Taking a break from COVID and climate change 😁😁 A few updates on various names I've been tweeting about on and off over last few months...in no particular order. May add thoughts ad hoc to this thread later.

As always, I have positions here, DYODD.

👇👇

As always, I have positions here, DYODD.

👇👇

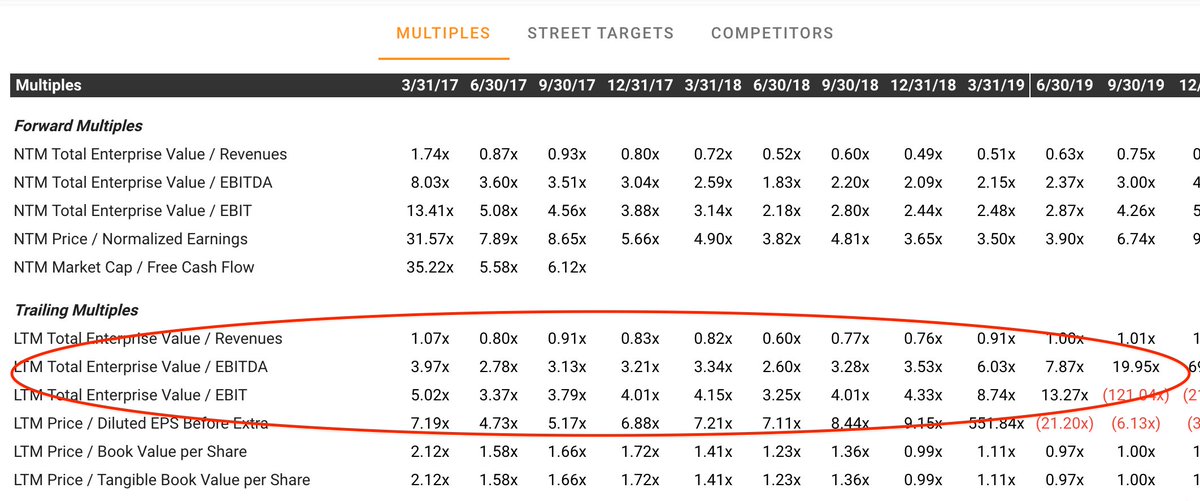

1) Hunter Douglas $HDG.NA. Stock is off a bit post (v strong) earnings, no real change in thesis or biz. 4.5x VY EV/EBITDA, zero debt, insane discount to comps, somewhat illiquid, no-one wants to own.

Still believe Sonnenberg comes back next April to clean up w/ another bid....

Still believe Sonnenberg comes back next April to clean up w/ another bid....

Fair value somewhere between 190-240 EUR. Stock is 99 EUR. Acceptable bid? TBD but unlikely south of 140 EUR imo. Frustrating/boring but still a core holding.

2) Amerigo $ARG.TO. Stock is mid 1.30s, 2.5x EV/EBITDA, maybe 3-4x EV/FCF and paying it all out...

2) Amerigo $ARG.TO. Stock is mid 1.30s, 2.5x EV/EBITDA, maybe 3-4x EV/FCF and paying it all out...

...and response to recent tender (just 7-8mm shs tendered at 1.3) suggests its going higher. BUT - I cut my position in mid-1.40s. Not about the valn (obvi still v cheap), but there are major drought issues that could limit production from late next yr....

...excellent co and strong operators. But hard to see it re-rating w/ drought issues, and competing for capital against other commod names trading at similar or low multiples w/out this kind of idiosyncratic risk.

3) Michael Hill $MHJ.AX. Stock now up to ~5x EV/EBIT, w a strong rerate likely as Aus/NZ opens up. Near-term financial perf has been excellent (in context of lockdowns) and stock is still cheap.

That said at >$1.2 it is not the no-brainer it was at 80c when I first discussed...

That said at >$1.2 it is not the no-brainer it was at 80c when I first discussed...

Still think this is a >$1.5 stock by mid-next yr. That said I have lightened up a bit in recent days, still involved, still like it.

4) Galaxy Gaming $GLXZ. Hardly the axe here (check @MaldenDriveCap @OtterMarket ) but thesis pretty clear and more intact now given the debt...

4) Galaxy Gaming $GLXZ. Hardly the axe here (check @MaldenDriveCap @OtterMarket ) but thesis pretty clear and more intact now given the debt...

...funding to take out Triangulum was minimally dilutive and can be called at yr1 or yr 2 w/ no penalty (meaning cost of financing much lower than i anticipated). Stock at ~10x EV/EBITDA w tailwinds from global reopening and obvious takeout target to anyone in igaming content.

I would have a bigger position if IB would let me trade the stock more actively (they've decided I'm an 'affiliate' somehow??). I still like it, prob wake up and they'll be sold to $EVO at $8 a share sometime in the next 2yrs.

5) The Works $WRKS.LN. Prob worthy of a longer thread. Still involved and adding shares. Prob one of the more mispriced smallcaps I cover. 1.7x EV/EBITDA for a biz growing comps double digits. Ecom now ~30% of revs. This seems wild, mgmt not at all promotional, I get it...

...but I think rerate is coming in face of superior financials and barring further UK lockdowns this could easily multibag.

OK thats enough for now, will do a few more later maybe 👊👊

OK thats enough for now, will do a few more later maybe 👊👊

• • •

Missing some Tweet in this thread? You can try to

force a refresh