2021/22 (£10m).

#CFC match day income dropped £46m (86%) from £55m to just £8m, as all home games were played behind closed doors (except three with very restricted capacity, two of them with only 2,000 fans). This revenue stream was as high as £74m in 2018.

For games played with fans, #CFC 2019/20 attendance of 40,563 was only 9th highest in England (4th best in London). Helps explain why club wanted to upgrade stadium to 60,000, but £1 bln development been put on hold, officially “due to current unfavourable investment climate”.

#CFC also had £12.6m in other operating income, comprising recharged costs £10.6m (no details provided), research & development tax credit £1.1m and insurance claim £0.8m. I believe this is the first time that the club has included income under this category.

#CFC wage bill shot up £50m (17%) from £283m to £333m, due to new signings, contract extensions and bonuses for winning the Champions League. This means that wages have increased by £113m (52%) in just 4 years.

As recently as 2015, #CFC had the highest wage bill in the Premier League, but they were down to 4th in 2020. Following the step increase in 2021, they are currently second highest, only behind #MCFC £351m, though some have not yet published 2020/21 accounts.

#CFC wages to turnover ratio increased from 70% to 77%, the club’s highest since 2010. This is not too bad, given the revenue lost to COVID, but is significantly worse than #MUFC 65% and (particularly) #THFC 57%.

#CFC highest paid director’s remuneration increased by a third from £1.7m to £2.2m, the third highest in the top flight. That’s a tidy sum, but still a long way below Ed Woodward’s £3.1m at #MUFC and Daniel Levy’s £2.7m at #THFC.

#CFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, surged £35m (27%) from £127m to £162m, the second highest in Premier League history (only behind their own £168m in 2019). Way ahead of #MCFC £146m and #MUFC £120m.

#CFC other expenses decreased £15m (16%) from £96m to £81m, due to reduced match day costs as games were played behind closed doors. This had previously risen from £71m in 2016 to £118m in 2019 (including the buyback of merchandising rights).

#CFC spent £221m on player purchases in 2020/21, including Kai Havertz from Bayer Leverkusen, Timo Werner from RB Leipzig, Ben Chilwell from #LCFC, Hakim Ziyech from Ajax and Edouard Mendy from Rennes. Highest in the Premier League, almost as much as #MUFC and #THFC combined.

Following £31m sales, #CFC net spend in 2020/21 was £189m. This means that in the last 5 years their gross transfer spend was just shy of a billion (£992m), while net spend was almost half a billion (£465m). Spent £110m since accounts, mainly on Romelu Lukaku from Inter.

In the 5 years up to 2019 #CFC had the third highest gross transfer spend in the Premier League of £890m, only surpassed by #MCFC £974m and #MUFC £902m. However, thanks to high sales, their net spend of £317m was only fifth highest, a fair way below #MCFC £704m and #MUFC £655m.

#CFC only have £30m debt in the football club, down from £47m prior year, though it should be noted that the holding company, Fordstam Limited, does have £1.4 bln of debt in the form of an interest-free loan from the owner, theoretically repayable on 18 months notice.

#CFC £30m football club debt is one of the lowest in the Premier League, though their £1.4 bln holding company debt would be much higher than #THFC £854m (mainly new stadium), #MUFC £530m (even after all the Glazers’ re-financings), #EFC £409m, #BHAFC £306m and #LFC £268m.

As a result, #CFC have only paid £6m interest (mainly on transfer fee stage payments), while others have had to make substantial annual payments, e.g. #MUFC £21m, #THFC £18m and #AFC £11m.

#CFC don’t separately report transfer debt, but if we assume this is 90% of Trade Creditors, it has risen from £128m to £147m, which is third highest in the Premier League, behind #THFC £170m and #AFC £154m. Chelsea are owed £162m by other clubs, leaving £15m net receivables.

After adding back £192m non-cash items and £61m working capital movements, #CFC had £70m operating cash flow, but then spent £86m on players (purchases £206m, sales £120m), capex £9m and interest £1m. Funded by £43m share capital, offset by £17m loan repayments.

As a result, #CFC cash balance fell from £17m to £16m, which was a lot lower than the likes of #LFC £149m, #THFC £148m, #MUFC £111m and #AFC £110m, though Chelsea can always rely on the Bank of Roman.

Since Abramovich acquired the club, he has put £1.4 bln into the club (including £20m in 2021), of which £400m is share capital. Most of this funding has been seen on the pitch with a massive £1.2 bln spent on players (net), while £179m went on infrastructure.

To further illustrate the Russian’s generosity, in the 10 years up to 2020 he put £559m into #CFC, the second highest of any Premier League owner, only surpassed by #MCFC £837m. In stark contrast, only £15m was provided by the owners at #AFC and #THFC – combined.

#CFC confirmed they have complied with UEFA and Premier League financial regulations (i.e. FFP) and expect to do so for the foreseeable future. The reported loss over the 3-year monitoring period is offset by allowable deductions and special dispensation for COVID impact.

Despite their huge transfer spend, #CFC should continue be fine with FFP, as UEFA changed the rules to “neutralise the adverse impact of the COVID-19 pandemic” by allowing clubs to adjust the break-even calculation by averaging losses posted in 2020 and 2021.

#CFC huge loss was partly due to COVID, but was also driven by significant investment in the squad, mitigated by Champions League success. The strategy is very reliant on player trading, which did not deliver as much as normal in 2020/21, though figures will be better this year.

#CFC chairman Bruce Buck was positive overall, but added a note of caution, “Our revenue streams remain strong, however, COVID-19 will continue to have an impact going into the next financial year as our commercial operations resume normal activities.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh