A thread on #Valiant Organics

A Fully Integrated speciality Chemical Company !

Now Let's dive into what the company does !

A Fully Integrated speciality Chemical Company !

Now Let's dive into what the company does !

Valiant Organics is in agro-chemical, pharmaceuticals, rubber, dyes, pigment industries .

Revenue Split 88% Domestic and 12% from Exports

Revenue Split 88% Domestic and 12% from Exports

The Product Portfolio of Valiant Organics

These are Basically split into

Chlorination

Ammonolysis

Acetylation

Hydrogenation

Sulphonation

Methoxylation

O-Nitro Anisole and P-Nitro Anisole were addition in the Hydrogenation section recently .

These are Basically split into

Chlorination

Ammonolysis

Acetylation

Hydrogenation

Sulphonation

Methoxylation

O-Nitro Anisole and P-Nitro Anisole were addition in the Hydrogenation section recently .

On the back of the continuous expansion plans, the Company has been expanding its presence and widening its portfolio with the help of forward or backward integration. With help of integrated operations, the Company has been creating more value and enhancing its margins.

Backward integration will help in manufacturing key RM in-house & in providing significant cost savings & better profit margins .

Now lets Look at valuations

Now lets Look at valuations

Valiant Organics

Market Cap 2907 Cr

PE - 27.1

ROCE / ROE nearly 27%

D/E -0.34

Working capital reducing gradually - Good sign .

Operating Leverage will play out sooner or Later

Market Cap 2907 Cr

PE - 27.1

ROCE / ROE nearly 27%

D/E -0.34

Working capital reducing gradually - Good sign .

Operating Leverage will play out sooner or Later

Valiant Organics is yet to see operating leverage play out in their Balance Sheets

This time RM cost have hit huge and the margins contracted from 22- 17% and will get back to the normal Gross Margin Levels ..

The margins are expected to Improve which will expand PE also

This time RM cost have hit huge and the margins contracted from 22- 17% and will get back to the normal Gross Margin Levels ..

The margins are expected to Improve which will expand PE also

A small Comparison with other Speciality Chemical Companies

A picture worth thousand words ..

People still dont consider GNFC as a chemical Giant and excluded from the list ( Sad ) but it will show how good it is soon ( GNFC)

Valiant Organics can be rerated definitely

A picture worth thousand words ..

People still dont consider GNFC as a chemical Giant and excluded from the list ( Sad ) but it will show how good it is soon ( GNFC)

Valiant Organics can be rerated definitely

Above Average margins compared to Other SPeciality chemicals and Better ROE in 3Y Avg.

The PE is definitely lesser than most others and hence there is a strong chance of rerating

Also Margin expansion and Operating Leverage will kick in Soon .. Waiting .

The PE is definitely lesser than most others and hence there is a strong chance of rerating

Also Margin expansion and Operating Leverage will kick in Soon .. Waiting .

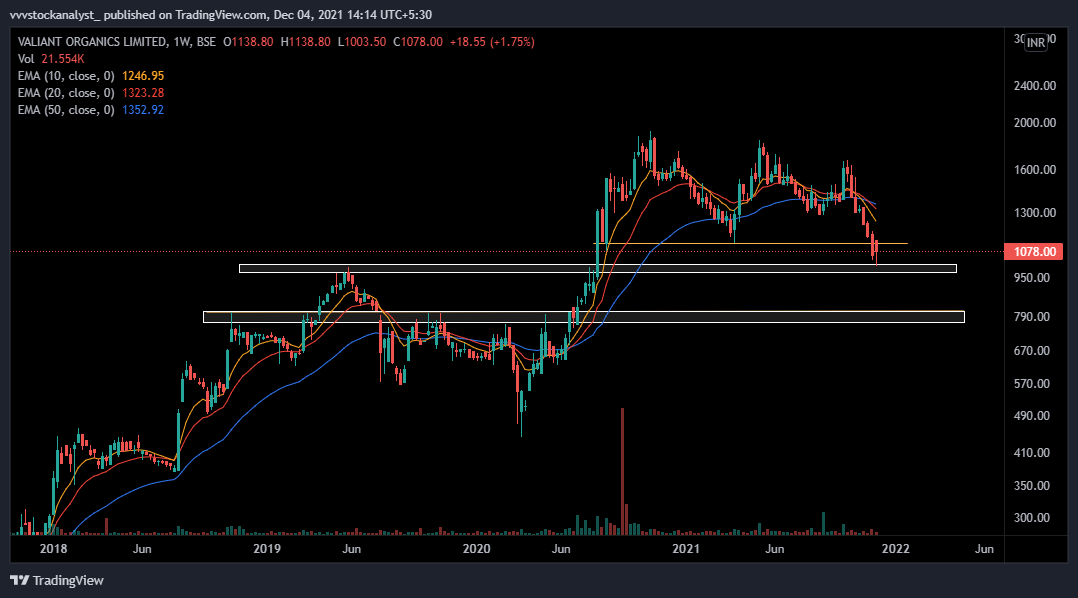

What's more Special here is Stock is Available at a good discount due to RM headweights and will ease out in a while

Near a Major Support . More Safer Investment option for Long term is near 820-800 Range ( Second Opportunity )

There are two ways i would plan to play this

Near a Major Support . More Safer Investment option for Long term is near 820-800 Range ( Second Opportunity )

There are two ways i would plan to play this

1> Buy Point near 1050 with stop near 950

2> Buy Near 800-760 Range with Stop near 680 Stop

I will try the first Plan and if it gets me Stopped out will try again near the 2nd Plan Range .

This way i save time and Money ..

2> Buy Near 800-760 Range with Stop near 680 Stop

I will try the first Plan and if it gets me Stopped out will try again near the 2nd Plan Range .

This way i save time and Money ..

Risk Management is clearly mentioned ( My way of doing it ) .

If you like my thread on Valiant Organics take some time to Like retweet and Share .

I would be happy and motivated to write more related threads

If you like my thread on Valiant Organics take some time to Like retweet and Share .

I would be happy and motivated to write more related threads

Do provide your comments on the Valiant Organics Thread Resp People

@nid_rockz @drprashantmish6 @Investor_Mohit @ishmohit1 @jatankothari @LuckyInvest_AK @sourabhsiso19 @insharebazaar @caniravkaria @jhunjhunwala_b @vivbajaj @stockifi_Invest @blazingbhat @PrasadWakchaure

@nid_rockz @drprashantmish6 @Investor_Mohit @ishmohit1 @jatankothari @LuckyInvest_AK @sourabhsiso19 @insharebazaar @caniravkaria @jhunjhunwala_b @vivbajaj @stockifi_Invest @blazingbhat @PrasadWakchaure

• • •

Missing some Tweet in this thread? You can try to

force a refresh