Short $CREAM and $veIB Thesis 🧵

CREAM is one of the best trades in crypto right now. I'm not necessarily super bullish on the protocol itself, but I am super bullish on Iron Bank $veIB. Those staking CREAM on $ETH on 27 January will receive 40% of the initial $veIB supply.

CREAM is one of the best trades in crypto right now. I'm not necessarily super bullish on the protocol itself, but I am super bullish on Iron Bank $veIB. Those staking CREAM on $ETH on 27 January will receive 40% of the initial $veIB supply.

Given the $veIB tokens are "vested escrow" (that's what the ve stands for) tokens, holders won't be diluted. As @kamikaz_ETH eloquently put it, we "should be thinking of $CREAM purchases as a seed round investment with a non-dilution provision".

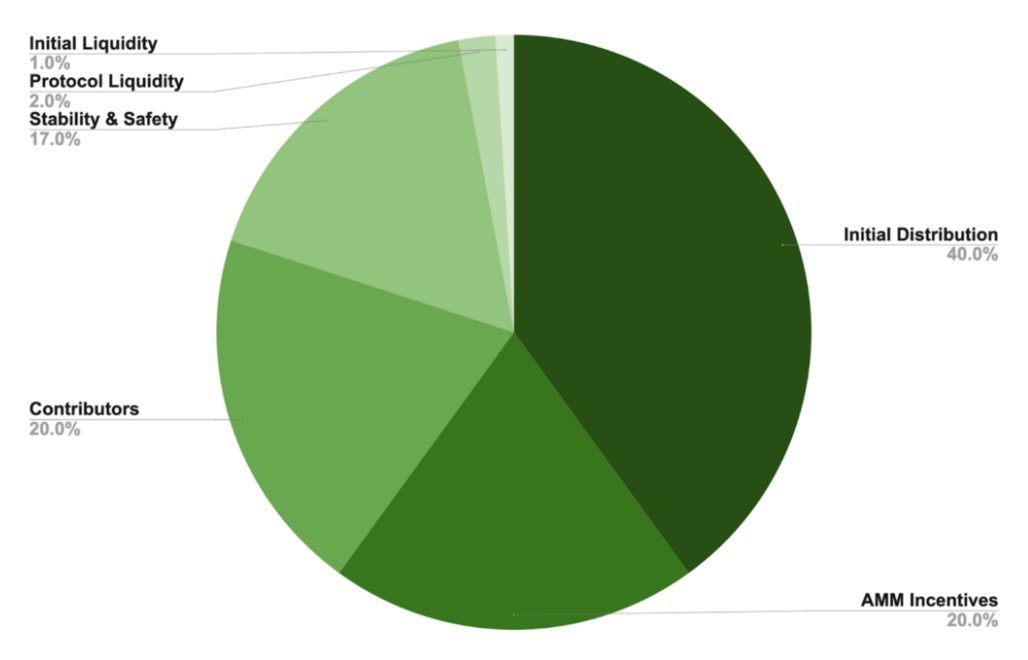

So $CREAM stakers are receiving and retaining (if desired) 40% of the supply of a what might become a blue chip revenue producing defi protocol. ibdotxyz.medium.com/the-iron-bank-…

So what is the Iron Bank?

So what is the Iron Bank?

The Iron Bank is Yearn's central bank, created by @iearnfinance and @AndreCronjeTech.

To date the Iron Bank has been primarily used to mint ib tokens by users depositing various crypto collateral types.

To date the Iron Bank has been primarily used to mint ib tokens by users depositing various crypto collateral types.

You'll be familiar with ib tokens if you've used fixedforex.fi.

The Iron Bank is a key part of the whole system, and will likely become a key part of more defi protocols, particularly as non-USD stables and crypto forex proliferate as I expect.

The Iron Bank is a key part of the whole system, and will likely become a key part of more defi protocols, particularly as non-USD stables and crypto forex proliferate as I expect.

https://twitter.com/BillyBobBaghold/status/1478841725594390528

50% of Iron Bank protocol fees will be shared weekly with $veIB stakers. And this figure could become significant As the Iron Bank adds more assets and collateral types.

So $veIB has a similar model to KP3R and FixedForex (both of which I am very bullish on). As I have discussed, I think legit passive income projects will get more attention as the year goes on (it has already started with KP3R). $veIB could be another.

https://twitter.com/BillyBobBaghold/status/1479747095045160962

$veIB will be one of if not the the first token to launch with the much hyped ve(3,3) Ouroboros Token model designed by @AndreCronjeTech. The $FTM protocol utilising the model that AC is developing with @danielesesta has already generated massive hype - ve(3,3) season anyone?

So those are the key points regarding $veIB and the token model.

Now imagine the FOMO and $CREAM supply crisis as we get closer to 27 January as progressively more holders stake for the airdrop.

Now imagine the FOMO and $CREAM supply crisis as we get closer to 27 January as progressively more holders stake for the airdrop.

More stakers means fewer and fewer sellers coupled with more and more buyers wanting to fomo into $veIB as they both realise the utility of the token and that it's a ve(3,3) token.

Plus at the end of the day, you still have your staked $CREAM.

Plus at the end of the day, you still have your staked $CREAM.

Hopefully you now realise why I'm so bullish on $CREAM.

I highly recommend this thread if you're interested to learn more background:

And you should follow @kamikaz_ETH

I highly recommend this thread if you're interested to learn more background:

https://twitter.com/kamikaz_ETH/status/1481360236531564545

And you should follow @kamikaz_ETH

• • •

Missing some Tweet in this thread? You can try to

force a refresh