Johannesburg Stock Exchange (JSE)

My stock picks for 2022

Find out 👇🏽

My stock picks for 2022

Find out 👇🏽

1/

Prosus N.V ( $PRX )

• Current Price: R1363

• Dividend Yield: 0.18%

• Current Ratio: 3.12

• P/E ratio: 8

Prosus N.V ( $PRX )

• Current Price: R1363

• Dividend Yield: 0.18%

• Current Ratio: 3.12

• P/E ratio: 8

2/

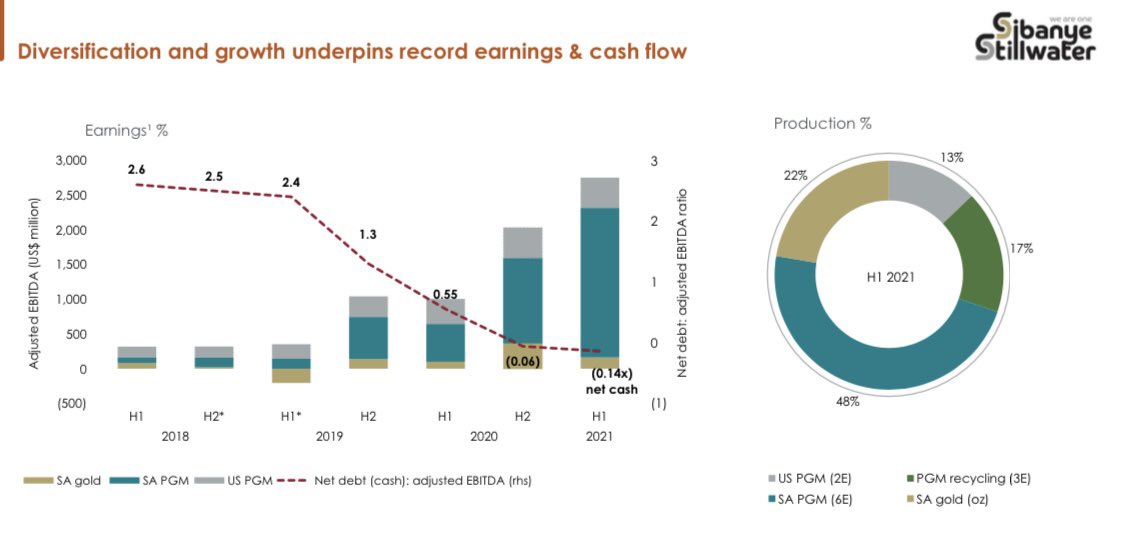

Sibanye Stillwater ( $SSW )

• Current Price: R56.22

• Dividend Yield: 11%

• Current Ratio: 2.7

• P/E ratio: 4

Sibanye Stillwater ( $SSW )

• Current Price: R56.22

• Dividend Yield: 11%

• Current Ratio: 2.7

• P/E ratio: 4

3/

Stor-age Property REIT ( $SSS )

• Current Price: R14.97

• Dividend Yield: 7.3%

• Current Ratio: 0.22

• P/E ratio: 7

Stor-age Property REIT ( $SSS )

• Current Price: R14.97

• Dividend Yield: 7.3%

• Current Ratio: 0.22

• P/E ratio: 7

4/

Lewis Group ( $LEW )

• Current Price: R47.57

• Dividend Yield: 8.2%

• Current Ratio: 3.4

• P/E ratio: 7

Lewis Group ( $LEW )

• Current Price: R47.57

• Dividend Yield: 8.2%

• Current Ratio: 3.4

• P/E ratio: 7

Join the community and receive premium content every Monday absolutely FREE

Sign up here👇🏽

davidketh.substack.com/p/talkcents

Sign up here👇🏽

davidketh.substack.com/p/talkcents

That’s it, that’s the tweet. If you enjoy my content then don’t forget to follow @talkcentss for more threads.

You can expect more of:

- Stock analysis

- Trading ideas

- Educational content

- Property analysis

Have a superb day 😊

You can expect more of:

- Stock analysis

- Trading ideas

- Educational content

- Property analysis

Have a superb day 😊

• • •

Missing some Tweet in this thread? You can try to

force a refresh