Is India Ready for Electric Vehicle?

🇮🇳🤔

Here’s our analysis of what’s going on in the EV sector.

The Advantage, the hurdles and how is India positioned to face the disruption in the Auto Sector.

Thread Below 🧵🧵👇🏻

#ElectricVehicles #investing #Tesla @caniravkaria

🇮🇳🤔

Here’s our analysis of what’s going on in the EV sector.

The Advantage, the hurdles and how is India positioned to face the disruption in the Auto Sector.

Thread Below 🧵🧵👇🏻

#ElectricVehicles #investing #Tesla @caniravkaria

Defining Disruption:

When a new Product or Service helps create a new market AND significantly weaken, transform, or destroy an existing product, market category / industry

When a new Product or Service helps create a new market AND significantly weaken, transform, or destroy an existing product, market category / industry

Defining The Chasm:

The Chasm is defined as a common constraint that occurs in a market segment between "early adopters" - who are willing to put up with a lot, and "early majority", who expect a lot.

A lot must be done to bridge this gap. This is where EV is positioned

The Chasm is defined as a common constraint that occurs in a market segment between "early adopters" - who are willing to put up with a lot, and "early majority", who expect a lot.

A lot must be done to bridge this gap. This is where EV is positioned

But the question remains:

Are EV even disruptive?

Answer is YES!

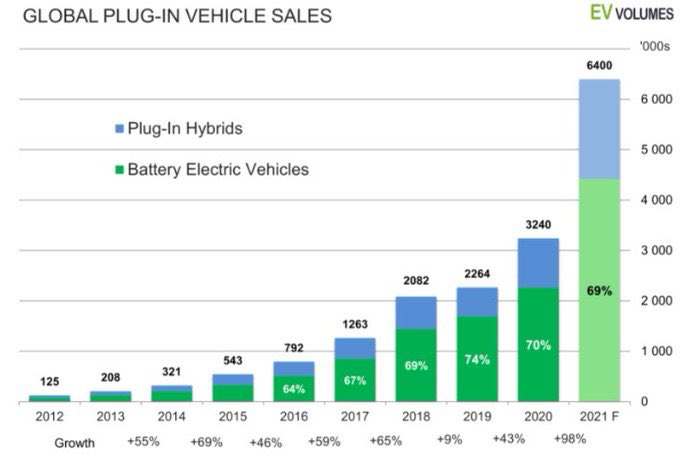

From less than 0.2% market share in 2012, they have increase to 9% by CY2021.

Fact:

Tesla’s Model 3 was the top-selling car in Europe in Aug 2021, the first time an electric car has outsold a gasoline engines

Are EV even disruptive?

Answer is YES!

From less than 0.2% market share in 2012, they have increase to 9% by CY2021.

Fact:

Tesla’s Model 3 was the top-selling car in Europe in Aug 2021, the first time an electric car has outsold a gasoline engines

What is aiding this growth of EV over ICE?

1. Electric cars are 3 to 10x cheaper on a per km basis compared to ICE cars, largely because electric motors are much more energy-efficient (3-5x) than ICEs.

2. Enhanced power and handling are other attractions of EVs

1. Electric cars are 3 to 10x cheaper on a per km basis compared to ICE cars, largely because electric motors are much more energy-efficient (3-5x) than ICEs.

2. Enhanced power and handling are other attractions of EVs

3. Higher Safety Standards:

Better handling comes due to the lower center of gravity in EVs, as electric batteries are located at the bottom of the car.

Better handling comes due to the lower center of gravity in EVs, as electric batteries are located at the bottom of the car.

4. Maintenance costs go down by 40-50%

Fact: EVs have 100x fewer parts; A conventional car has anywhere b/w

2000 moving parts compared to a Tesla Model S which has only 18!

5. EV powertrains can last up to 5 lakh miles compared to ICE which is 1.5-2 lakh miles

Fact: EVs have 100x fewer parts; A conventional car has anywhere b/w

2000 moving parts compared to a Tesla Model S which has only 18!

5. EV powertrains can last up to 5 lakh miles compared to ICE which is 1.5-2 lakh miles

Thus, The future of mobility is skewed towards EV. This is also visible in the electrification targets by global OEMs that plan to sell 30-50% of incremental cars as EVs between 2025 to 2030.

Additionally, EV adoption is supported by national policies, targets, and tax breaks

Additionally, EV adoption is supported by national policies, targets, and tax breaks

But it’s not all rosey, here are the Challenges with EV

1) The battery is still too Expensive

2) Too Short ranged with respect to pricing. One of the biggest remaining fears is that of running out of juice between Point A and Point B.

3) Too slow to charge

1) The battery is still too Expensive

2) Too Short ranged with respect to pricing. One of the biggest remaining fears is that of running out of juice between Point A and Point B.

3) Too slow to charge

Challenges in India 🇮🇳

1) Unaffordable

2) Lack of charging infrastructure

3) Lack of electricity generation

4) Less range compared to ICE, meaning it can be only used for Intra city travel

5) Traditional Banks are still skeptical about EV

6) Threat of substitutes like CNG

1) Unaffordable

2) Lack of charging infrastructure

3) Lack of electricity generation

4) Less range compared to ICE, meaning it can be only used for Intra city travel

5) Traditional Banks are still skeptical about EV

6) Threat of substitutes like CNG

What’s needed to cross the hurdle?

1) EV pricing should go down faster

2) Govt starts spending more on the charging infrastructure

3) EVs have to increase the range dramatically

4) Fleet operators (private & public) start preferring EVs over ICEs

1) EV pricing should go down faster

2) Govt starts spending more on the charging infrastructure

3) EVs have to increase the range dramatically

4) Fleet operators (private & public) start preferring EVs over ICEs

Our Bet will be on Auto Ancillaries that are EV agnostic or benefits from increased volume due to EV sales.

The government’s plan is to have 30% of incremental sales of private cars, 70% of commercial vehicles, 40% of buses and 80% of two and three-wheelers go electric by 2030.

The government’s plan is to have 30% of incremental sales of private cars, 70% of commercial vehicles, 40% of buses and 80% of two and three-wheelers go electric by 2030.

The next few years will surely be interesting from EV perspective as it surely looks like one of the biggest disruption in last 100 years in the Auto Industry.

Happy Reading! :)

Happy Reading! :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh