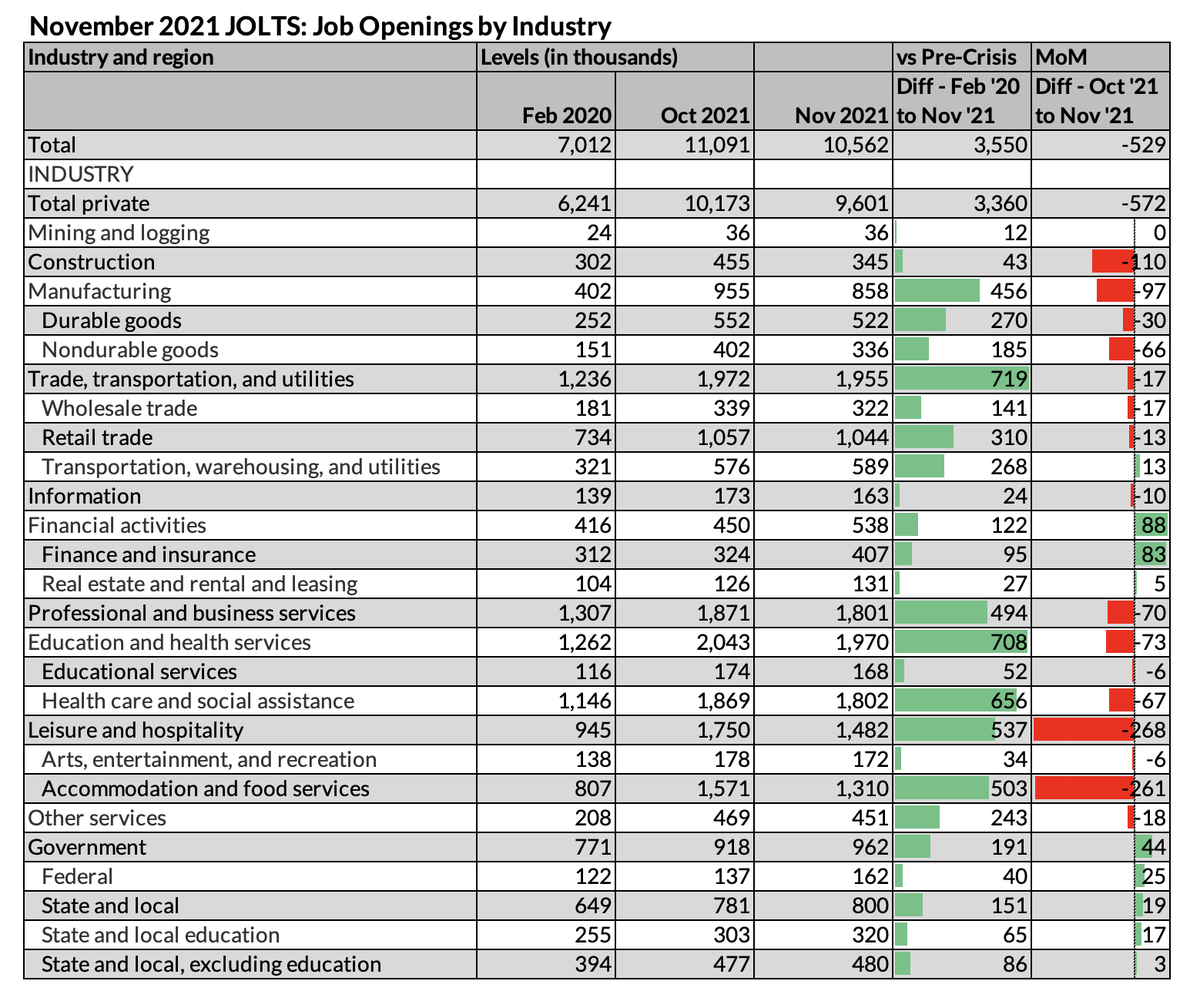

Job openings fell to 10.6 million in Nov, still near record highs but lower as the resurgent Delta wave in Nov crimped demand for workers, even before the impacts of Delta are fully felt.

#JOLTS 1/

#JOLTS 1/

The slowdown was primarily in accommodation & food services (no surprise worker demand there falls as the pandemic worsens). Job openings in accommodation & food services are at their lowest since April 2021, though they're still up 62% over the course of the pandemic.

#JOLTS 2/

#JOLTS 2/

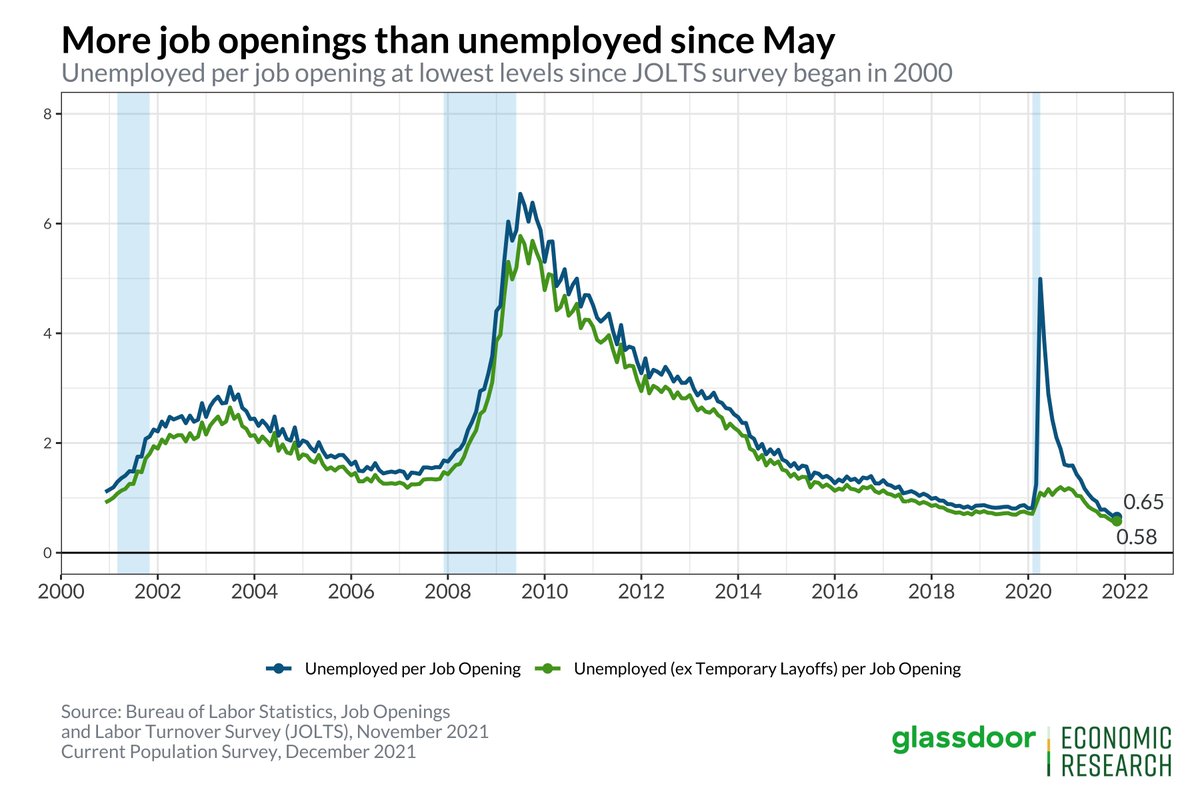

Despite the drop in job openings, the number of unemployed per job opening fell to 0.65 in Nov (or 1.54 job opening per unemployed worker). A year ago, this figure was reversed with 1.59 unemployed per job opening.

#JOLTS 3/

#JOLTS 3/

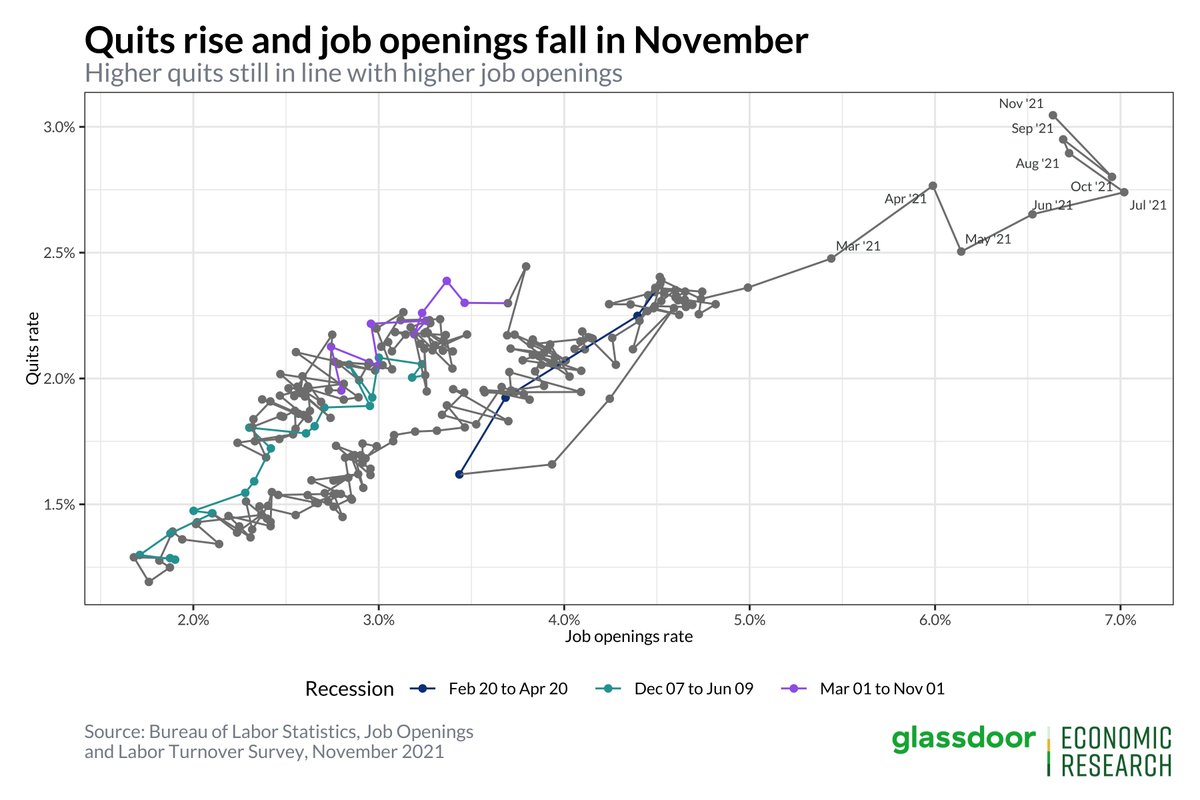

Quits also rose to a new record high of 4.5 million in November, hitting a 3 percent quits rate for just the second time. The surge in quits comes as the Delta variant began to rebound in mid-November.

#JOLTS 4/

#JOLTS 4/

The surge in quits is being driven primarily by accommodation & food services where the quits rate spiked to 6.9 percent. Not 100% sure but I would hazard a guess that 6.9 percent is the highest of any industry ever since the survey began.

#JOLTS 5/

#JOLTS 5/

The Beveridge curve shifted to the left in November as both job openings and unemployment fell, though today's job openings rate has been more consistent w/ a ~4% unemployment rate in years past.

#JOLTS 6/

#JOLTS 6/

Chart's a little messy but high quits are still in line with high job openings. That's a useful reminder that the "Great Resignation" is likely best explained simply by the hot job market. Employers are hiring away workers from their competitors, driving higher churn.

#JOLTS 7/

#JOLTS 7/

While today's #JOLTS report doesn't bake in the effects of Omicron, it does show what to expect when the pandemic worsens: falling but still high demand for workers and increasing churn, especially in Covid-sensitive sectors.

8/8

8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh