Anatomy of a good whitelist flip

Yesterday, I minted a @pxquest adventurer for 0.125+gas and flipped it half an hour later for 0.6+gas.

In a bear market (which we're likely heading into), WL flips are one of the main ways to make money from trading.

So how do they happen?

👇

Yesterday, I minted a @pxquest adventurer for 0.125+gas and flipped it half an hour later for 0.6+gas.

In a bear market (which we're likely heading into), WL flips are one of the main ways to make money from trading.

So how do they happen?

👇

The first thing you need to be able to do a WL flip, of course, is to be on the WL for the project.

There are many ways to do this. Some people grind in countless discords all day. Some people just find out about new projects really early.

There are many ways to do this. Some people grind in countless discords all day. Some people just find out about new projects really early.

Some people hire other ppl to grind for them (because who has the time to get to Level 30 - a requirement I've seen!). Some people are just well connected. Some people are parts of alpha groups that get them WL spots. That last one is me.

BTW: A common principle for ppl who make their money from WL flips is: WL first, research later.

If, unlike me, you're going to *really* play this game, you need to get into all the WLs so you have a chance of having WL for the right projects.

If, unlike me, you're going to *really* play this game, you need to get into all the WLs so you have a chance of having WL for the right projects.

There are a lot of ways to get those whitelist spots. Which one is right for you will depend on, well, you, and where you are in life, what projects you're able to join, etc.

But getting the WL spot is not even half the battle, it's maybe 1/4 of it.

But getting the WL spot is not even half the battle, it's maybe 1/4 of it.

The next step is figuring out whether to mint at all! This might come as a surprise to some, but a WL spot is actually mostly worthless, without further info about the project. Don't pay for WL.

If you're investing, the info is: does the project have a future.

If you're investing, the info is: does the project have a future.

But here we're talking about whitelist flipping, which is a very short term, narrow subset of trading, which relies not on the long-term prospects, but on the short term hype potential.

And that's the main thing to look at to decide whether to mint at all.

And that's the main thing to look at to decide whether to mint at all.

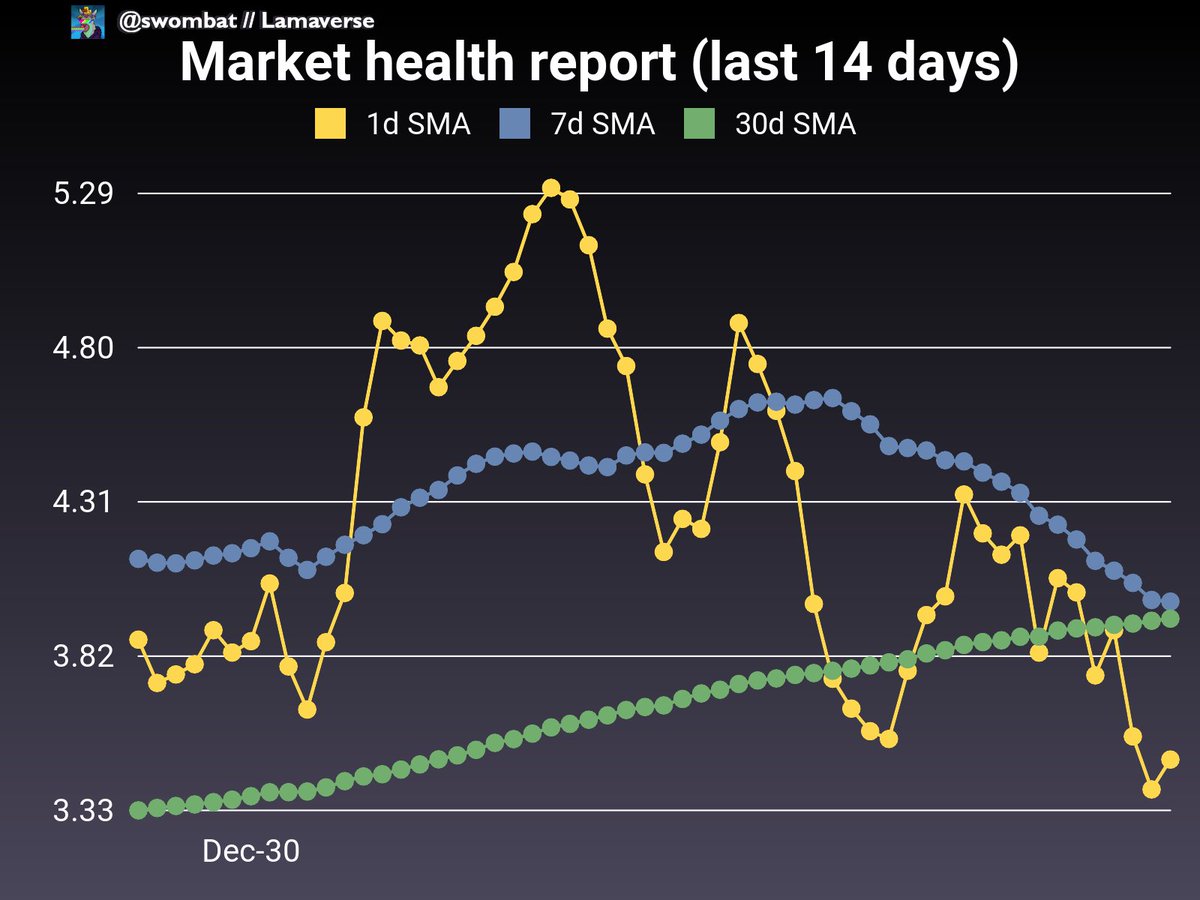

There are various ways to figure out whether something has enough hype. Sometimes monitoring the Discord helps. Sometimes a tool like @mobyinsights (see graph below) can help spot a minting process that's taking off.

I'm a lazy bastard, and I have the benefit of being on a server full of smart traders and flippers (@Llamaverse_) so I just rely on their judgement. If they mint, I'll mint. I could make my own decisions of course, but my success rate would be lower than theirs!

One of the critical factors you'll want to look at if you're minting to flip is - well, is there an active secondary market? Are people selling? Are they selling for substantially more than mint?

If there's no market to sell into, don't mint!

If there's no market to sell into, don't mint!

A healthy secondary market can happen that early because there's a lot of hype in the project and people who didn't get whitelisted still want to buy into it.

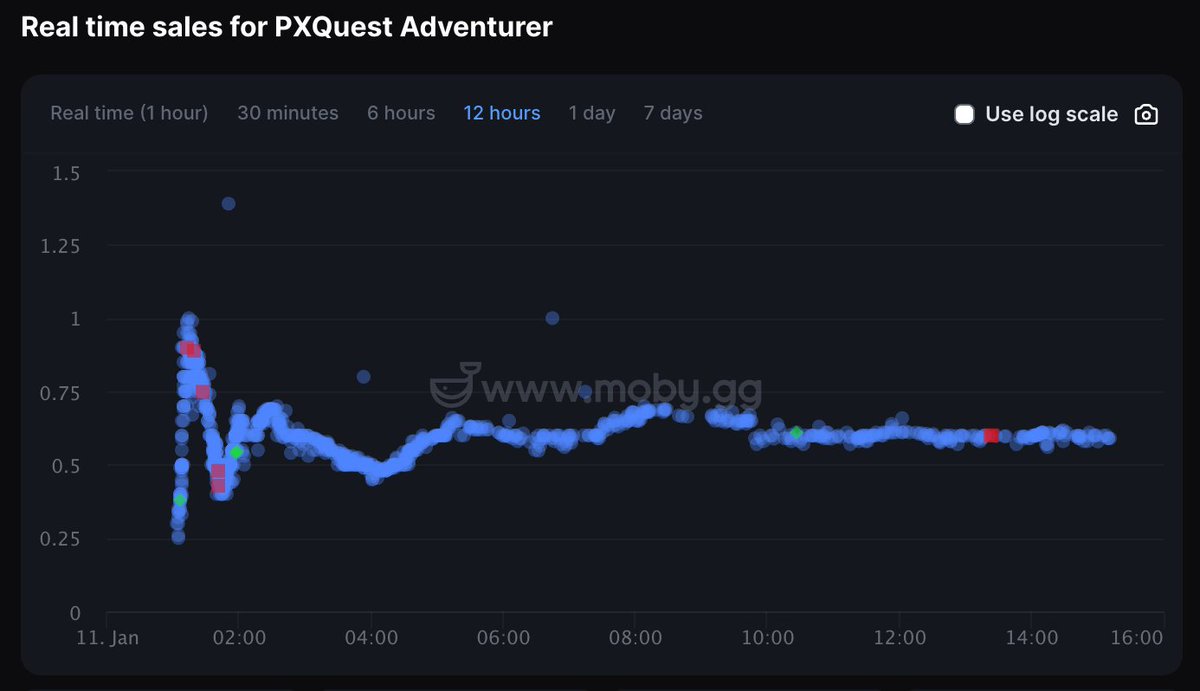

In the case of @pxquest, yes, there was a lot of secondary trading around .6 when I decided to mint for .125.

In the case of @pxquest, yes, there was a lot of secondary trading around .6 when I decided to mint for .125.

Once you've decided to mint... well, go ahead. Chances are, if it's a popular mint, gas won't be great. So make sure the flipping price is high enough to cover all that and make you a profit. My principle is: if it's not obvious that it's going to be profitable, I don't mint.

I've said before that to trade well you should sell into a pump. If there isn't a pump going on, don't even mint. If there is one going on, generally just sell into it. At what price though?

There's a bit of an art there, a balance of reading the chart and gut feel.

There's a bit of an art there, a balance of reading the chart and gut feel.

When I first minted the Adventurer, the floor was .6... but a few minutes later as I was considering the flip, it collapsed downwards the chart looked like this:

I did not sell into the collapse though. Remember: volume and price are linked. Why some panicked sellers were listing lower and lower, I don't know. I think they may have been relying on out of date OpenSea listings, which were slow to update.

The floor sank as low as .4 at one point, but my gut told me it would go back up because volume was still there. The undercutters were being irrationally impatient. And soon the graph started to look like this:

Much more promising. As volume continued to be steady, I listed at .6, a whole .1 above where the floor was at that point. And then I waited. And yes, the floor did bounce back up.

Soon my adventurer sold for .6... and that was somewhat lucky, because shortly after, this happened:

Volume dried up. It was for a silly reason: gas went up to 500+ so people stopped buying. But since price follows volume, as described in a previous thread (

https://twitter.com/swombat/status/1480506965411381248), undercutters started panicking and the pump died.

Luckily, gas eventually went down again, and so volume picked up again. It turns out, if I'd been less lucky, I might have ended up selling at 0.7.

Remember: never look back! I flipped at .6, around that red circle, and that's good enough!

Remember: never look back! I flipped at .6, around that red circle, and that's good enough!

What happened over the longer term? Since then, @pxquest has stabilised around, whaddayaknow, .6! In this particular case, my exit timing was mostly irrelevant. Still, this was a successful WL flip and I imagine going through this with me might help someone.

Some further thoughts about the WL flipping.

Shouldn't the project just have set mint price at .6?

No. Let's look at why.

Shouldn't the project just have set mint price at .6?

No. Let's look at why.

Hype driven projects and mint flippers have a relationship that's either symbiotic or parasitic depending on how you look at it. I think it's symbiotic because it's often hard to tell which one is the parasite!

When a project is relying on hype, one of the best drivers of hype is high activity in the project. It shows the project is alive and kicking and worth being excited about. If they had set the price at .6, that simply wouldn't have happened.

Instead, they had at it at .125, and the frenzy of activity that followed as flippers did their work helped establish the project. @pxquest is now firmly on the map as a project which successfully executed the risky hype-mint strategy (

https://twitter.com/swombat/status/1473671098885627906).

And lest you think the project was robbed of the revenues they might have had had they set the mint price to .6... well, they got 500 Eth from the mint. At .6 they would have had 2400 Eth... if they had minted out. But they would not have.

If the mint price was set too high, low momentum would have become a self-fulfilling prophecy. Everyone would have waited for someone else to get the momentum going. And this game of chicken ends up the project losing and investor attention moving on.

0.125 Eth is actually already a fairly high mint price. Most projects go for 0.08 or even lower. 0.2 would have been quite risky. 0.3 would have been implausible. A 0.6 mint price would simply have ben dead in the water. Quite possibly, no one would have minted.

Also, less than 24 hours after mint, @pxquest have already had 733 Eth of trading volume. Their royalties are a whopping 8.5%, so that's another 62 Eth. They won't maintain that volume every day of course, but they *will* continue getting volumes. They haven't even revealed yet!

I think the dynamic works out very well for both the project and the flippers. The project creates an opportunity for flipping to make money. The flippers take a risk and help discover the correct price for the project.

As for the people buying at .6, if they are buying to flip (or playing the lottery by hoping to reveal a rare)... well, I believe they are not playing that game very well and I hope they read this thread and stop doing that.

More positively, I hope that people are continuing to buy at .6 now because they believe the opportunity to participate in @pxquest's game is worth that much.

I'm very selective about my investments and so I decided not to hold this one. But looking at the website, I didn't think it was garbage. It might work, it might not work. I don't know. I don't have a strong enough feel about it to stay invested.

So it became a wonderful trading opportunity that made me a bit of money for relatively little effort, which I'll be able to reinvest into projects I'm more interested in. And it became this thread :-)

Trading isn't my daily cup of tea, but it's nice to play from time to time.

Trading isn't my daily cup of tea, but it's nice to play from time to time.

An interesting thing (for me) about this process is how unemotional it is. They say good traders don't trade on emotions. That's doubly true for flippers. It's going to be very hard to flip if you're emotionally into the project (see

https://twitter.com/swombat/status/1468235357099540488).

It took months into my NFT journey before I got to "flip a mint". Until then, it was a mysterious process and I would have appreciated reading a thread like this.

I hope this helps demystify it for some people.

gm & gl

I hope this helps demystify it for some people.

gm & gl

• • •

Missing some Tweet in this thread? You can try to

force a refresh