Thread 1/5: After seeing such a clean rejection off of the 30m OR (opening range) for #NQ_F on Friday, I thought of @Michigandolf, who loves the 30m OR. I then wondered how often we close below or above the 30m OR. I decided to do the math so you don’t have to.

Although #ES_F did not reject the 30m OR like NQ on Friday, it did reject the open. You can see the highlighted area around open is the 30 second OR, popularized by @paxtrader777 and shared by a few others. My favorite opening range on my chart.

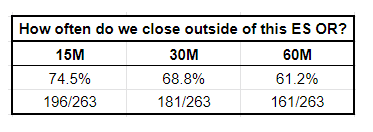

I was surprised, I would have guessed we closed outside of the 30m OR ~50% of the time or less, but actually we close outside of the 30m OR 73% of the time. NQ even closes outside of the 60m OR more times than it closes inside.

ES is less likely to close outside of the OR than NQ, but still shows we close outside more than we do inside. I was reminded of those famous words from @ES_F_Leo, if B is inside of A.. well, if B is inside of A, ES still closes outside of the 30m OR 61.9% (26/42) of the time...

... which is less than if B is not inside of A, but this was only 42 instances in the last 263 trading days.

I thought this information was at least somewhat useful so I decided to share it.

Start date for data: 1/4/2021, end date: 1/7/2022.

I thought this information was at least somewhat useful so I decided to share it.

Start date for data: 1/4/2021, end date: 1/7/2022.

• • •

Missing some Tweet in this thread? You can try to

force a refresh