West Ham’s 2020/21 financial results covered a season when they finished 6th in the Premier League, thus qualifying for the Europa League, though it was “another difficult year” with finances significantly impacted by COVID. Some thoughts in the following thread #WHUFC

#WHUFC pre-tax loss reduced from £65m to £27m, as revenue rose £53m (38%) from £140m to £193m, while other operating income was up £3m to £5m, offset by profit on player sales falling £7m to £18m. There was growth in operating expenses £7m and net interest payable £4m.

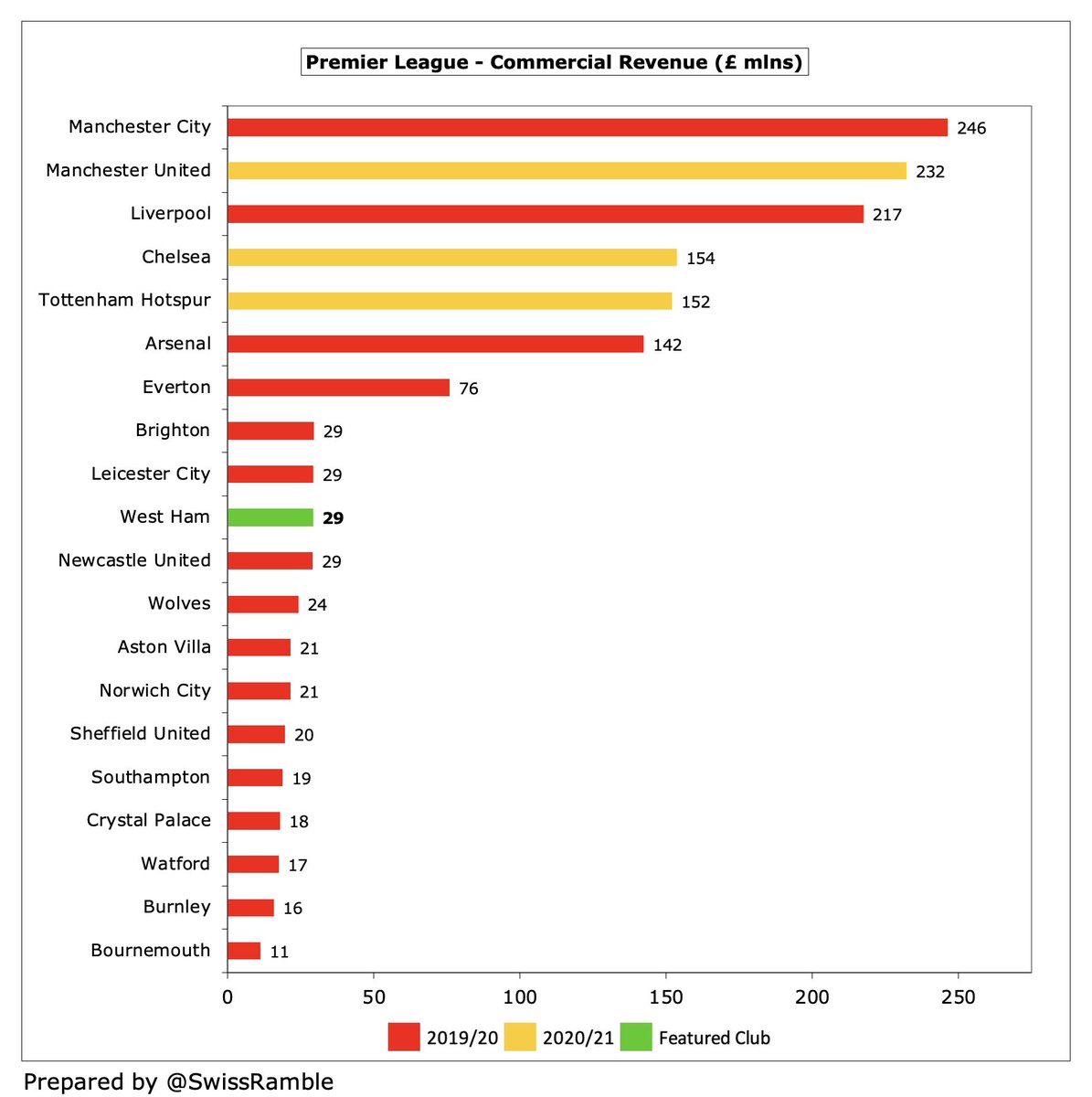

#WHUFC broadcasting revenue virtually doubled from £83m to £163m, including deferred money from 2019/20, which offset COVID driven reductions in match day, down £22m (98%) to just £508k, and commercial, down £5m (16%) to £29m. Other income included £2.5m insurance claim.

#WHUFC wage bill rose £2m (2%) to £129m, while other expenses were cut £1m (2%) to £32m. Player amortisation flat at £58m, but impairment increased £8m to £10m. There was £1.4m exceptional charge for EFL pension scheme revaluation (prior year £3.5m for Manuel Pellegrini’s exit).

Although the £27m loss is not great, it’s one of the better financial results of the clubs that have reported so far in 2020/21, with only #MUFC having a lower loss of £24m. Two other London clubs have posted much higher losses: #CFC £156m and #THFC £80m.

As the club stated, “the financial effect of COVID has been significant for all PL clubs and #WHUFC is no exception”. Net impact in 2020/21 was £12.5m, as revenue was £15.9m lower, offset by £3.4m cost savings. Revenue loss was £41.6m, though £25.7m was deferred from 2019/20.

#WHUFC £41.6m COVID revenue loss in 2020/21 was mainly driven by match day £37.8m, plus commercial income £4.4m and broadcasters’ rebate £1.9m, partly offset by £2.5m insurance claim. Added to the £16.2m lost in 2019/20 gives a total revenue loss of £57.8m.

#WHUFC profit from player sales fell £7m from £25m to £18m, including Sebastian Haller to Ajax (albeit at a loss), Grady Diangana to WBA, Albian Ajeti to Celtic and Jordan Hugill to #NCFC. Most clubs were impacted by the restrained transfer market in 2020/21.

#WHUFC have now posted losses 3 years in a row, adding up to a combined £120m deficit over that period, though they did make profits in 4 of the previous 5 years. The 2020/21 loss was impacted by £10m player impairment charge, presumably for the Haller transfer.

Like many clubs, #WHUFC have become increasingly reliant on player sales, making £114m over the last 5 years, averaging £23m per annum. However, very little made this season (before January window) with only small money received for Felipe Anderson’s move to Lazio.

The adverse impact of exceptional items that have historically hit #WHUFC is largely in the past, though 2021 included £1.4m for pension scheme revaluation, while 2020 featured a £3.5m pay-off for Pellegrini. 2018 benefited from £8.7m profit from sale of the Boleyn Ground.

#WHUFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), which strips out player sales and exceptional items, improved from £19m loss to £36m profit. This is not bad (just above #CFC £33m), though far below #MUFC and #THFC, who both reported £95m in 2020/21.

#WHUFC operating loss (excluding player sales and interest) narrowed from £82m to £34m, which is actually the best result to date in 2020/21 Premier League, as other clubs had even higher losses: #CFC £159m, #THFC £60m and #MUFC £44m (five clubs were above £100m in prior season).

#WHUFC £193m revenue is actually £2m higher than the 2019 pre-pandemic level, despite significant falls in match day, down £27m (98%), and commercial, down £7m (19%), as broadcasting rose £36m (28%), partly due to deferred revenue from 2019/20.

#WHUFC £193m revenue is currently 7th highest in the Premier League. It has increased by £72m (60%) since 2015, which is pretty good, but the problem is that the Big Six has seen even more growth (exception #AFC), e.g. #THFC £164m and #CFC £121m, so the gap has still widened.

As a result of the steep revenue fall in 2019/20, #WHUFC dropped from 18th to 26th in the Deloitte Money League, which ranks clubs globally by revenue, their lowest ranking since 2013. That said, they were still ahead of recent Champions League semi-finalists Ajax and Milan.

#WHUFC broadcasting income rose £80m (98%) from £83m to £163m, due to revenue from 9 games deferred to 2020/21 (played after end-May 2019/20 accounting close), higher Premier League merit payment for finishing 6th (prior year 16th) and lower broadcasters’ rebate (£2m vs £6m).

Revenue for games played after the accounting close could not be booked in 2019/20, but the impact was different for each club. Those like #WHUFC whose accounts closed on 31st May had the largest revenue deferrals, while clubs with 31st July year-end deferred zero revenue.

#WHUFC 2021/22 figures will benefit from qualifying for the Europa League. I estimate they have already earned €24m for reaching the last 16. That’s not too shabby, but is a lot lower than the Champions League representatives, e.g. #CFC and #MCFC both received €120m in 2020/21.

#WHUFC match day income fell £22m (98%) to just £508k, as all home games were played behind closed doors (except 2 with very restricted capacity, 1 with only 2,500 fans). Pre-pandemic £27m income was 7th highest in the PL, but much less than #THFC £95m after their stadium move.

#WHUFC 2019/20 average attendance of 59,925 (for those games played with fans), was the second highest in the Premier League, only beaten by #MUFC 72,726. Club is in latter stages of securing planning consent to raise capacity from 60,000 to 62,500, the largest in London.

#WHUFC commercial revenue fell £5m (16%) from £34m to £29m, comprising £19m commercial activities and £10m retail and merchandising, due to games played without fans. Retail actually rose £1m, despite closure of many outlets, thanks to successful online sales.

#WHUFC commercial income of £29m is 10th highest in England, a long way behind the Big Six (the lowest of which is #AFC £142m, i.e. five times as much). Hardly any growth in last 5 years, while others have seen this revenue stream surge, e.g. #THFC up £93m to £152m.

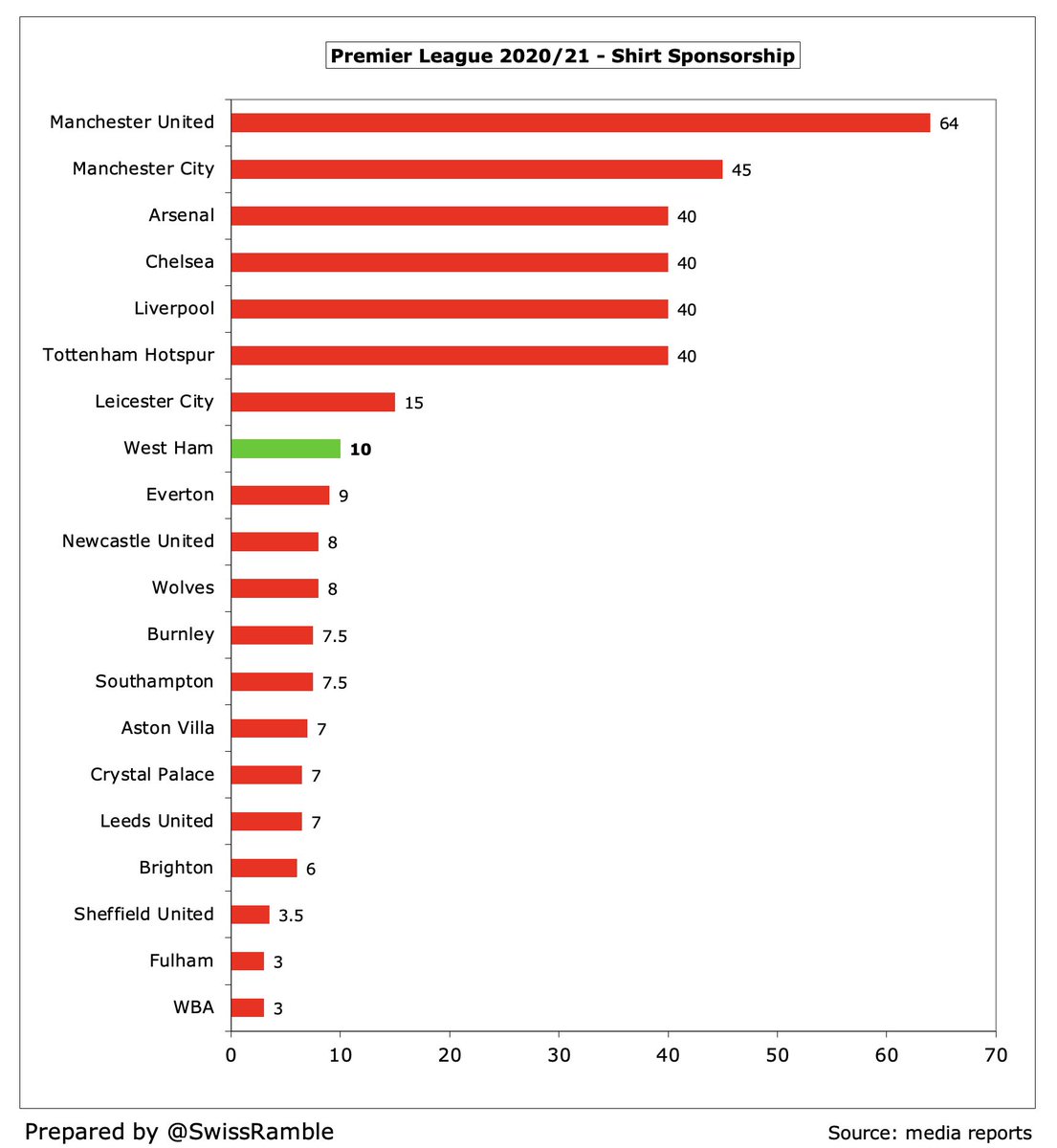

#WHUFC £10m Betway shirt sponsorship is the 8th highest in Premier League, though still £30m lower than their London neighbours. Umbro kit supplier deal of £4m has been extended to 2025, reportedly for £6m, while sleeve sponsor switched to Scope Markets in 2020/21 (£1-1.5m).

#WHUFC other operating income increased from £1.4m to £4.6m, mainly an insurance claim for losses sustained as a result of the pandemic in 2019/20 (£2.5m received to date). Also included Premier League youth academy grant income £1.2m (same as prior year).

#WHUFC wage bill only rose £2m (2%) from £127m (excluding Pellegrini £3.5m pay-off) to £129m, still lower than the £136m peak in 2019, though wages have grown by £45m (53%) in the last 5 years.

#WHUFC £127m wage bill is around mid-table in the Premier League, though £36m below 7th placed #EFC £165m. For some perspective, wages were around £200m less than #CFC £333m and #MUFC £323m in 2020/21, which highlights how well Moyes’ team has performed.

#WHUFC wages to turnover ratio improved from 91% to 67%, though is up from 52% in 2017. Obviously impacted by COVID revenue shortfall. Still pretty good for the Premier League, better than #CFC 77% and around the same as #MUFC 65%, though worse than #THFC 57%.

Vice-chairman Karren Brady’s remuneration rose 30% from £1.0m to £1.3m, the 6th highest in the Premier League, but a long way below Ed Woodward #MUFC £3.1m and Daniel Levy #THFC £2.7m. That said, I estimate she has received well over £10m since arriving at #WHUFC in January 2010.

#WHUFC player amortisation, the annual charge to expense transfer fees over a player’s contract, was unchanged at £58m. Mid-table in the Premier League, over £100m less than big spending #CFC £162m. Also booked £10m impairment, possibly due to selling Haller to Ajax at a loss.

#WHUFC spent £54m on player purchases, half the previous season’s £108m, mainly on two signings from Slavia Prague (Tomas Soucek and Vladimir Coufal) plus Said Benrahma from Brentford. Only around a quarter of #CFC £221m, though others have also reduced spend in 2020/21.

However, #WHUFC have been no slouches in the transfer market with gross spend rising to £412m in last 5 years, compared to only £170m in the preceding 5-year period. Net spend only increased from £136m to £188m, as sales shot up even more from £34m to £224m.

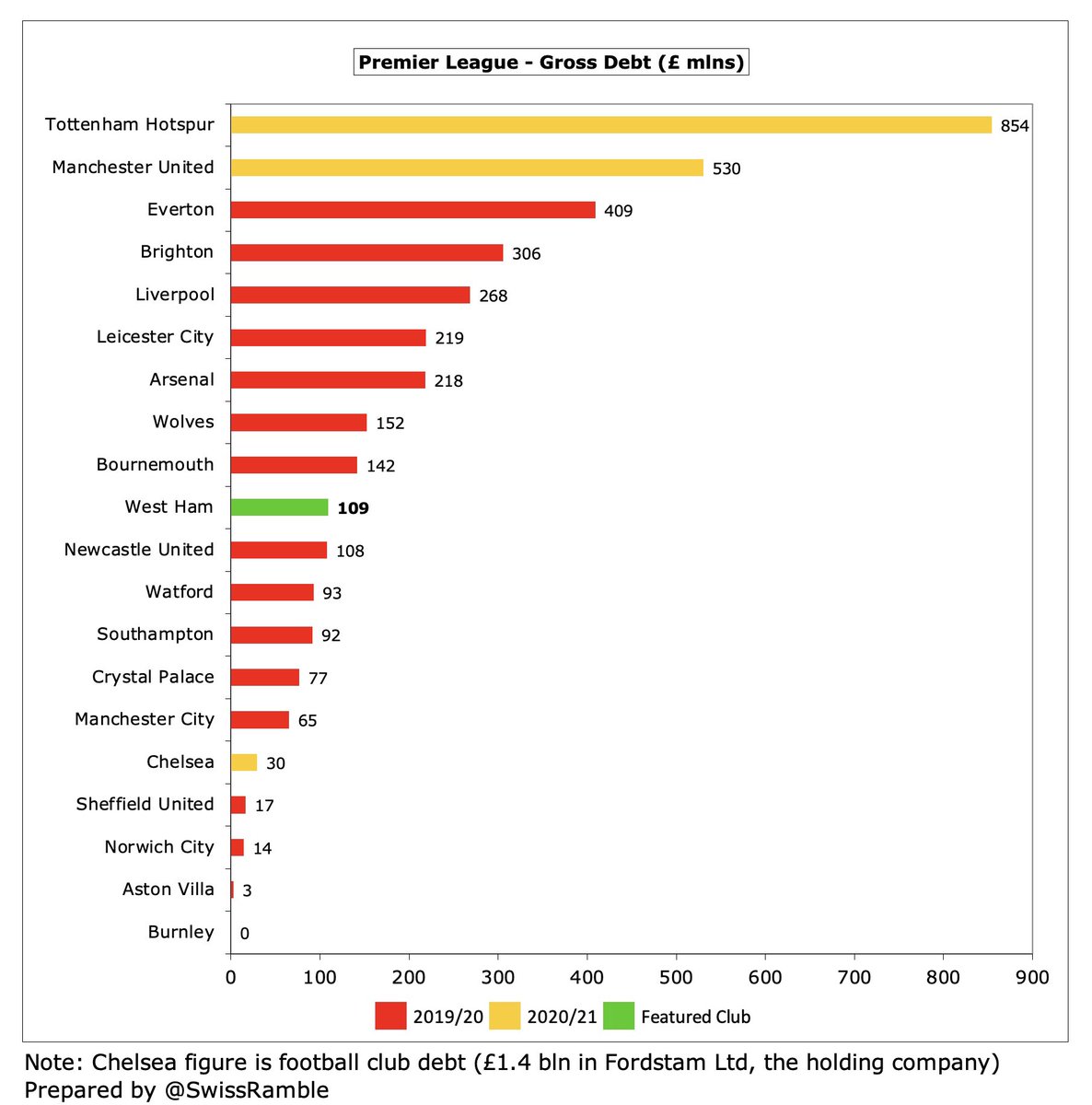

#WHUFC gross debt was cut from £120m to £109m. Shareholder debt unchanged at £54.5m: Sullivan and Gold £44m (4% interest) and J Albert Smith £9.5m (interest-free). External debt down £10m to £55m with short-term Rights & Media loan replaced by 5-year facility with MSD.

In September 2021, after these accounts closed, #WHUFC made an additional £20m draw-down from the £120m MSD facility to take the outstanding balance up to £75m (due for repayment in March 2026) and total debt therefore up to £129m.

MSD Holdings Ltd is Michael Dell’s investment firm, which has already provided loans to other football clubs like Burnley, Derby County, Southampton and Sunderland. Some of those loans are at a high 9% interest rate, but the #WHUFC rate has not been divulged.

Following the decrease, #WHUFC debt of £109m is 10th largest in the Premier League, though miles below #THFC £854m (new stadium), #MUFC £530m (Glazers’ leveraged buy-out). #EFC £409m and #BHAFC £306m debt is very much in the form of “friendly” owner loans.

#WHUFC interest payment increased from £3.6m to £8.1m, 5th largest in the top flight, driven by new MSD loan. Most recent £1.9m payment to Sullivan and Gold was in August 2019. The owners are not paid a salary or dividend, but they have received a lot of interest on their loans.

In light of the pandemic, Sullivan and Gold have deferred payment of £3.7m interest, but they have trousered around £19m interest on their loans to date, which is in sharp contrast to more benevolent owners, who often provide loans interest-free and convert debt to equity.

#WHUFC player purchases have been partly funded by transfer debt. Although down from £111m to £91m, this is still 6th highest in the Premier League. West Ham owed £27m by other clubs, so net payable is £64m. Remaining Haller debt to Eintracht Frankfurt deferred to September 2022.

After adding back £62m non-cash items, offset by £6m working capital movements, #WHUFC had £28m operating cash flow, but then spent £33m on players (purchases £80m, sales £46m), interest £8m and capex £1m. Funded by £30m share capital, offset by £10m loan repayments.

As a result, #WHUFC cash balance increased from £15m to £20m, but this was still firmly in the bottom half of the Premier League. Included £30m investment from the shareholders (mainly Sullivan and Gold) via a rights issue to support the club during the pandemic.

Since 2010 majority of cash has come from #WHUFC operations £245m, supplemented by £113m financing from shareholders (£57m loans and £56m share capital) plus £29m from Boleyn Ground sale. Most (£290m) was spent on new players, £52m on interest payments and £31m on capex.

In the 10 years up to 2020, #WHUFC owners have provided £59m (excludes £30m capital in 2021). This is miles below #MCFC £837m and #CFC £559m, but also a lot less than other clubs with more generous owners, e.g. #AVFC £434m, #EFC £348m, #BHAFC £319m and #LCFC £301m.

Despite the last 3 years’ losses, #WHUFC are still fine for Premier League’s Profitability and Sustainability rules, as allowable deductions (academy, women’s football, community, etc) take them below the 3-year £105m limit even before special COVID dispensation.

Czech billionaire Daniel Kretinsky purchased a 27% stake in #WHUFC in October with an option to acquire shares owned by Sullivan and Gold for a set price. This option apparently has a time limit, though the date has not been disclosed.

Sullivan and Gold stand to make a huge profit on their original investment in #WHUFC with the club valued at £600-700m, though any sale before March 2023 would incur a payment to the taxpayer under the terms of the agreement made when the club moved to the London Stadium.

Like other clubs, #WHUFC finances have been severely impacted by COVID, but Sullivan is optimistic: “With recent investment into the club helping to strengthen long-term stability, we have much reason to be positive and confident about further progress in the right direction.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh