1/

Investing is a marathon not a sprint

Translation,

investing takes time, don’t be in a rush to get rich quick.

Investing is a marathon not a sprint

Translation,

investing takes time, don’t be in a rush to get rich quick.

2/

Liquidity is like oxygen,

you don’t notice that you need it until is not there.

Translation,

having cash available is important to be able to cover emergencies, or to be able to take advantage of market sell offs.

Liquidity is like oxygen,

you don’t notice that you need it until is not there.

Translation,

having cash available is important to be able to cover emergencies, or to be able to take advantage of market sell offs.

3/

Don’t put all your eggs in one basket.

Translation,

don’t have all your money in one asset class because if it does bad then your entire net worth is affected.

Don’t put all your eggs in one basket.

Translation,

don’t have all your money in one asset class because if it does bad then your entire net worth is affected.

4/

Investing should be like watching paint dry.

Translation,

It’s not meant to be fun, it should be boring

Investing should be like watching paint dry.

Translation,

It’s not meant to be fun, it should be boring

5/

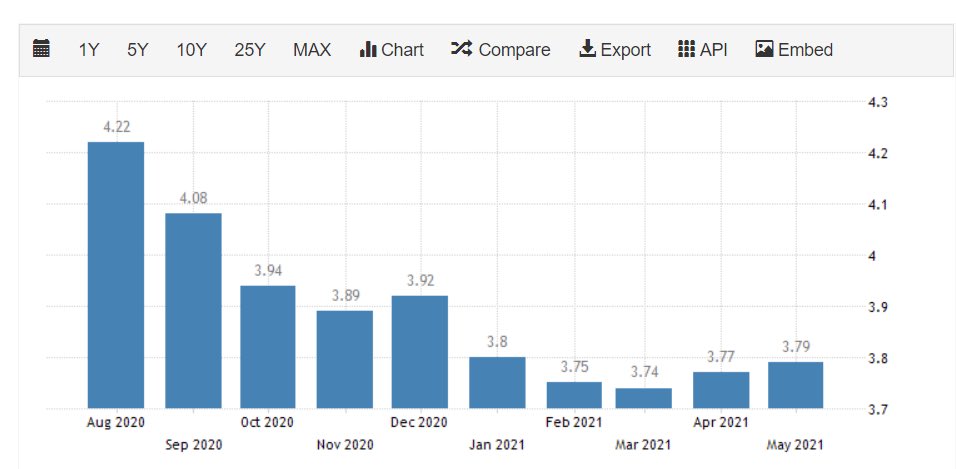

Build a nest egg.

Translation,

make sure to have enough money for retirement so you can take care of yourself in the future.

Build a nest egg.

Translation,

make sure to have enough money for retirement so you can take care of yourself in the future.

6/

Choose your investments like you pick your spouse.

Translation,

don’t just marry anyone, similarly vet your investments thoroughly before committing to it.

Choose your investments like you pick your spouse.

Translation,

don’t just marry anyone, similarly vet your investments thoroughly before committing to it.

8/

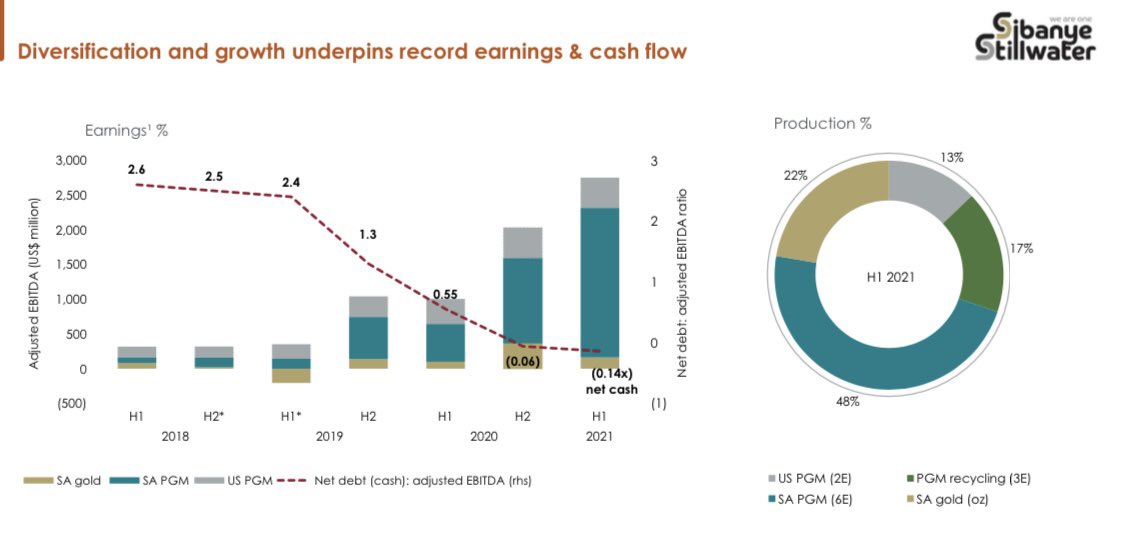

That company is printing money

Translation,

the business itself has many customers, it is making a lot of profit.

That company is printing money

Translation,

the business itself has many customers, it is making a lot of profit.

10/

Pouring money down the drain

Translation,

you are wasting money, the odds are high that you won’t get a return on your investment.

Pouring money down the drain

Translation,

you are wasting money, the odds are high that you won’t get a return on your investment.

11/

Time is money

Translation,

don’t waste your time because it’s valuable, it’s better to do things now and efficiently instead of procrastinating.

Time is money

Translation,

don’t waste your time because it’s valuable, it’s better to do things now and efficiently instead of procrastinating.

12/

My two cents worth

Translation,

you are giving your opinion on something, even if the person never asked.

My two cents worth

Translation,

you are giving your opinion on something, even if the person never asked.

• Shout out

You made it to the end, now learn how to become a millionaire 👀👇🏽

You made it to the end, now learn how to become a millionaire 👀👇🏽

https://twitter.com/talkcentss/status/1420302948278489088

• • •

Missing some Tweet in this thread? You can try to

force a refresh