2021 is in the books and didn't we go out with 🎆

We can't really call it the 'Origin Story' now as we are in year 8 😆. Still, here's how it went...

2021 was a life-changing yr for me in many respects (2nd child born, 1st yr back in 🇯🇵).

Prior episodes below 👇

We can't really call it the 'Origin Story' now as we are in year 8 😆. Still, here's how it went...

2021 was a life-changing yr for me in many respects (2nd child born, 1st yr back in 🇯🇵).

Prior episodes below 👇

https://twitter.com/puppyeh1/status/1443920686053924864

Basically 2021 was the 'manna from heaven' year, where due to much fortune and some skill I achieved 'escape velocity' - ie never having to worry about working for anyone else again. For that I am most thankful!

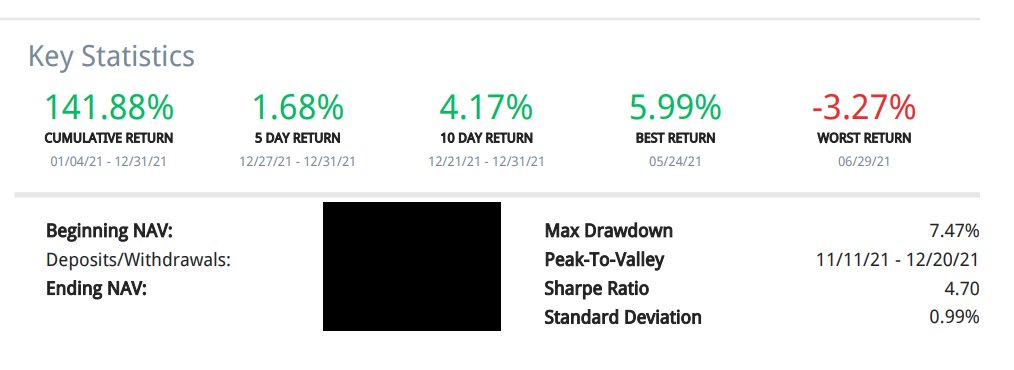

Headline perf: +142% vs the SPX +29%, with a 4.7 Sharpe 😮😮

Headline perf: +142% vs the SPX +29%, with a 4.7 Sharpe 😮😮

Tbh this actually understates returns quite a bit as excludes $PBIT.TO which I hold outside my IB account.

Still the nos are remarkable and I doubt I'll ever come close to a yr like this again. $HDG.NA on the last day of the yr was a massive cherry on top of a money sundae 🙏

Still the nos are remarkable and I doubt I'll ever come close to a yr like this again. $HDG.NA on the last day of the yr was a massive cherry on top of a money sundae 🙏

A cpl of general thoughts. The opp set for what I do - special sits/deep value/foreign activism - had never been deeper than in 2021. I cycled my book >4x, and had 12 names contribute more than 8pts...and I still left huge opps on the table ($TGA.LN, $GOED, $VTNR, tons of others)

As my man @hkuppy said, if you knew what you were doing this year there was 💰 to be made.

Secondly I semi-gave up on shorting during 2021. You can see I'm ending the yr ~75% gross and ~60% net. This was my rough level over the yr...

Secondly I semi-gave up on shorting during 2021. You can see I'm ending the yr ~75% gross and ~60% net. This was my rough level over the yr...

...as it bec basically impossible to carry many shorts, let alone talk about them, for much of the yr. most all of my residual shorts are outside the US in more 'rational' markets (and rarely will I talk about them, rare exceptions being $GAN, $8848.T, a cpl others).

So instead of running a chunky short book I just took gross down. 60-65% net with most all my exposure in off-the-run idiosyncratic stuff was reasonably lower beta (explaining, partially, the high Sharpe as I did OK during the intermittent sell-offs). Obvi a value weight helped!

As for where the PnL came from. Again the depth of opportunity was incredible and prob won't be repeated.

Top 5 names: $HDG.NA (38pts), $HRBR (13pts), $DXLG (11pts), $CLMT (10pts), and $ARG.TO (9pts). Some of these I have tweeted about in detail, others not...

Top 5 names: $HDG.NA (38pts), $HRBR (13pts), $DXLG (11pts), $CLMT (10pts), and $ARG.TO (9pts). Some of these I have tweeted about in detail, others not...

W/ $HRBR, $DXLG, $CLMT still core holdings (will prob unpack $CLMT in more detail at some point).

Below this I had another 7-10 names putting up 5-10pts each ($SHVA.TA, $CDD.AX, $TNK.AX, $CDON.SS, $KCN.AX, $MBR.PW, $690D.DE, $MBR.PW).

As I said - the opportunity set was rich!

Below this I had another 7-10 names putting up 5-10pts each ($SHVA.TA, $CDD.AX, $TNK.AX, $CDON.SS, $KCN.AX, $MBR.PW, $690D.DE, $MBR.PW).

As I said - the opportunity set was rich!

You can tell most all these fell in my sweet spot: special sits; undercovered/unknown/unappreciated foreign equity; merger arb, etc. Australia was a very juicy mkt 🍑

This remains my focus, along with the activism in some of these sits my profile now allows (like w/ $HDG.NA).

This remains my focus, along with the activism in some of these sits my profile now allows (like w/ $HDG.NA).

The other notable feature was the lack of massive blow-ups. In prior years I had $TSLA or $NIO take a huge bite out of my returns. This yr it seemed either everything worked, or when it didn't work didn't break me. V unusual

$BWMX largely retracing 2020 was the one black eye...

$BWMX largely retracing 2020 was the one black eye...

...and cost me 4pts. Other than that most all losers were well under 1pt. Another explanation for the high Sharpe.

In closing - this was a blessed year, the kind you can't even dream of having. I highly doubt I will come close to repeating it, and think I was v fortunate...

In closing - this was a blessed year, the kind you can't even dream of having. I highly doubt I will come close to repeating it, and think I was v fortunate...

...but I do think I can replicate the process (if not all the results) and we can do more good work, together, w/ some of the skills I further developed this year.

Wishing you all the best in your 2022 investing (and life) journey 👊☮️

Wishing you all the best in your 2022 investing (and life) journey 👊☮️

• • •

Missing some Tweet in this thread? You can try to

force a refresh