Why is volume a good indicator to watch in NFTs?

What moves the price of NFTs?

What is the fundamental behaviour and psychology behind those price shifts?

Let's break down the dynamics of NFT pricing a bit and figure out why.

👇

What moves the price of NFTs?

What is the fundamental behaviour and psychology behind those price shifts?

Let's break down the dynamics of NFT pricing a bit and figure out why.

👇

Credit where it's due, I got the idea to look at volume from some of @NFTLlama's earliest videos and posts. He suggested that a project that went through the mint hype drop, had a period of decrease, and then managed to create a spike of interest, was well placed to have another.

Volume, in that context, was a proxy for "the team is still working hard and is able to drive attention to the project", which was a proxy for "the project has good chances of succeeding at drawing even more attention to it and therefore going up."

These days, I see volume slightly differently.

Back when I was trading crypto, I remember feeling confused by what made prices go up and down, and wishing for a breakdown of how the fundamental dynamics worked, something slower and easier to understand.

Back when I was trading crypto, I remember feeling confused by what made prices go up and down, and wishing for a breakdown of how the fundamental dynamics worked, something slower and easier to understand.

I imagined myself on a trading floor three hundred years ago in, say, Amsterdam (the world's first stock market!), watching the action and observing the psychology and the behaviour that led a price to rise and fall. Can't do that on Binance, of course, but I had that wish.

NFTs granted my wish: the action is so much slower and more piecemeal that you can see the psychology at work. Because each item is listed individually, it's easier to see what is actually going on.

Here are my observations.

Here are my observations.

By the way, if you like this thread, please RT it so others can learn. And if you want more, you can find more threads at swombat.io - I also post daily market health stats and analysis. Follow me for more good stuff. And occasional bad jokes.

As a simple starting point, at most times, most (non-dead) projects are in a state of relative balance. There are about as many people listing as people buying. As people list things, others buy them up. The price remains roughly constant.

This happens because of two factors:

1) the sellers believe in the project's value and aren't in a rush to sell

2) new buyers keep coming to the project, believing the project is worth its current price, and so buy what's on offer

1) the sellers believe in the project's value and aren't in a rush to sell

2) new buyers keep coming to the project, believing the project is worth its current price, and so buy what's on offer

In fungible token trading this would be called, usually, a consolidation phase, and it's understood to have a finite time horizon. Why is that?

Well, why are the sellers selling at all? If they believe the project has value, why sell?

Enter "taking profits".

Well, why are the sellers selling at all? If they believe the project has value, why sell?

Enter "taking profits".

Let's take a simplified case and say most holders bought in at 0.1. The price is now at 0.5. Holders might want to sell some NFTs to derisk their holdings. Or they might want to take some profits at a very healthy 5x level.

This creates the famous "resistance" levels.

This creates the famous "resistance" levels.

For this imaginary project, then, there's a resistance around .5. Whenever the floor price hits .5, people list between .4 and .5, looking to take profits. The price hovers around there for weeks.

Then it starts taking off. Why?

Then it starts taking off. Why?

Because eventually, you run out of people who bought at 0.1 and so are willing to sell at 0.5. That's what consolidation is. We shift from an owner base that is willing to sell at 0.5 to an owner base that won't sell until the price goes higher.

Once you run out of sellers, if the project is still attracting buyers and still looks like it might be worth that price, then naturally the price goes up.

That's the healthy, slow dynamic for prices to go up.

Same # of buyers + fewer sellers => price goes up

That's the healthy, slow dynamic for prices to go up.

Same # of buyers + fewer sellers => price goes up

What can end this dynamic is if the price rises to a point where people just don't think the project is worth this much. This doesn't mean the project is bad, just that it's overpriced.

Then sales will slow down, and the next dynamic will kick in.

Then sales will slow down, and the next dynamic will kick in.

If the project is not able to keep drawing in new potential buyers, because it's not generating attention or simply because it's too expensive, then listings won't sell.

Inevitably, at leat some sellers get impatient or spooked and... they list lower. They undercut.

Inevitably, at leat some sellers get impatient or spooked and... they list lower. They undercut.

There's a bad habit in the NFT market to blame the undercutters for pricing issues. The problem is not the undercutters: it's that the project is overpriced and/or not attracting enough buyers. Undercutters are a very natural and helpful symptom, a part of price discovery.

One real helpful piece of wisdom I encountered at one point (in a youtube video, I can't remember who from - it might have been @GiancarloChaux?) is that:

The floor price not the fair price of the project: it's the price that no one is willing to pay for the project right now.

The floor price not the fair price of the project: it's the price that no one is willing to pay for the project right now.

Undercutters, for whatever reasons (desire for liquidity; fear; curiosity; etc), want to sell soon, notice that things aren't selling, and list lower, until they find buyers again. The project discovers its actual price instead of the artificial "floor price".

Fewer buyers + same number of sellers = price goes down

It's a simple and robust dynamic and explains the price oscillations during consolidation phases, as the project rises above its perceived fair price and then goes back down to a price where people are willing to buy.

It's a simple and robust dynamic and explains the price oscillations during consolidation phases, as the project rises above its perceived fair price and then goes back down to a price where people are willing to buy.

What about more extreme phases, like pumps?

Prices can rise without a pump, as we've suggested. But often, when the prices start rising, a pump follows, because people get excited that the consolidation phase has finished and they want to get some quick profits.

Prices can rise without a pump, as we've suggested. But often, when the prices start rising, a pump follows, because people get excited that the consolidation phase has finished and they want to get some quick profits.

Other reasons for pump include: an ethical influencer mentioning a project they love; a criminal influencer shilling a project they want to flip to their followers; some kind of external event suddenly bringing the project a lot more attention (e.g. Jimmy Fallon buying an ape).

Either way, the dynamic with pumps, and why you should avoid buying into pumps, is entirely predictable. Pumps are like bad drugs: they always come with a hangover.

New buyers flood in. As the number of sellers doesn't adjust as quickly, the price inevitably starts trending up.

New buyers flood in. As the number of sellers doesn't adjust as quickly, the price inevitably starts trending up.

This makes the project more attractive to ppl looking for quick profits, so even more buyers come in. The price rises more. And the cycle continues until... it ends.

Why? Well that depends on what started it. But one thing is for sure: pumps always end.

Why? Well that depends on what started it. But one thing is for sure: pumps always end.

What happens at the end of a pump?

Well, it's pretty simple, really: the project is, at that point, usually way overvalued. So real buyers, who want the project's long term sustainable benefits rather than a quick profit, aren't buying. They stay away because it's poor value.

Well, it's pretty simple, really: the project is, at that point, usually way overvalued. So real buyers, who want the project's long term sustainable benefits rather than a quick profit, aren't buying. They stay away because it's poor value.

Meanwhile, the short-term flippers looking for a quick profit sense the wind turning and shift from buying to selling. So the number of buyers collapses, and the number of sellers multiplies. Some inevitably undercut.

This is why pumps are pretty much always followed by dips.

This is why pumps are pretty much always followed by dips.

How bad the dip is depends on:

1) how unnatural the pump was

2) how big it was

3) how far above fair market value we are

Now, fair market value can be influenced by the size of the pump itself, because some ppl buy solely to flip, and a previous high ATH is something they value.

1) how unnatural the pump was

2) how big it was

3) how far above fair market value we are

Now, fair market value can be influenced by the size of the pump itself, because some ppl buy solely to flip, and a previous high ATH is something they value.

But on the whole, I find that most of the time, after a pump, a project ends up trending back towards something that feels like it would have been its fair market value at that point if the pump had not happened.

That's a good thing. It means that there is a buying market that is discerning and only buying projects when they appear to be good value for money. This is a different, and much healthier, buying pattern than buying for short term flips.

I'm pretty sure this dynamic, in a much less discernible, quicker way, happens with fungible crypto & stocks too. Taking profits. Pumps. Dumps.

It's the same psychology, with a harder to track product. With NFTs you can see exactly how the drama unfolds.

It's the same psychology, with a harder to track product. With NFTs you can see exactly how the drama unfolds.

So let's go back to volume. Why is it such a good indicator?

The best indicators for trading are leading indicators - meaning, they start showing signals early, while you can still act on them.

Less good indicators are lagging indicator which tell you what happened a while ago.

The best indicators for trading are leading indicators - meaning, they start showing signals early, while you can still act on them.

Less good indicators are lagging indicator which tell you what happened a while ago.

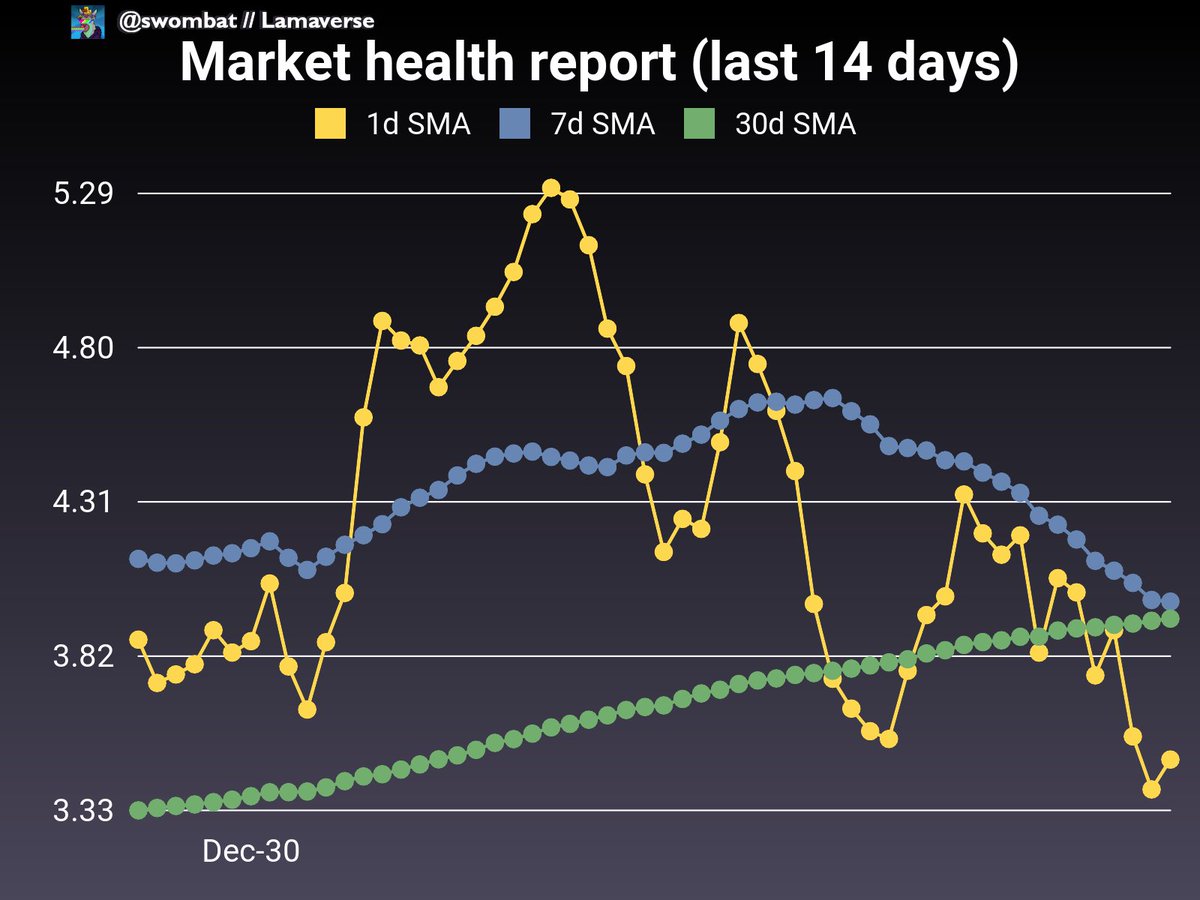

As an example, the moving average lines, present on so many charts, are very nice to make long-term patterns visible but by the time they change direction, it's often too late to buy or sell - the market has already moved, and the SMA just confirms that.

The pattern that drives a project's price up or down is:

1) More or fewer buyers; leading to

2) More or fewer purchases; ->

3) Floor price rises or drops

1) More or fewer buyers; leading to

2) More or fewer purchases; ->

3) Floor price rises or drops

Specifically, during a pump, the cycle is:

1) Buyer interest grows

2) Sales increase

3) Floor goes up

4) Average price goes up

5) Buyer interest wanes

6) Sales slow down

7) Floor goes down

8) Average price goes down

1) Buyer interest grows

2) Sales increase

3) Floor goes up

4) Average price goes up

5) Buyer interest wanes

6) Sales slow down

7) Floor goes down

8) Average price goes down

Average price is a lagging indicator. By the time the average price shifts, the action has already happened. You're just seeing the final outcome.

Buyer interest would be the ultimate leading indicator, and it's why people able to manipulate buyer interest (e.g. influencers with no morals) have such an unfair advantage. They can make the leading signal go their way.

People who really have their finger on the pulse of the NFT market might be able to occasionally sense buyer interest early, and they too have a (much fairer) advantage.

Floor price is relatively easy to measure but is also a lagging indicator.

Floor price is relatively easy to measure but is also a lagging indicator.

The earliest indicator that is actually measurable from data that's easily available is the actual sales - i.e. the realised buyer interest.

That's why I built my market health index around sales (counts rather than volume, but that's a tangent):

That's why I built my market health index around sales (counts rather than volume, but that's a tangent):

https://twitter.com/swombat/status/1478794518745001984

This is true when looking at a single project: when you see the sales slowing down on the activity tab of OpenSea or on a site like Moby, chances are the price is about to stop rising. If you *can* time this well (really hard), that's the perfect time to sell, "into the pump".

I believe it's also true across the market. When the sales volumes taper off, prices start trending downwards.

So when I observe sales volume slowing down on bluechips, I can confidently predict prices will follow.

So when I observe sales volume slowing down on bluechips, I can confidently predict prices will follow.

Why are bluechips important?

One particularly important, if not very healthy, dynamic in the crypto space in general but especially in the NFT space, is that there are a lot of "investors" who are not here to invest, they're just here to get rich quick.

One particularly important, if not very healthy, dynamic in the crypto space in general but especially in the NFT space, is that there are a lot of "investors" who are not here to invest, they're just here to get rich quick.

Those folks have no patience with waiting for long term value to realise itself, so if they buy into, say, MAYC, and it goes up by 2x and then the price stabilises, they'll sell and look for the next thing that might pump.

This creates an unhealthy dynamic of money chasing pumps. It's unhealthy because those pumps are, as we discussed, unsustainable. If the project just isn't worth its price, real investors will stay away. The price will trend down. Flippers will be left holding bags.

This dynamic wouldn't be so bad if it wasn't so dominant in the NFT space. It drives the whole story, and the NFT space becomes *about* Cool Alien Frenoodle pumping, as if that was the best thing about the NFT space.

It's not, but it's what ppl end up talking about.

It's not, but it's what ppl end up talking about.

Eventually, the Mutant Baby Phlipped Rocks pump finishes, the price collapses, and money is redistributed, usually from ppl who were chasing "get money quick" vibes to unethical influencers and dubious project founders.

Those people might be unethical, but they're not as stupid as the Fools they took the money from, so they don't immediately pump that money back into a nonsense project. So the dumb money gets drained out of the market as if by a relentless vampire.

This is not even a zero-sum game. It's a less-than-zero-sum game. When the music stops playing, a bunch of white collar criminals take the money they fleeced from naive investors and retire (or, more likely, have another go under another pseudonym).

Once the new money bags are finally empty, the "bear market" begins, again... Until the next time a pile of new, uneducated money enters the market and is willing to believe the fake WAGMI promises that if you just invest it his garbage, you'll be rich forever!

Each time this cycle unfolds, these scammers, ruggers, shills and low-effort copycats scoop up another few hundred million dollars out of the NFT space.

They'll keep twisting the towel until it stops dripping water.

They'll keep twisting the towel until it stops dripping water.

You can probably tell I don't like this cycle. I think it makes the NFT space look bad, and of course it also involves fleecing a lot of ppl who are only guilty of being a bit naive. I'm not a fan of cons, grifters, scams, and other ponzis.

While boom/bust cycles have been a feature of markets forever, I don't think they are really relevant to investing (though highly relevant to trading).

The projects most worth investing in are those where the hype cycle is mostly irrelevant. Those exist.

The projects most worth investing in are those where the hype cycle is mostly irrelevant. Those exist.

2021 was definitely the year of the NFT hype cycle.

I don't know what 2022 will bring. To me it looks like it's beginning with another one of those cycles. The "get rich quick" fomo dynamic is in full play right now.

How long it will last, idk - but I do know it will end.

I don't know what 2022 will bring. To me it looks like it's beginning with another one of those cycles. The "get rich quick" fomo dynamic is in full play right now.

How long it will last, idk - but I do know it will end.

Here's to hoping that 2022 is the year when the NFT market matures past this, and the hype/fomo cycle becomes a minor driver of market activity instead of the major thing.

gm & gl

gm & gl

• • •

Missing some Tweet in this thread? You can try to

force a refresh