Follow for bad trading advice and mediocre memes. It's up to you to decide what's a meme.

How to get URL link on X (Twitter) App

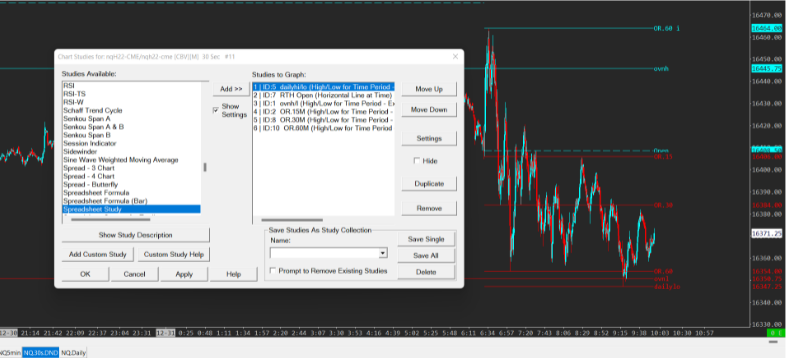

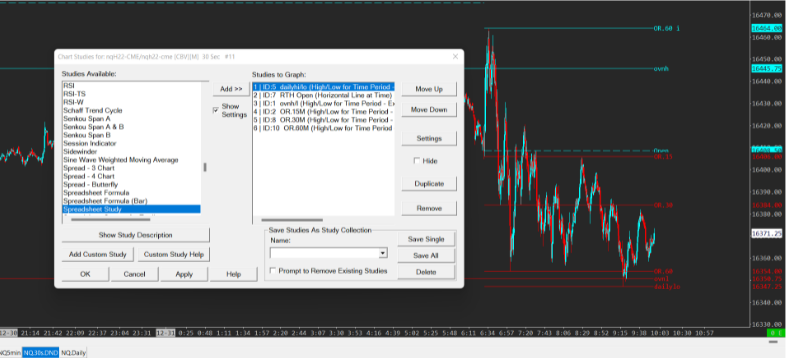

Although #ES_F did not reject the 30m OR like NQ on Friday, it did reject the open. You can see the highlighted area around open is the 30 second OR, popularized by @paxtrader777 and shared by a few others. My favorite opening range on my chart.

Although #ES_F did not reject the 30m OR like NQ on Friday, it did reject the open. You can see the highlighted area around open is the 30 second OR, popularized by @paxtrader777 and shared by a few others. My favorite opening range on my chart.

Now how I prefer to do things is go to a daily candle chart and overlay the studies, this reduces the amount of data cleaning I need to do before analyzing, otherwise it would show OR row on every candle row. "Study/Price Overlay" is how I overlay studies.

Now how I prefer to do things is go to a daily candle chart and overlay the studies, this reduces the amount of data cleaning I need to do before analyzing, otherwise it would show OR row on every candle row. "Study/Price Overlay" is how I overlay studies.