Daily Market Health Stats update time...

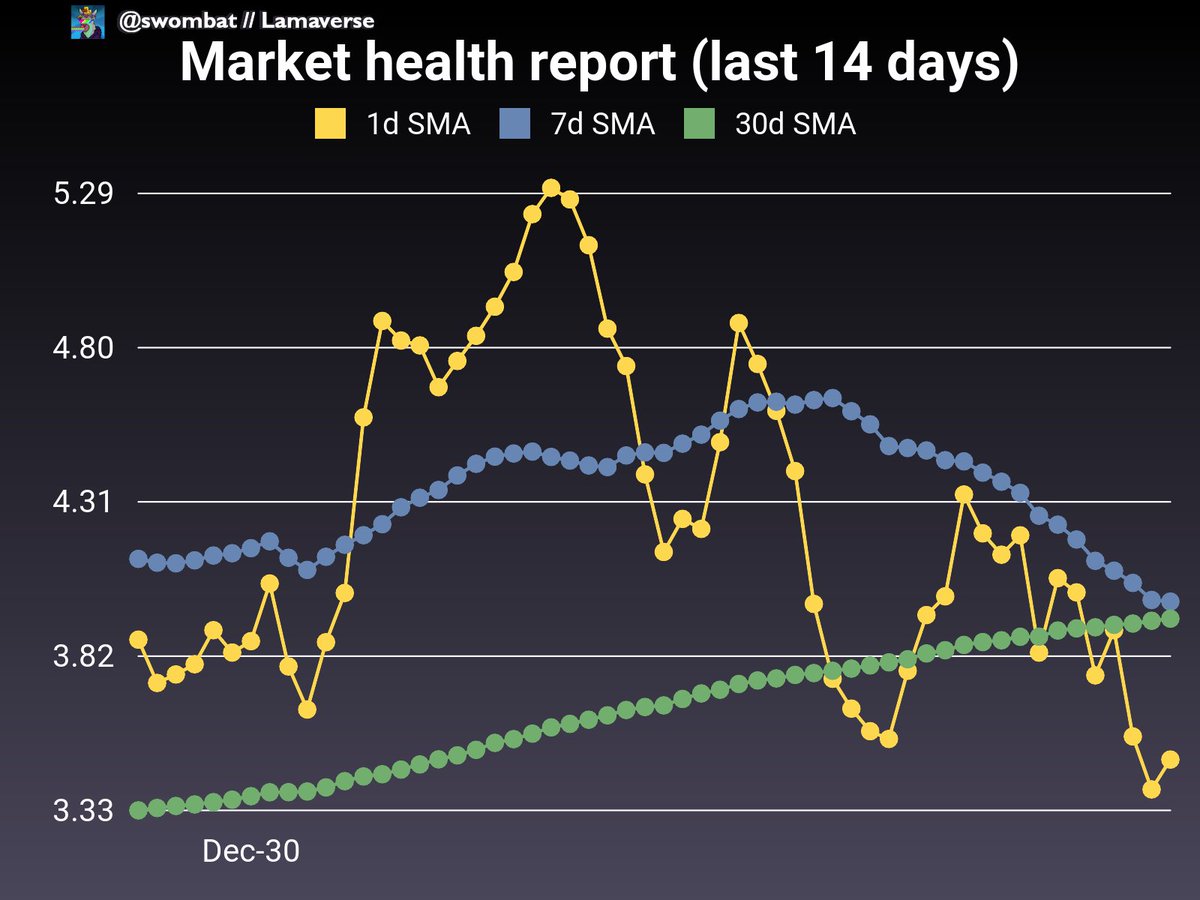

I don't think the euphoria will last for weeks. Imho we're close to the end now.

There's been a slight bounce in the top-nine activity led by Creature World, but that has subsided now.

I don't think the euphoria will last for weeks. Imho we're close to the end now.

There's been a slight bounce in the top-nine activity led by Creature World, but that has subsided now.

We are still at relatively higher volumes of activity than during the deep bear last quarter, so things are not too bad, at least not yet.

Of course, usual disclaimer that these charts don't predict the future. Something could happen in 1 minute to change the picture.

Of course, usual disclaimer that these charts don't predict the future. Something could happen in 1 minute to change the picture.

You can read more about how these charts are calculated here:

I post updates to this every day (as well as other more reflective threads), so please follow if you want to get them, and if you find them useful I'd appreciate some RTs.

https://twitter.com/swombat/status/1478794518745001984

I post updates to this every day (as well as other more reflective threads), so please follow if you want to get them, and if you find them useful I'd appreciate some RTs.

Looking at the 6h stacked bar chart, we can see the more detailed, more immediate picture. It's looking ok but not super exciting. The attention has mostly moved away from the top nine.

Here's the 90 day and 45 day views of the top nine, so you can see the trends more easily for yourself. Based on these graphs, it seems like we're definitely not in a bear, but also not really in a bull. Somewhere in between.

My guess as to why, is that some of the profits from the euphoric bull-market-end get cycled back into bluechips. We'll see if that theory is true. If bluechips trend down more sharply once the euphoria is over, that would support this thesis.

For today I thought it might be worth spicing things up by also looking at some other datasets than just the top 9. The 2 other datasets I look at are what I called the Zeneca "old" and "new" sets, both taken from @Zeneca_33's daily floor stats docs.google.com/spreadsheets/d…

The Zeneca Old dataset, which reflects the performance of projects that were mostly started in August and early September, is... not looking particularly hopeful. It seems to have followed the bluechips in trending down recently.

The Zeneca New data set includes newer projects but not the latest alien poodles that are pumping randomly as influencers shill them. It also looks fairly meh, with a correction happening.

This feels like conclusive evidence, to me, that what's pumping is mostly very recent garbage projects. There is the odd exception that is doing reasonably well in these data sets, but on the whole they're not seeing much increased activity.

So, the TL;DR:

- We're not in a deep bear

- We're also not in a mega bull

- We're probably somewhere in between, at the end of a bull run

My experience is that bull runs are usually followed by corrections. I could be wrong about this. Draw your own conclusions.

gm&gl

- We're not in a deep bear

- We're also not in a mega bull

- We're probably somewhere in between, at the end of a bull run

My experience is that bull runs are usually followed by corrections. I could be wrong about this. Draw your own conclusions.

gm&gl

• • •

Missing some Tweet in this thread? You can try to

force a refresh