#CandlestickPatterns - "As simple as it can be."

A Candlestick is a style to represent the price movement of a stock or a derivative or a currency.

+Thread [1/24]

#Thread #TechnicalAnalysis #StockMarket

#learning

A Candlestick is a style to represent the price movement of a stock or a derivative or a currency.

+Thread [1/24]

#Thread #TechnicalAnalysis #StockMarket

#learning

It is a must for every trader to hold some basic knowledge about candlesticks up his quiver in his journey which helps in understanding the #priceaction in a better dimension.

A Candle is formed based on the buying and selling pressures in a particular time frame.

[2/24]

A Candle is formed based on the buying and selling pressures in a particular time frame.

[2/24]

Body – A Body is known as the “open to close” range.

Shadow – Also known as a “Wick” indicates the High and Low of a candle formed.

Candle Color – Represents the direction of price’s movement. It is shown in green (bullish) and Red (Bearish) candles.

lets see patterns now [4/24]

Shadow – Also known as a “Wick” indicates the High and Low of a candle formed.

Candle Color – Represents the direction of price’s movement. It is shown in green (bullish) and Red (Bearish) candles.

lets see patterns now [4/24]

When it comes to #trading , it is reqd to keep a close watch on candles and their formations which when formed at crucial places, gives us a hint well in advance about the price’s direction and if we are quick to interpret this info and take a trade can reap huge rewards [5/24]

There are 2 types of candlestick patterns:

1.Bullish Reversal Candlestick Patterns

2.Bearish Reversal Candlestick Patterns

Lets see Bullish Reversal patterns now.

[6/24]

1.Bullish Reversal Candlestick Patterns

2.Bearish Reversal Candlestick Patterns

Lets see Bullish Reversal patterns now.

[6/24]

1. #Hammer

A Hammer is a single candle bullish reversal pattern. It consists of a small body with a long wick. If a hammer is formed at the end of a downtrend, it represents a potential upside and price can reverse from the next candle. [7/24]

A Hammer is a single candle bullish reversal pattern. It consists of a small body with a long wick. If a hammer is formed at the end of a downtrend, it represents a potential upside and price can reverse from the next candle. [7/24]

1.2#InvertedHammer

Inverted hammer is also a single candle bullish reversal pattern which is similar to hammer with the difference being the wick’s direction. If it is formed at the end of a downtrend, represents a potential upside and price can reverse. [8/24]

Inverted hammer is also a single candle bullish reversal pattern which is similar to hammer with the difference being the wick’s direction. If it is formed at the end of a downtrend, represents a potential upside and price can reverse. [8/24]

1.3#BullishEngulfing

Bullish Engulfing is a 2-candle bullish reversal pattern that holds credibility if formed after a price decline. Here, the first candle has a bearish close, the second candle has a bullish close and fully engulfs the first candle within its body. [9/24]

Bullish Engulfing is a 2-candle bullish reversal pattern that holds credibility if formed after a price decline. Here, the first candle has a bearish close, the second candle has a bullish close and fully engulfs the first candle within its body. [9/24]

This suggests the end of the earlier downtrend and buyers are in control now and can expect a price reversal into an uptrend. [10/24]

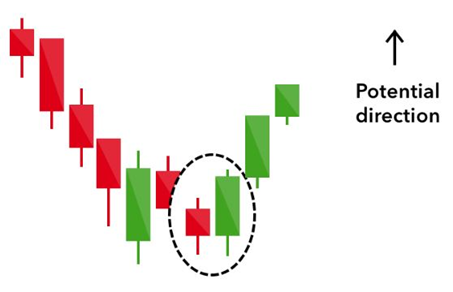

1.4#MorningStar

Morning Star is a 3-candle bullish reversal pattern that forms after a price decline. Here, the first candle has a bearish close, the second candle has a small range and the third candle is a gap-up candle and has a bullish close. [11/24]

Morning Star is a 3-candle bullish reversal pattern that forms after a price decline. Here, the first candle has a bearish close, the second candle has a small range and the third candle is a gap-up candle and has a bullish close. [11/24]

If this pattern is formed after a downtrend, suggests that buyers won the battle over sellers and buyers are in control now. [12/24]

1.5Three White Soldiers

Three White Soldiers is a 3-candle bullish reversal pattern that forms after a price decline. Here, the three candles have to be green with little to no wick. The three candles have to close progressively above the previous candle (refer above). [13/24]

Three White Soldiers is a 3-candle bullish reversal pattern that forms after a price decline. Here, the three candles have to be green with little to no wick. The three candles have to close progressively above the previous candle (refer above). [13/24]

Let's see Bearish Reversal Candlestick patterns now

2.1Hanging Man

Hanging Man is a single-candle bearish reversal pattern that forms after an advancement in the price. This candle looks similar to a “Hammer” suggesting a price reversal as it forms after an uptrend. [15/24]

2.1Hanging Man

Hanging Man is a single-candle bearish reversal pattern that forms after an advancement in the price. This candle looks similar to a “Hammer” suggesting a price reversal as it forms after an uptrend. [15/24]

2.2Shooting Star

Shooting Star is also a 1-candle bearish reversal pattern that forms after an advancement in the price. This candle looks similar to an Inverted Hammer suggesting a price reversal as it forms after an uptrend. [17/24]

Shooting Star is also a 1-candle bearish reversal pattern that forms after an advancement in the price. This candle looks similar to an Inverted Hammer suggesting a price reversal as it forms after an uptrend. [17/24]

2.3Bearish Engulfing

Bearish Engulfing is a 2-candle bearish reversal pattern that holds credibility if formed after a price advancement. Here, the first candle has a bullish close, the second candle has a bearish close and fully engulfs the 1st candle in its body [19/24]

Bearish Engulfing is a 2-candle bearish reversal pattern that holds credibility if formed after a price advancement. Here, the first candle has a bullish close, the second candle has a bearish close and fully engulfs the 1st candle in its body [19/24]

2.4Evening Star

Evening Star is a 3-candle bearish reversal pattern that forms after a price advancement. Here, the first candle has a bullish close, the second candle has a small range and the third candle has a bearish close.[21/24]

Evening Star is a 3-candle bearish reversal pattern that forms after a price advancement. Here, the first candle has a bullish close, the second candle has a small range and the third candle has a bearish close.[21/24]

If this pattern is formed after an uptrend, suggests that buyers are exhausted and sellers are momentarily in control now. [22/24]

2.5Three Black Crows

Three Black Crows is a 3-candle bearish reversal pattern that forms after a price advancement. In this pattern, you see three big red candles forming consecutively with small or no wicks. [23/24]

Three Black Crows is a 3-candle bearish reversal pattern that forms after a price advancement. In this pattern, you see three big red candles forming consecutively with small or no wicks. [23/24]

Here each candle opens at almost at the close of previous candle but the selling pressure pushes the candle lower.

This suggests that sellers are in control now and traders take it as a start of a downtrend. [24/24]

This suggests that sellers are in control now and traders take it as a start of a downtrend. [24/24]

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh