1/ A few evolving thoughts on what decentralization means for energy and electric transport systems, as both scale up massively in the 2020s.

2/ First we are going to get so much more of...everything. About 300 gigawatts of installed small-scale solar today, going to 10x that much; 22GW of batteries, going to 2,800 (130x). bloomberg.com/news/articles/…

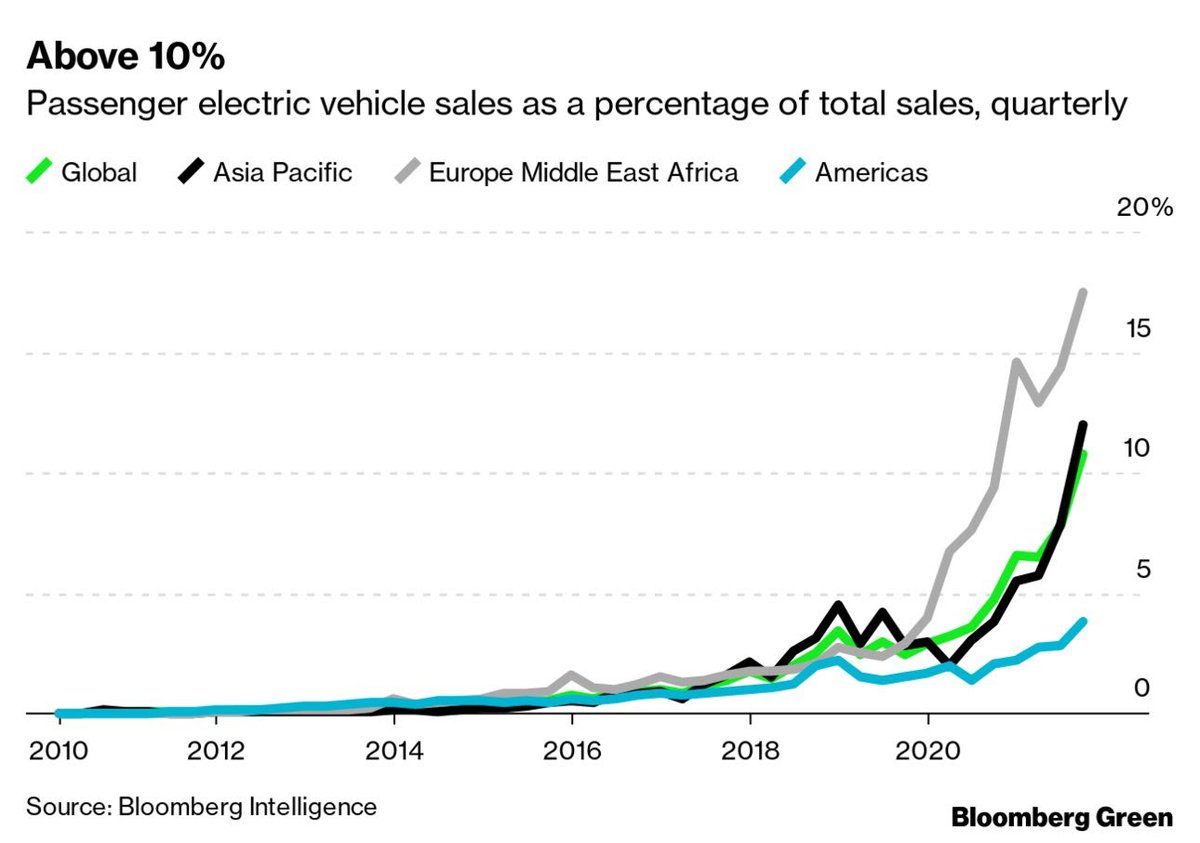

3/ Then there are electric vehicles, connected/mobile/potentially bi-directional+transactive batteries. 10% of sales already, with so much headroom in a $2-2.5T annual market

4/ @VW says that it wants its cars to "be used on the energy market as flexible, mobile energy storage units.” volkswagen-newsroom.com/en/press-relea…

5/ Millions of solar generation systems and battery systems will be individually owned, participating in power markets that only a few decades ago were the exclusive province of large utilities and state-owned and state-regulated companies.

6/ Cars have been individually owned since the beginning of course, but if hundreds of millions of them become participants in the power market in the coming years, they will play a very different role than they do today.

7/ Decentralization of energy systems could enable myriad new business models to flourish. Individuals can arbitrage price differentials; neighbors can trade with each other; companies can aggregate assets and act in place of larger and established energy market participants.

8/ This is all good, great even. And should be embraced, but not without a lot of clear thinking on nth-order effects.

9/ Power markets are not the consumer internet. Power markets are highly regulated for a reason, and we collectively place expectations on those markets — of reliability, of universal service, and of cost — that we do not typically apply to individual actions.

10/ In a decentralized age, would someone be able to price her own power at 10,000 times the average? Or, would a small clique of insiders wash trade and essentially spoof the market with price signals that do not reflect supply and demand? investopedia.com/terms/w/washtr…

11/ Another equally important question is, does decentralization necessarily imply more innovation?

12/ Here I drew inspiration from some typically cogent thoughts from @levie, who crisply captures the tradeoffs between decentralization and innovation. He's writing on Web3, but it is relevant here

https://twitter.com/levie/status/1476631515039625225?s=21

13/ The web, @levie says, “is already decentralized, allowing you to launch any new product to the market at any time.”

https://twitter.com/levie/status/1476631515039625225?s=21

14/ A further decentralization — in which each product itself is without a center — breaks a market’s natural efficiency at determining the right product that it needs.

https://twitter.com/levie/status/1476631515039625225?s=21

15/ Add in requirements for availability and reliability, and it is unclear the degree to which decentralized electricity and electric transport markets could operate without some centralized control.

16/ The future likely will offer a blend: a decentralization of assets along with entities that will serve ‘command and control’ functions.

17/ That could leave plenty of rom for innovation and blue sky for new businesses and new business models - while also maintaining reliability, equity, universal service etc. More on that to come /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh