I missed whitepaper szn but I wrote a quick ~30-page primer to introduce institutions and new investors to blockchains, eth, web3, defi, and the competitive landscape. This is the ground-up investment case for anyone starting out. (link in next tweet)

The Investment Case for Ethereum, Web3, and Decentralized Finance

~30 pages but don't worry there are 25+ pictures and charts

drive.google.com/file/d/17zTf9r…

~30 pages but don't worry there are 25+ pictures and charts

drive.google.com/file/d/17zTf9r…

I tried to make this as accessible as possible. A 101 piece with some 201 data. This is a starting point hopefully to get institutions and individuals down the rabbit hole if they aren't already. Hope my @bankless @RyanSAdams @TrustlessState guys enjoy!(Yes we discuss valuation)

Did my best to cite and distill all the awesome work of others: @jaintanay_ @twobitidiot @theblock_ @packyM @BitwiseInvest @TrustlessState @SquishChaos @defipulse @cdixon @Data_Always @Cooopahtroopa @tokenterminal @Gemini @matthew_sigel...and avoid the thoughts of @jack

I got the idea from @michaelbatnick and @awealthofcs when on a recent episode when they had a listener question on where to even get started if you are interested in learning more about crypto. Cliffnotes of the paper in the next few tweets.

Page 5-9. What is the blockchain? What is Bitcoin? What is Ethereum? What is POW vs POS?

page 9-12 Defi--> AMMs, borrowing and lending, much more. Takeaway: huge growth. Defi only 1% of global banking revs while cutting out lawyers/bankers and moving faster. Infra exploding

page 9-12 Defi--> AMMs, borrowing and lending, much more. Takeaway: huge growth. Defi only 1% of global banking revs while cutting out lawyers/bankers and moving faster. Infra exploding

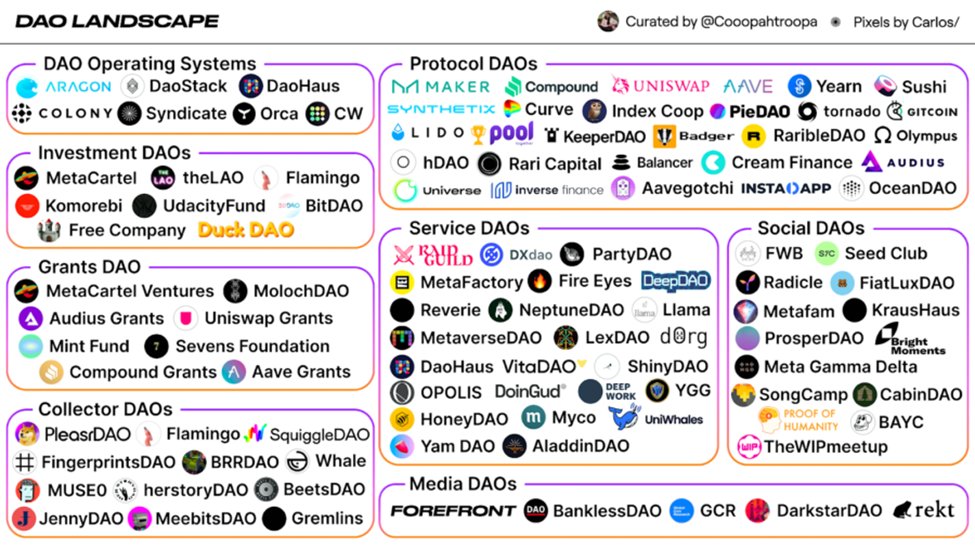

pages 13-17 Web3--> DAOS. NFTs. Metaverse. ENS

More explosive growth. Get ready for the year of the DAO. NFTs are just getting started. 300k active monthly users on OS, 3m+ on coinbases waitlist. Metaverse will be the theme of 2020s.

More explosive growth. Get ready for the year of the DAO. NFTs are just getting started. 300k active monthly users on OS, 3m+ on coinbases waitlist. Metaverse will be the theme of 2020s.

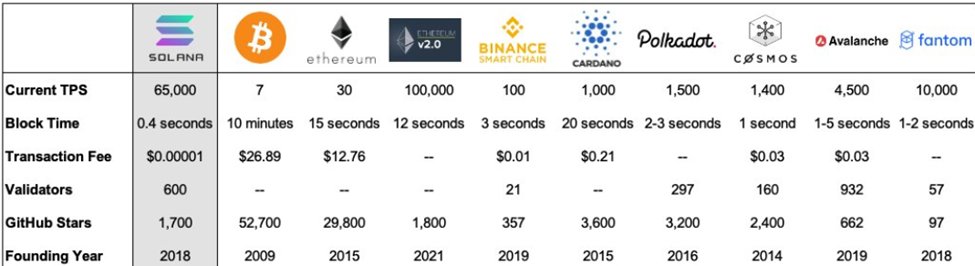

18-22 Competition--> Dive into $Sol $AVAX $ADA and quick view of key metrics of others. @ethereum cant get complacent. Other L1s have taken 30% market share in 2021 alone. Speed and fees will be an issue until we get to sharding. 2 platforms will likely win out

23-30 Valuation. Look from multiple angles: supply-based, fundamentals, market cap, comparables, Industry targets. $20k not unreasonable by end of 2022

30-32 how to invest/investing in context/risks

TLDR of a lot of research others have done, with some of my thoughts/synthesis distilled to a manageable length for new investors. NFA, of course.

TLDR of a lot of research others have done, with some of my thoughts/synthesis distilled to a manageable length for new investors. NFA, of course.

Happy holidays and WGMI in 2022. Forward to anyone you think may be ready to go down the rabbit hole this year.

If you enjoyed please follow me, pass it along to others, and consider reaching out if you need help with any Crypto-related research

If you enjoyed please follow me, pass it along to others, and consider reaching out if you need help with any Crypto-related research

Also thanks to others who helped influence my thinking though not directly quoted @iamDCinvestor @dlawant @katie_haun @ericgoldenx @nic__carter

• • •

Missing some Tweet in this thread? You can try to

force a refresh