THREAD: Exactly 10 years ago, solar PV module manufacturer Solyndra went bankrupt. It's quite the story. VCs, Silicon Valley, the U.S. Treasury, trade, supply/demand, technology risk/innovation, competition.

And the most important thing, 10 years later? It doesn't matter at all.

And the most important thing, 10 years later? It doesn't matter at all.

2/ What it was: a solar novelty in (literally) multiple dimensions. Cadmium telluride thin-film PV, mounted in a glass tube, with a bespoke racking system only for commercial roofs, needing a special rubber roofing backsheet. Mounted, it looked like this:

3/ Why it was: conceived when crystalline silicon solar panels were 1/ very expensive 2/ relatively inefficient (compared to today) with 3/ scarce inputs and 4/ uncertain future supply - targeted at an underserved market

4/ Who it was: Chris Gronet, a visionary founder with deep experience in semiconductors, and a whole raft of investors (some of whom will read this!) and, (in)famously, the U.S. government via the @ENERGY loan guarantee program

5/ Where it was: Fremont, California - just east of Silicon Valley, close to founder/funders/expertise in everything you'd want to set up a company: capital equipment, tooling, line automation, and decent logistics too

6/ What happened?

After $1 billion of private investment, the DOE went through a multi-year vetting process, and awarded its loan guarantee on September 3, 2009 energy.gov/key-facts-soly…

After $1 billion of private investment, the DOE went through a multi-year vetting process, and awarded its loan guarantee on September 3, 2009 energy.gov/key-facts-soly…

7/ Solyndra scaled up, launched with some fanfare (a former president, initials BHO, showed up at the factory), began shipping, and things looked good

8/ But - while cadmium telluride solar semiconductors might work in an evacuated tube...Solyndra was not working in a vacuum. At all.

9/ First, supply of, well, everything going into conventional crystalline silicon PV modules was soaring. Markets respond to incentives, after all. What happens when supply catches up to demand? What happens when it exceeds it?

Polysilicon prices fell 90% bernreuter.com/polysilicon/pr…

Polysilicon prices fell 90% bernreuter.com/polysilicon/pr…

10/ Module manufacturing capacity caught up too - so, the price of the final purchased energetic thing (the solar panel) fell massively. See - Solyndra's market moment was a glitch in the trendline assets.bbhub.io/professional/s…

11/ The price of solar power also dropped massively - from $347 per megawatt-hour in 2009 (year of Solyndra's loan guarantee) to half that much in late 2011, to 90% less by the end of 2020

12/ And in this process, something that the bankers knew, and technology developers were rapidly understanding, became clear:

Solar's product isn't semiconductors - it is electrons. And those are sold on cost and volume.

Solar's product isn't semiconductors - it is electrons. And those are sold on cost and volume.

13/ Got a multidimensionally-novel solar semiconductor that needs bespoke tooling/automation/assembly/installation processes? Great! As long as your product, electrons, can compete.

And if they don't, it's existential.

And if they don't, it's existential.

14/ Put it another way: Solyndra really WAS optimal for its specific application. BUT - you can only make a market, if the market won't make it first. And at a low enough cost, and at high enough availability, a suboptimal option prices everything else out

15/ You (multidimensionally-novel solar semiconductor manufacturer) might be selling something hardware+process, but the market is buying electrons, even if it's less efficient to get them from a flat panel with heavy rooftop mounting and ballasting

16/ If you've read this far, you already know the what happened: Solyndra went bust. @ENERGY has a very good history here: energy.gov/key-facts-soly…

17/ I honestly think that Silicon Valley was prepared for this - it is the business model! - but DC was not, nor were most commentators. And so, down went the first of the guaranteed DOE loans, and with it, a lot of political will as well.

18/ But here is the most important part, as I write a decade later:

None of the above matters at all, except as a learning exercise. And here is why.

None of the above matters at all, except as a learning exercise. And here is why.

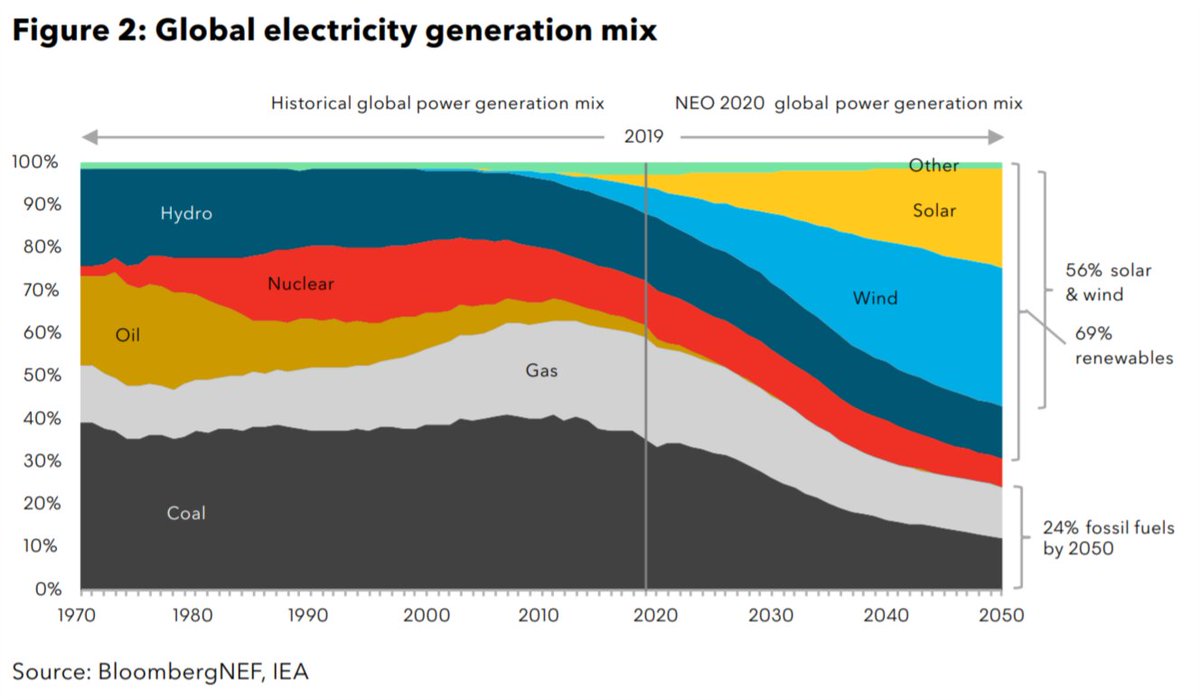

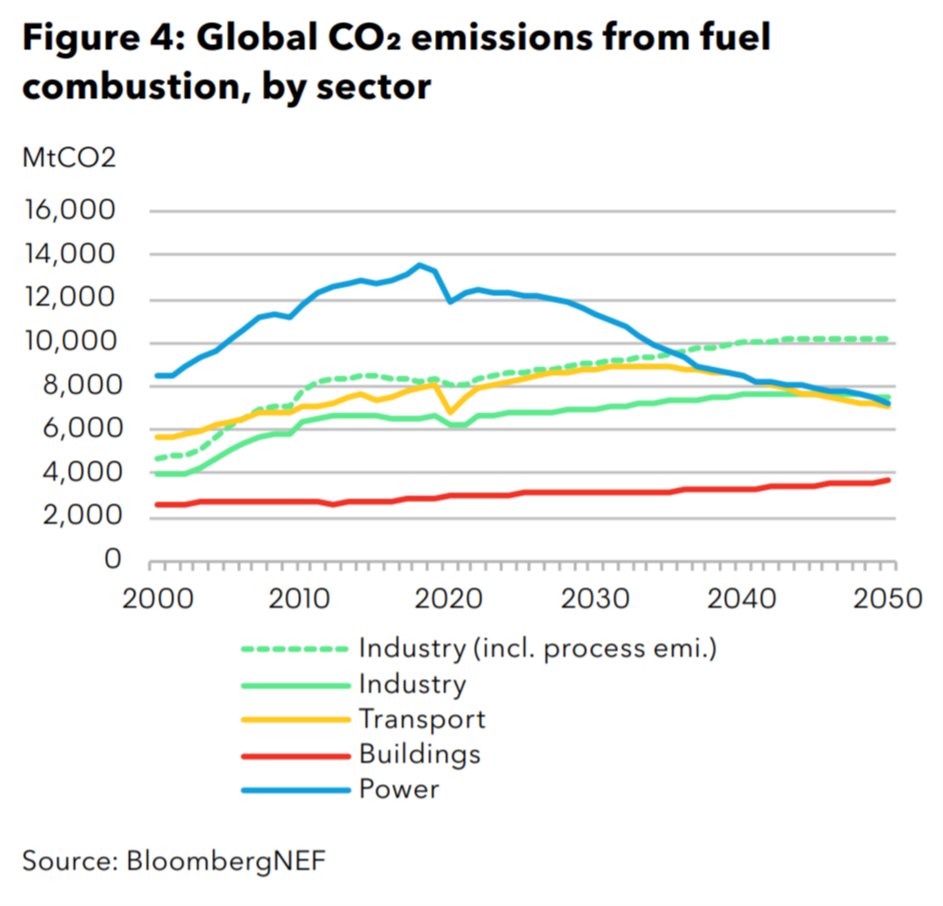

19/ Cost: solar (and wind) are now the cheapest sources of new electricity for 66% of global population, 71% of global GDP, and 85% of global power generation assets.bbhub.io/professional/s…

20/ Deployment: more than 700 gigawatts of PV has been installed since 2011. This year, the market could be 200 gigawatts, which still astonishes me

21/ Investment: Asset developers have invested more than $1.4 trillion in solar in the past decade.

22/ Innovation: process innovation, materials science, and the hard graft of site mapping, groundwork, optimizing wiring and racking and zip tying - it's a huge virtuous machine, and it works

23/ More innovation: new capital markets approaches, better management software, efforts to procure renewables 24/7...it's all going gangbusters cloud.google.com/blog/products/…

24/ And - as the very sage @energyequity noted today, the Solyndra dream isn't dead! It's just been done elsewhere, and better, by bifacial modules that get 1/5th of it output from...its backside. You can now buy a 500 Watt bifacial module for €199 todoensolar.com/epages/6198724…

25/ The idea wasn't wrong, it was just early and done wrong. Or to be more generous: the idea was right for the future, but there was no way to do it right at the time.

26/ And the main reason none of this matters (in a good way) is that innovation in climate tech is on fire, and funding at every stage is following, and there is a $100 trillion investment need with multiple trillion-dollar TAMs within it

27/ Check out the latest from @climatetech_vc for just a glimpse of that. climatetechvc.org/%f0%9f%8c%8f-c…

28/ It's been a minute, so thanks for reading. And if you're ever driving on the 880, cast an eye over 47700 Kato Road. That was the factory. Then it was a Seagate R&D facility. Then it was a SolarCity facility. And now Tesla leases it. So it goes!

/END

/END

CODA: the semiconductor was CIGS, not CdTe (ugh. I knew this one. Thanks @ashumisra for reminding).

• • •

Missing some Tweet in this thread? You can try to

force a refresh