India is a Growth Story !

What is Important in India's Growth ?

Isnt it Infrastructure ??

So today's Let's look at a Infrastructure Company having Aim as high as the Sky and Vision as clear as the Glass and Focus as sharp as the Arrow !

Like and Retweet for wider reach !

What is Important in India's Growth ?

Isnt it Infrastructure ??

So today's Let's look at a Infrastructure Company having Aim as high as the Sky and Vision as clear as the Glass and Focus as sharp as the Arrow !

Like and Retweet for wider reach !

The Company is none other than G R Infra

Now Let's see what GR Infraprojects does ?

Civil : Construction of roads, state and national

highways, bridges, culverts, flyovers, airport runways, etc

Railway : Construction, track lining, bridges, etc.

• Construction of metro rail

Now Let's see what GR Infraprojects does ?

Civil : Construction of roads, state and national

highways, bridges, culverts, flyovers, airport runways, etc

Railway : Construction, track lining, bridges, etc.

• Construction of metro rail

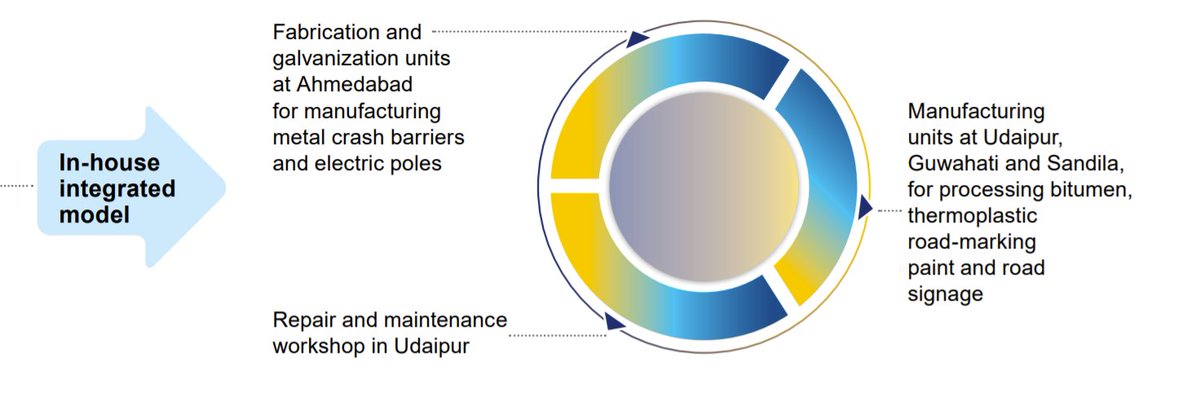

Manufacturing Facilities :

• Process bitumen

• Manufacture thermoplastic road‑marking paint and road signage

• Fabricate and galvanise metal crash barriers, high mast pole & lighting poles, OHE, PEB fabrication

• Process bitumen

• Manufacture thermoplastic road‑marking paint and road signage

• Fabricate and galvanise metal crash barriers, high mast pole & lighting poles, OHE, PEB fabrication

Now Let's Look at GRIL in a Glance and what they have achieved during the years

100+ Road Projects completed

16000+ Workforce

4 Manufacturing Facilities

100+ Road Projects completed

16000+ Workforce

4 Manufacturing Facilities

Project Mix of GRIL

63% HAM

31% EPC

5% Railways

GRIL Boasts a Strong Order Book of 15782.7 Crore with clientwise mix as shown Below

63% HAM

31% EPC

5% Railways

GRIL Boasts a Strong Order Book of 15782.7 Crore with clientwise mix as shown Below

Let's look at the Earnings Trends now

Revenue has Doubled and EBITDA has Tripled in the Last 5 years .

That's Solid Growth

Revenue has Doubled and EBITDA has Tripled in the Last 5 years .

That's Solid Growth

The Business boasts a Good 25 % Margin that's excellent in my View

The Business has Nominal Debt/Equity of 1.1

A infrastructure business is Asset Heavy and Debt is very common .

Even LT has a debt to Equity near 1

The PAT is growing at an Exponential Rate

The Business has Nominal Debt/Equity of 1.1

A infrastructure business is Asset Heavy and Debt is very common .

Even LT has a debt to Equity near 1

The PAT is growing at an Exponential Rate

Let's look at the Opportunity and Growth triggers of the Sector

Only small % of National highways are higher than 4 lanes presenting Huge opportunity

All developed/developing countries have higher % than India and growth is Clearly Visible Here !

Only small % of National highways are higher than 4 lanes presenting Huge opportunity

All developed/developing countries have higher % than India and growth is Clearly Visible Here !

As the economy expands, both in terms of population

and output, infrastructure remains a critical pillar

necessary to support its growth. This will necessitate

increased investment in new and upgraded

infrastructure, particularly within the transportation

segment.

and output, infrastructure remains a critical pillar

necessary to support its growth. This will necessitate

increased investment in new and upgraded

infrastructure, particularly within the transportation

segment.

Now Let's Look why I love GR Infra more than the many other Names in Market

A simple One Liner Theory

GR Infra Management aims as high and walks their talk as clear as the Sky

" GR Infra aims to become as good/better than LT "

"Targets are never impossible

A simple One Liner Theory

GR Infra Management aims as high and walks their talk as clear as the Sky

" GR Infra aims to become as good/better than LT "

"Targets are never impossible

Now Looking at the Investment Theory of @VijayKedia1 Sir

There should be a Big Sized Opportunity which is clearly Visible

Management should Aim the Skies which is again clearly evident here

Old Management - In case of GR Infra is 20+ Yr Old

Small Company - 18000Cr MCap

There should be a Big Sized Opportunity which is clearly Visible

Management should Aim the Skies which is again clearly evident here

Old Management - In case of GR Infra is 20+ Yr Old

Small Company - 18000Cr MCap

All the required Points are clearly visible here which just adds this in a Good Basket

Now Going Forward Let's Dive deep into Valuations and Share Holding Pattern !

GR Infra trades at Reasonable Valuations

2.4 times Sales

20 times their Earnings

Now Going Forward Let's Dive deep into Valuations and Share Holding Pattern !

GR Infra trades at Reasonable Valuations

2.4 times Sales

20 times their Earnings

Boasting a 25% ROCE,ROE and Trading at Less Multiples to ROCE is another Way to call it Undervalued

The Shareholding Pattern of GRIL as of Sept 2021

Promotors 87 %

FII+DII 10%

Public 2%

You heard me right just 2% .. That itself gives me strong Confidence to own GRIL

The Shareholding Pattern of GRIL as of Sept 2021

Promotors 87 %

FII+DII 10%

Public 2%

You heard me right just 2% .. That itself gives me strong Confidence to own GRIL

I have been Invested in GRIL from 1700-1730 Levels and have been Bullish on the Infrastructure Theme and India 's Growth with a lot of Confidence

Not an SEBI Registered Inv Advisor . Please contact your Advisor before any Buy / Sell Actions . This is Purely for Education

Not an SEBI Registered Inv Advisor . Please contact your Advisor before any Buy / Sell Actions . This is Purely for Education

The thread took me a hefty time of the Evening and hence as a Small Return Gift i would expect you to please Like Share and Retweet the First Thread Without Fail ..

It would be an encouragement to me

@ishmohit1 @soicfinance @sahil_vi @nid_rockz @insharebazaar @kuttrapali26

It would be an encouragement to me

@ishmohit1 @soicfinance @sahil_vi @nid_rockz @insharebazaar @kuttrapali26

Please do read this if you get some time @LuckyInvest_AK sir . Would be so happy to hear your words on my small Investment attempts and learn/improve as i move on ..

Thank you But please dont forget to Like Share and Retweet the First post of this Thread

Thank you But please dont forget to Like Share and Retweet the First post of this Thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh