Alibaba as an Investment Case

• What they do

• Revenue Breakdown

• Competitive advantage

• Whose buying the stock

• Risks of buying Alibaba

• Valuation

- Thread -

• What they do

• Revenue Breakdown

• Competitive advantage

• Whose buying the stock

• Risks of buying Alibaba

• Valuation

- Thread -

1/

Alibaba Group was established in 1999 by 18 people led by Jack Ma, a former English teacher from Hangzhou, China.

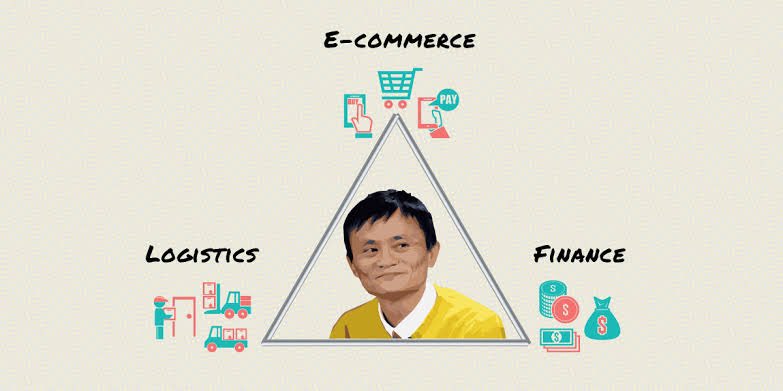

This Chinese multinational technology company that specializes in e-commerce and retail internet has built their business around the iron triangle.

Alibaba Group was established in 1999 by 18 people led by Jack Ma, a former English teacher from Hangzhou, China.

This Chinese multinational technology company that specializes in e-commerce and retail internet has built their business around the iron triangle.

2/

The Iron Triangle

Before we take a deep dive into understanding this triangle, we need to have a look at the core businesses of Alibaba first

The Iron Triangle

Before we take a deep dive into understanding this triangle, we need to have a look at the core businesses of Alibaba first

3/

Alibaba really took off after the launch of Taobao in 2003. Taobao would later become their prize asset

•Taobao is a consumer to consumer e-commerce site, similar to eBay

•Revenue is generated from sellers paying to rank higher in the search. (Similar to google rankings)

Alibaba really took off after the launch of Taobao in 2003. Taobao would later become their prize asset

•Taobao is a consumer to consumer e-commerce site, similar to eBay

•Revenue is generated from sellers paying to rank higher in the search. (Similar to google rankings)

4/

From Taobao’s success, Alibaba launched TMALL COM in 2008.

• A business to consumer e-commerce store.

•An online mall that allows global brands to sell their products to Chinese consumers

• Revenue is generated through sale commissions and advertising

From Taobao’s success, Alibaba launched TMALL COM in 2008.

• A business to consumer e-commerce store.

•An online mall that allows global brands to sell their products to Chinese consumers

• Revenue is generated through sale commissions and advertising

5/

In 2004 Alipay was launched.

Ant Financial owns Alipay, and Alibaba owns 1/3rd of Ant Financial

•Alipay is a digital wallet online payment platform - similar to PayPal

•Currently has over 1.3billion users

In 2004 Alipay was launched.

Ant Financial owns Alipay, and Alibaba owns 1/3rd of Ant Financial

•Alipay is a digital wallet online payment platform - similar to PayPal

•Currently has over 1.3billion users

•Alipay processed $17 trillion worth of transactions in China.

•80 million Merchants use Alipay for business.

•Partnered with more than 2000 financial institutions

(These numbers are incredible) the tailwind behind Alibaba is enormous - IMO.

•80 million Merchants use Alipay for business.

•Partnered with more than 2000 financial institutions

(These numbers are incredible) the tailwind behind Alibaba is enormous - IMO.

6/

In 2013,

Alibaba and 6 large Chinese logistic companies established Cainiao, for delivery of packages in China. It had grown to 14 by 2014.

The network aims to provide one service and supply chain management solutions, fulfilling logistic needs of merchants and consumers.

In 2013,

Alibaba and 6 large Chinese logistic companies established Cainiao, for delivery of packages in China. It had grown to 14 by 2014.

The network aims to provide one service and supply chain management solutions, fulfilling logistic needs of merchants and consumers.

7/

All of these businesses above form Alibaba’s Iron Triangle I mentioned earlier. It creates their competitive advantage and is what makes their MOAT so powerful.

It’s why the barriers to entry are extremely difficult, and why Alibaba should continue to dominate in the region

All of these businesses above form Alibaba’s Iron Triangle I mentioned earlier. It creates their competitive advantage and is what makes their MOAT so powerful.

It’s why the barriers to entry are extremely difficult, and why Alibaba should continue to dominate in the region

8/

The strength of their Iron Triangle lies in:

- E-commerce Network Effect

- Trustworthy Payment Platform

- Efficient Logistics Services.

Let’s take a look at how this translates into numbers…..

The strength of their Iron Triangle lies in:

- E-commerce Network Effect

- Trustworthy Payment Platform

- Efficient Logistics Services.

Let’s take a look at how this translates into numbers…..

9/

2021 Revenue Breakdown

1. Core commerce 87%

2. Cloud computing 8%

3. Digital Media/enter 4%

4. Innovation and others. 1%

2021 Revenue Breakdown

1. Core commerce 87%

2. Cloud computing 8%

3. Digital Media/enter 4%

4. Innovation and others. 1%

10/

1. Core commerce

This is still the most important revenue contributor for Alibaba, and includes 👇🏽

• E-commerce 75%

• Cainaio 5%

• Eleme+Koubei+Figgy 5%

• Other 2%

1. Core commerce

This is still the most important revenue contributor for Alibaba, and includes 👇🏽

• E-commerce 75%

• Cainaio 5%

• Eleme+Koubei+Figgy 5%

• Other 2%

11/

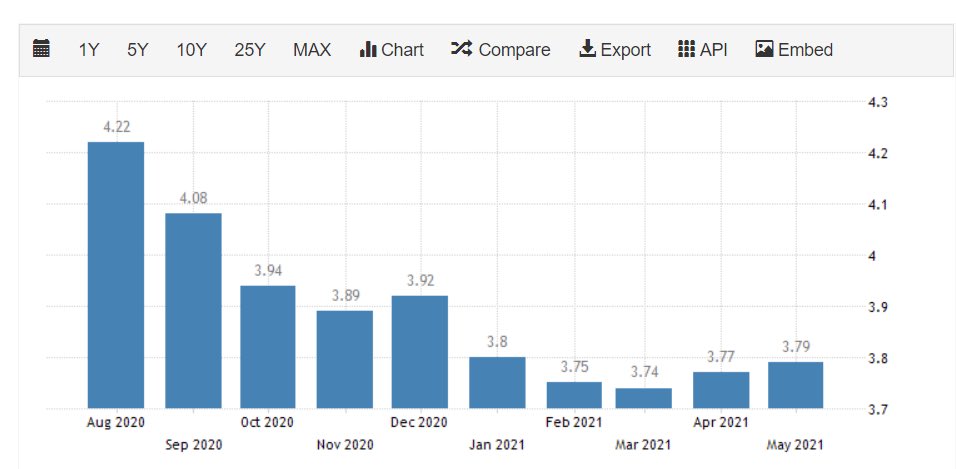

2. Cloud Computing

Alibaba Cloud launched in 2009, it’s China’s largest provider of public cloud services

It’s revenue has been growing astronomically:

2019 = $3.8B

2020 =$ 6.2B

2021 = $ 9.1B

However, it is still in the red and is consuming money.

2. Cloud Computing

Alibaba Cloud launched in 2009, it’s China’s largest provider of public cloud services

It’s revenue has been growing astronomically:

2019 = $3.8B

2020 =$ 6.2B

2021 = $ 9.1B

However, it is still in the red and is consuming money.

12/

3. Digital Media and Entertainment

- Youku

- Alibaba Pictures

Youku is one of China’s top online video and streaming platforms. It’s like the Netflix in China, with 70% of users opting to use it to watch TV series and movies.

3. Digital Media and Entertainment

- Youku

- Alibaba Pictures

Youku is one of China’s top online video and streaming platforms. It’s like the Netflix in China, with 70% of users opting to use it to watch TV series and movies.

13/

4. Innovation and Other

Their playground to experiment with upcoming businesses, also known as ‘other bets’.

Examples:

- A Map ( Mobile digital map)

- DingTalk ( Mobile office platform)

- Tmall Genie ( Smart speakers)

4. Innovation and Other

Their playground to experiment with upcoming businesses, also known as ‘other bets’.

Examples:

- A Map ( Mobile digital map)

- DingTalk ( Mobile office platform)

- Tmall Genie ( Smart speakers)

14/

Alibaba’s Competitive Advantage

• Enormous network effect

• High barrier to entry for competitors

• Iron Triangle

• e-commerce network effect

• Trusted payment platform

• Efficient logistics Services

Alibaba’s Competitive Advantage

• Enormous network effect

• High barrier to entry for competitors

• Iron Triangle

• e-commerce network effect

• Trusted payment platform

• Efficient logistics Services

15/

Risks

• Chinese government

• Nationalization

• Big Tech Clampdown

• US auditors aren’t allowed to audit Chinese companies

• You have to trust the numbers.

Risks

• Chinese government

• Nationalization

• Big Tech Clampdown

• US auditors aren’t allowed to audit Chinese companies

• You have to trust the numbers.

However, although these risks exist and are possible, I personally don’t think they will materialize and it’s why we have seen big investors pile into the stock lately.

“Be greedy when others are fearful”

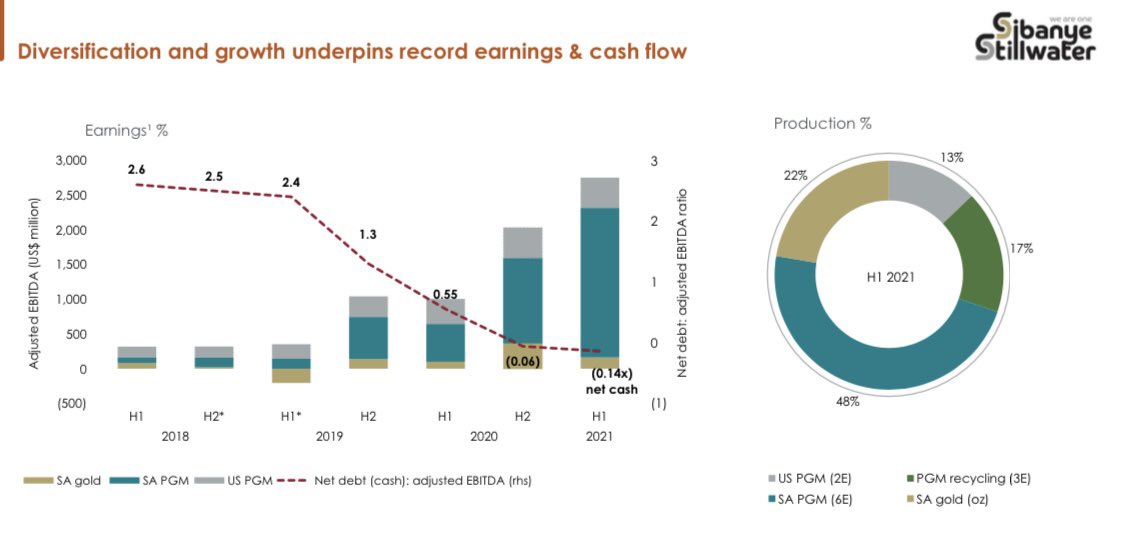

Alibaba is also major contributor to China’s GDP 👇🏽

“Be greedy when others are fearful”

Alibaba is also major contributor to China’s GDP 👇🏽

16/

Buyers of Alibaba stock

Q1 2021

• Charlie Munger added 165 320 shares (19%)

• Mohnish Pabrai added 168 843 shares (14.61%)

• Greg Alexander added 884 845 shares (12.33%)

Buyers of Alibaba stock

Q1 2021

• Charlie Munger added 165 320 shares (19%)

• Mohnish Pabrai added 168 843 shares (14.61%)

• Greg Alexander added 884 845 shares (12.33%)

In Q2 2021

Mohnish Pabrai continued adding Alibaba to his portfolio, adding 7% (89 878 shares)

Over Q1/Q2 of 2021 he added a total of 258 721 Alibaba shares

That is serious conviction, he believes the company will succeed.

“Heads I win, tails I don’t lose much”

Mohnish Pabrai continued adding Alibaba to his portfolio, adding 7% (89 878 shares)

Over Q1/Q2 of 2021 he added a total of 258 721 Alibaba shares

That is serious conviction, he believes the company will succeed.

“Heads I win, tails I don’t lose much”

For those of you who remember, I spoke about diversification and what Mohnish Pabrai had to say about it.

“It makes little sense if you know what you are doing”

He also holds about 10 stocks in his portfolio and he is backing Alibaba as one of them. 👇🏽

“It makes little sense if you know what you are doing”

He also holds about 10 stocks in his portfolio and he is backing Alibaba as one of them. 👇🏽

https://twitter.com/talkcentss/status/1430891521654419456

17/

Valuation

This behemoth has a market cap of $462 billion, take a look at their 10 year CAGR:

Revenue = 60%

EPS = 66%

FCF = 57%

An absolute monster, that IMO is undervalued. Let me explain why👇🏽

Valuation

This behemoth has a market cap of $462 billion, take a look at their 10 year CAGR:

Revenue = 60%

EPS = 66%

FCF = 57%

An absolute monster, that IMO is undervalued. Let me explain why👇🏽

It’s starting from a large base and is to big to power ahead at this current CAGR, but that doesn’t mean no growth in the future.

Let’s assume they continue growing at 16%.

This would value

the company at $707billion

Which is a 35% margin of safety at current levels.

Let’s assume they continue growing at 16%.

This would value

the company at $707billion

Which is a 35% margin of safety at current levels.

18/

An absolute steal of a company if you are willing to swallow the risks and hold for the long term.

Businesses that play the long term game usually are the ones that succeed, and it seems this is what Alibaba has been doing - playing the long term game.

An absolute steal of a company if you are willing to swallow the risks and hold for the long term.

Businesses that play the long term game usually are the ones that succeed, and it seems this is what Alibaba has been doing - playing the long term game.

That’s it, that’s the tweet. Follow me @talkcentss for more business breakdowns.

You can expect:

- 10x investment ideas

- Stock research

- Trade ideas

- Property threads

You can expect:

- 10x investment ideas

- Stock research

- Trade ideas

- Property threads

Or you can join a 1000 others who get my premium content absolutely FREE every Monday morning.

Sign up, it only take a few seconds. 👇🏽

davidketh.substack.com/p/talkcents

Sign up, it only take a few seconds. 👇🏽

davidketh.substack.com/p/talkcents

TL, DR

• Iron Triangle

• Strong Moat

• Strong Tailwinds

• Growing Business

• Decent entry price

• High barriers to entry

• Promising revenue streams

#alibaba #alipay #tech

• Iron Triangle

• Strong Moat

• Strong Tailwinds

• Growing Business

• Decent entry price

• High barriers to entry

• Promising revenue streams

#alibaba #alipay #tech

• • •

Missing some Tweet in this thread? You can try to

force a refresh