1/

Safety Framework

It’s difficult to ever go with no accidents, it is part of the industry, but let’s see how this translates into numbers.

Safety Framework

It’s difficult to ever go with no accidents, it is part of the industry, but let’s see how this translates into numbers.

2/

Revenue

(Up to June 30th, 2021)

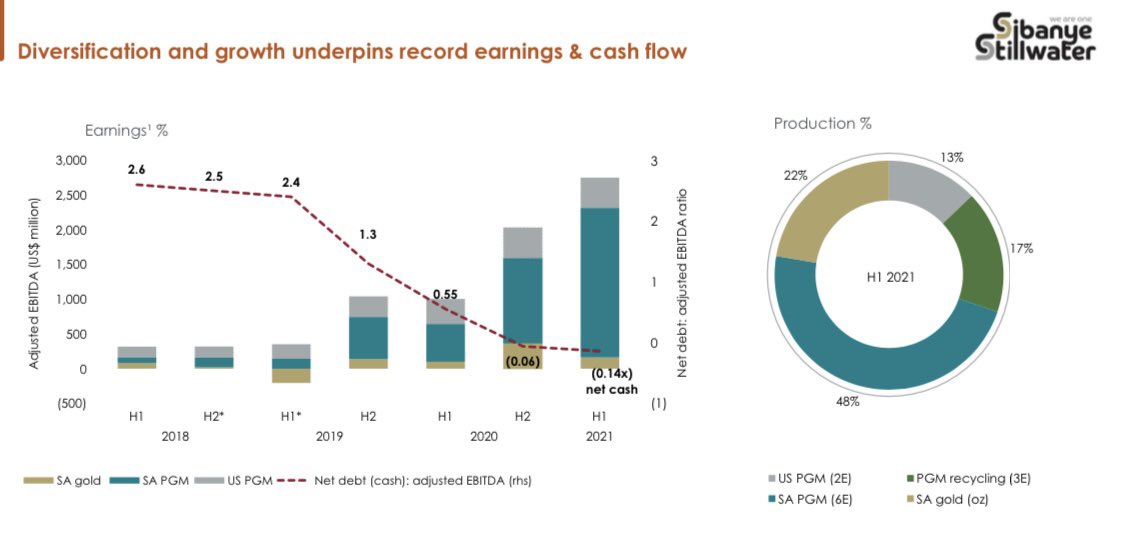

Diversified like this:

1. 48% = SA PGM

2. 22% = SA Gold

3. 17% = US PGM

4. 13% = PGM recycling

PGM = Platinum Group Metals

*The red line indicates debt.

Debt is going down while revenue is going up.

#markets

Revenue

(Up to June 30th, 2021)

Diversified like this:

1. 48% = SA PGM

2. 22% = SA Gold

3. 17% = US PGM

4. 13% = PGM recycling

PGM = Platinum Group Metals

*The red line indicates debt.

Debt is going down while revenue is going up.

#markets

3/

SA PGM operations

(Stellar performance )

All in sustaining costs (AISC)

- 10% reduction in AISC

- R14 billion in Free cash flow (FCF)

- 61% higher 4E PGM basket price

- Underground Production main contributor (risk)

SA PGM operations

(Stellar performance )

All in sustaining costs (AISC)

- 10% reduction in AISC

- R14 billion in Free cash flow (FCF)

- 61% higher 4E PGM basket price

- Underground Production main contributor (risk)

4/

US PGM operations

(Stable performance)

- Flat production due to 3week stoppage (safety incident)

- lower volumes

- 12% increase in AISC

- R153 million FCF

US PGM operations

(Stable performance)

- Flat production due to 3week stoppage (safety incident)

- lower volumes

- 12% increase in AISC

- R153 million FCF

5/

PGM Recycling

- An under recognized contribution of value

- R180million in net interest earned

- Increasing earnings

PGM Recycling

- An under recognized contribution of value

- R180million in net interest earned

- Increasing earnings

6/

SA Gold operations

(Solid performance)

- 29% higher production

- DRD Gold production 15% higher at an AISC cost of $1417

(margins increase as the price of gold increases, and protected to the downside a bit)

- 3% lower average Rand gold price

- 40% increase in earnings

SA Gold operations

(Solid performance)

- 29% higher production

- DRD Gold production 15% higher at an AISC cost of $1417

(margins increase as the price of gold increases, and protected to the downside a bit)

- 3% lower average Rand gold price

- 40% increase in earnings

7/

DRD GOLD

Sibanye-Stillwater owns a majority stake of 50.66% in DRD GOLD

They are listed on the JSE under the ticker $DRD and sell for R13.80

They too have declared a dividend of 40c a share.

DRD GOLD

Sibanye-Stillwater owns a majority stake of 50.66% in DRD GOLD

They are listed on the JSE under the ticker $DRD and sell for R13.80

They too have declared a dividend of 40c a share.

8/

Income Statement

- Revenue totaling R89.5billion

- Cost of sales R48.1billion

- 53% gross margin

- R25.3billion in profit

- 28% net margin

- R9 billion paid in mining + tax

Income Statement

- Revenue totaling R89.5billion

- Cost of sales R48.1billion

- 53% gross margin

- R25.3billion in profit

- 28% net margin

- R9 billion paid in mining + tax

9/

Highlights

- Gross debt was reduced by 44% from R28.1-billion to R15.9-billion

- 63% increase in revenue

- Cost sales up 28% (resulted in increased profits, so that’s fine)

-Earnings per share (EPS) up 140% to R 8.43

- R8.5billion paid to SA government (taxes)

Highlights

- Gross debt was reduced by 44% from R28.1-billion to R15.9-billion

- 63% increase in revenue

- Cost sales up 28% (resulted in increased profits, so that’s fine)

-Earnings per share (EPS) up 140% to R 8.43

- R8.5billion paid to SA government (taxes)

10/

Dividends

$SSW has declared an interim dividend of R2.92

- Rewarding shareholders with R8.5billion in dividends

- Dividends will continue to increase - as this is what shareholders want.

(Strong performances like this will allow for it to continue)

Dividends

$SSW has declared an interim dividend of R2.92

- Rewarding shareholders with R8.5billion in dividends

- Dividends will continue to increase - as this is what shareholders want.

(Strong performances like this will allow for it to continue)

11/

Stakeholders

$SSW has rewarded all stakeholders

- R39.7billion cash flow

- R5.6billion in capital Expenditure

- R4.5billion in working capital

- R9.7billion in dividend payments

- R742million share buybacks, and expected to increase this to R9.6billion.

Long $SSW

Stakeholders

$SSW has rewarded all stakeholders

- R39.7billion cash flow

- R5.6billion in capital Expenditure

- R4.5billion in working capital

- R9.7billion in dividend payments

- R742million share buybacks, and expected to increase this to R9.6billion.

Long $SSW

12/

Capital Allocation

Management continues to allocate capital in the most efficient and prudent way possible, to bring value to all stakeholders.

Their capital framework is below 👇🏽

Capital Allocation

Management continues to allocate capital in the most efficient and prudent way possible, to bring value to all stakeholders.

Their capital framework is below 👇🏽

13/

That’s not all, let’s look at some of their ambitious plans to change the energy sector and how they stand to benefit.

That’s not all, let’s look at some of their ambitious plans to change the energy sector and how they stand to benefit.

14/

Energy

Under schedule 2 of the electricity regulations act that recently passed, it allows for Sibanye to generate their own energy of up to 100MW

You can expect big investments in this field, with long term benefits. Driving down costs and improving reliance. (Derisking)

Energy

Under schedule 2 of the electricity regulations act that recently passed, it allows for Sibanye to generate their own energy of up to 100MW

You can expect big investments in this field, with long term benefits. Driving down costs and improving reliance. (Derisking)

15/

Reinvesting back in SA

Fantastic to see them laying out their plans to become carbon neutral

Projects in the pipeline:

- 50mw Gold solar project

- 250mw SA wind energy

- 175mw SA PGM solar projects

Sidenote:

These are jobs they are adding to the economy.

Reinvesting back in SA

Fantastic to see them laying out their plans to become carbon neutral

Projects in the pipeline:

- 50mw Gold solar project

- 250mw SA wind energy

- 175mw SA PGM solar projects

Sidenote:

These are jobs they are adding to the economy.

16/

DRD is going to play it’s role

- Producing the greenest gold

- Social investment into education and urban farming

- Hundreds of hectares cleared for social and industrial development

DRD is going to play it’s role

- Producing the greenest gold

- Social investment into education and urban farming

- Hundreds of hectares cleared for social and industrial development

17/

Battery metals

Sibanye is taking strategic bets in companies in Europe too.

Neal Froneman continues to diversify to into strategic regions that offer long term growth.

Read more here 👇🏽

Battery metals

Sibanye is taking strategic bets in companies in Europe too.

Neal Froneman continues to diversify to into strategic regions that offer long term growth.

Read more here 👇🏽

18/

2020 Financials

Check out my previous research on Sibanye-Stillwater.

I remain bullish on the company and plan to hold it long term. The share price has come under stress lately, but the value is there.

Last years financials 👇🏽

2020 Financials

Check out my previous research on Sibanye-Stillwater.

I remain bullish on the company and plan to hold it long term. The share price has come under stress lately, but the value is there.

Last years financials 👇🏽

https://twitter.com/talkcentss/status/1402161083385737217

That’s it, that’s the tweet. Follow me @talkcentss for more stock analysis.

You can expect more:

- Stock research

- Short term trades

- 10x investment ideas

You can expect more:

- Stock research

- Short term trades

- 10x investment ideas

Or you can be like 1000 other people who get my premium content for free every Monday morning.

Sign up now, it only takes a few seconds 👇🏽

davidketh.substack.com/p/talkcents

Sign up now, it only takes a few seconds 👇🏽

davidketh.substack.com/p/talkcents

• Recap

- Growing revenue

- Paying dividends

- Buying back shares

- Strong capital allocation

- Reinvesting back into SA

- Rewarding stakeholders

- Diversifying across regions

- Growing revenue

- Paying dividends

- Buying back shares

- Strong capital allocation

- Reinvesting back into SA

- Rewarding stakeholders

- Diversifying across regions

• • •

Missing some Tweet in this thread? You can try to

force a refresh