Relative Strength(RS) has emerged as one of the most sought-after indicators by Indian #traders. But, what makes it so special? 👇

In simple terms, Relative Strength refers to the measure of the price #trend of a #stock, compared to its Benchmark index/Sectoral Index👇

Indexes like #Nifty, #Sensex, or Sectors like #Banking, Automobiles, can be used. The data can be of a period of 55 days, for example, 👇

RS is calculated by dividing the percentage #price change of a stock over a specified period day by the percentage change of a #market index or sector over the same period👇

RS may also be used to compare two companies in the same industry or index👇

Read more on RS using our blogpost here: sedg.in/jhezvg4y 👇

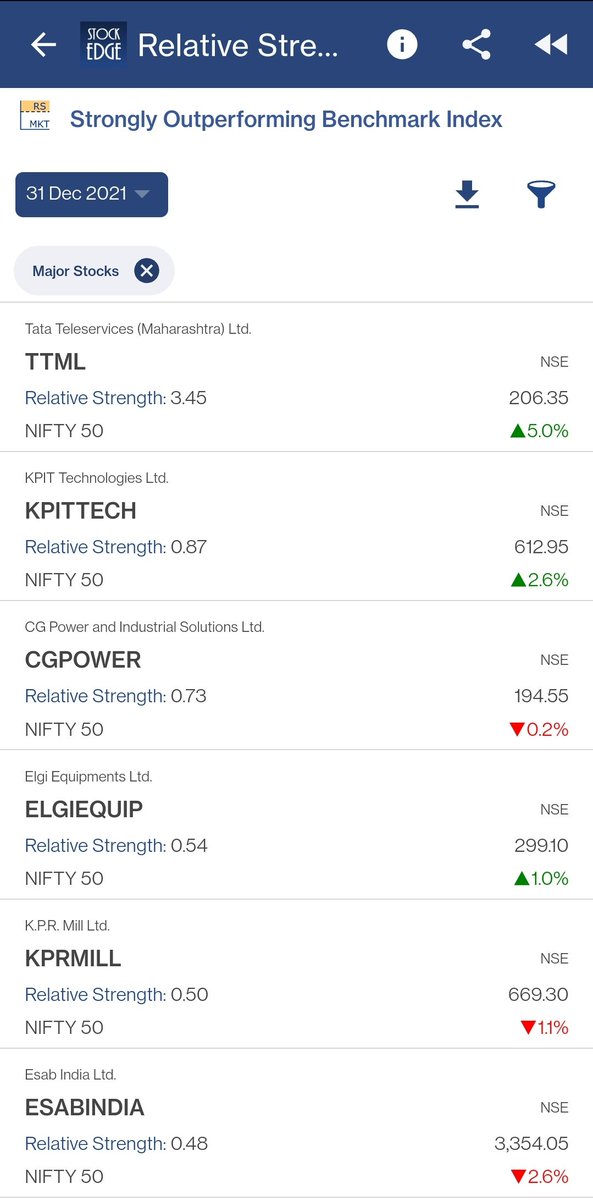

With StockEdge, you can filter out #stocks that are Strongly Outperforming the Benchmark/Sector Index sedg.in/4l5pr7ua 👇

For example, Stocks that have a Relative Strength of more than 30 are shown here under "Strongly Outperforming Benchmark Index" 👇

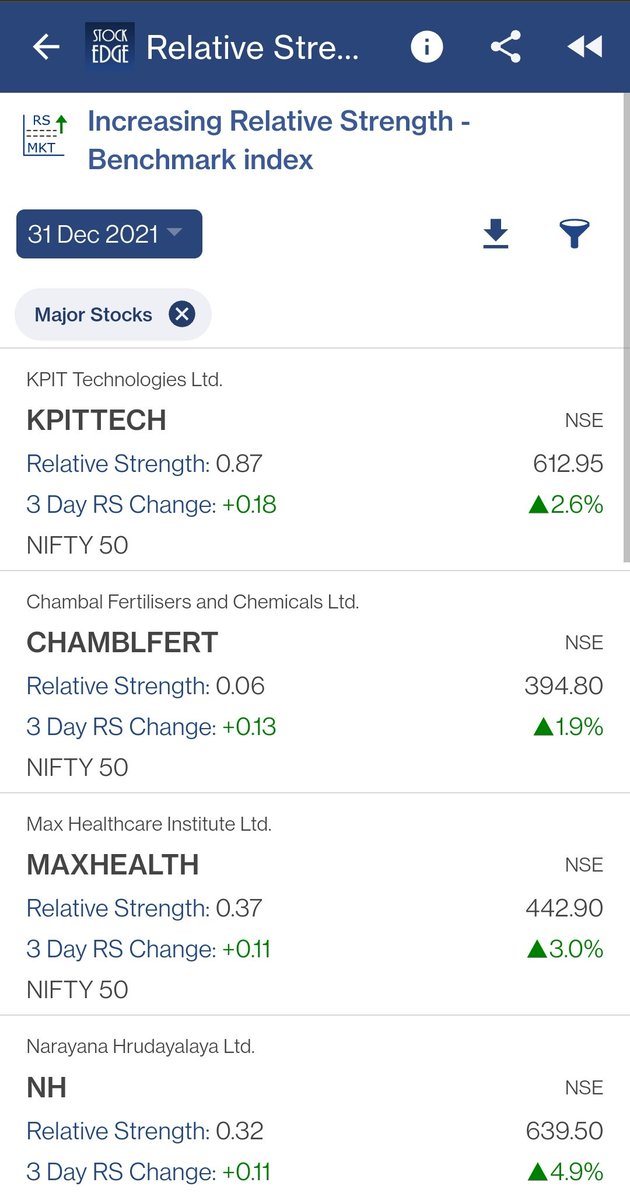

The "Increasing Relative Strength" filter picks out stocks where the RS is above 0 and is increasing for the last three days sedg.in/4xistzwg

To know more about Relative Strength in practical #trading, attend these EXCLUSIVE webinars by Premal Parekh: sedg.in/qn8p4y35

Use Code WEB20 For 20% Off!

Use Code WEB20 For 20% Off!

• • •

Missing some Tweet in this thread? You can try to

force a refresh