1/8

Nothing the Fed said today should have been a surprise.

The problem was the market just did not want to believe it until the minutes came out.

Now it hit them like a brick to the face.

A thread to explain

Nothing the Fed said today should have been a surprise.

The problem was the market just did not want to believe it until the minutes came out.

Now it hit them like a brick to the face.

A thread to explain

https://twitter.com/bchappatta/status/1478837819195994112?s=12

2/8

The orange line is the probability of a March hike. It has been above 50% since December 21, over 2 weeks now.

The blue line is a June rate hike. That has been priced in since late-Oct.

The Fed minutes should not have been a surprised, it's been priced in for some time.

The orange line is the probability of a March hike. It has been above 50% since December 21, over 2 weeks now.

The blue line is a June rate hike. That has been priced in since late-Oct.

The Fed minutes should not have been a surprised, it's been priced in for some time.

3/8

For a while I've talked about the disconnect between what the market has priced in and what the consensus says will happen. It is rare the market pricing is NOT the consensus view.

For a while I've talked about the disconnect between what the market has priced in and what the consensus says will happen. It is rare the market pricing is NOT the consensus view.

4/8

The consensus constantly argued that the Fed will not hike three times in 2022, and would not start with a March hike even though it was already priced in.

This is now changing as today seems to be the first step in the consensus converging to the market's view.

The consensus constantly argued that the Fed will not hike three times in 2022, and would not start with a March hike even though it was already priced in.

This is now changing as today seems to be the first step in the consensus converging to the market's view.

5/8

Now, they have to deal with the new reality ... the fourth hike is priced in for February 2023. And at 44%, the fourth hike in December is a real possibility.

Now, they have to deal with the new reality ... the fourth hike is priced in for February 2023. And at 44%, the fourth hike in December is a real possibility.

6/8

Four rate hikes get the funds rate to 1.00% to 1.25% by the end of the year.

The market still has the terminal rate at 1.70%.

What does it mean? It will not take much for the Fed to hike too much and break something.

Four rate hikes get the funds rate to 1.00% to 1.25% by the end of the year.

The market still has the terminal rate at 1.70%.

What does it mean? It will not take much for the Fed to hike too much and break something.

7/8

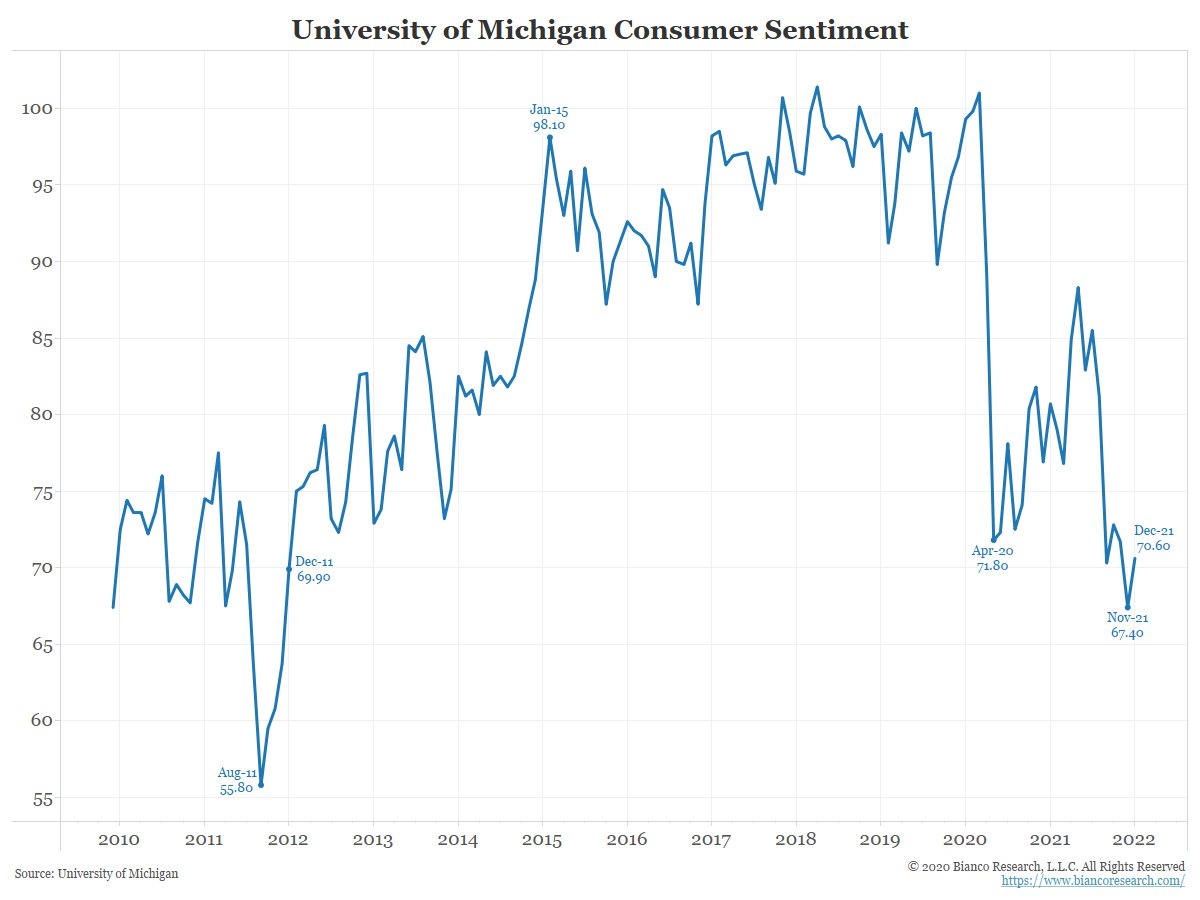

40% of the public rents and has less than $1,000 in savings. This cohort feels the brunt of inflation.

The Fed is in a tough spot. Respond to inflation and hike and risk the economy/stock market.

Do not respond to inflation and risk the ire of the majority party in DC.

40% of the public rents and has less than $1,000 in savings. This cohort feels the brunt of inflation.

The Fed is in a tough spot. Respond to inflation and hike and risk the economy/stock market.

Do not respond to inflation and risk the ire of the majority party in DC.

8/8

The Fed can no longer print money whenever the economy/markets falter.

Now they must decide to prop up stocks or tame inflation. Successfully doing both seems unlikely

The consensus/stock market started to figure this out about 3 hours ago, and fear they are going to lose.

The Fed can no longer print money whenever the economy/markets falter.

Now they must decide to prop up stocks or tame inflation. Successfully doing both seems unlikely

The consensus/stock market started to figure this out about 3 hours ago, and fear they are going to lose.

• • •

Missing some Tweet in this thread? You can try to

force a refresh