1) How to profit from the current uncertainties of MEMO’s future rebase rewards, a thread

#wonderland #FrogNation #pendle #memo

@pendle_fi

#wonderland #FrogNation #pendle #memo

@pendle_fi

2) With the recent tweets from @danielesesta, there are a lot of uncertainties in the MEMO’s rebase rewards in the coming weeks. Will the rebase rewards end? Will it be significantly reduced? When will these happen?

https://twitter.com/danielesesta/status/1483182059002957824

3) Uncertainties create opportunities. If you have an opinion on the future of MEMO’s rebase rewards in the coming weeks, here’s how you can bet on it (and get good returns if it turns out to be correct) by following Peepo or Wojak

4) [Peepo strat] Peepo is a happy-go-lucky guy, with an initial capital of 1 MEMO. He thinks that MEMO’s rebase rewards will likely stay the same at around 70000% APY, or at worst be slightly reduced, in the coming 5 weeks.

5) [Peepo strat] Peepo converts his 1 MEMO into 1221 MIM (assume current MEMO price is $1221), which he uses to buy 2.22 YT-wMEMO in Pendle (YT-wMEMO is currently 550 MIM)

6) [Peepo strat] What is this YT-wMEMO token anyway ? Basically, 1 YT-wMEMO will constantly give you the rebase rewards on 1 MEMO until the expiry (24 Feb 22)

7) [Peepo strat] Now, Peepo will just sit back and relax until the expiry (24 Feb 2022) while his 2.22 YT keeps giving him rebase rewards (which he can claim in the Pendle Dashboard anytime)

8) [Peepo strat] Peepo thinks MEMO’s rebase rewards will be 70000% on average from now until 24th Feb, so he is expecting to get 2.22 * (1+70000/100)**(36/365) - 2.22 = 2.02 MEMO by the expiry

9) [Peepo strat] Getting 2.02 MEMO from an 1 MEMO capital within 36 days is basically (2.02 / 1) ^ (365/36) -1 = 124000% APY. Not too shabby compared to the normal 70000%

10) [Peepo strat] The returns on Peepo’s strategy mostly depend on the timing of his trade. YT-wMEMO price could swing significantly, and Peepo would want to buy when it’s relatively cheap

11) [Peepo strat] This is another tweet about the same strategy with more details:

https://twitter.com/gabavineb/status/1471782829419745284

12) [Wojak strat] Next, let us meet Wojak. Wojak believes that MEMO’s rebase rewards will significantly reduce, to around 10000% (or even 0%). Wojak also has a capital of 1MEMO

13) [Wojak strat] Wojak converts his 1 MEMO into 1221 MIM, which he uses to buy 1.83 OT-wMEMO in Pendle (OT-wMEMO is currently 668 MIM)

14) [Wojak strat] What is this OT-wMEMO token? Basically, 1 OT-wMEMO will give you the right to get back 1 MEMO after the expiry (24 Feb 2022)

15) [Wojak strat] Now, Wojak will just sit back and relax until the expiry. After the expiry, Wojak redeems his 1.83 OT-wMEMO to get back 1.83 MEMO

16) [Wojak strat] Getting 1.83 MEMO from an 1 MEMO capital within 36 days is basically (1.83 / 1) ^ (365/36) - 1 = 45700% APY. That’s way better than the 10000% or 0% APY that Wojak thinks will be the average rebase rewards rate

17) [Wojak strat] The returns on Wojak’s strategy also depends mostly on the timing of his trade. OT-wMEMO price could swing significantly, and Wojak would want to buy when it’s relatively cheap

18) [Wojak strat] This is another tweet explaining Wojak’s strategy in more details:

https://twitter.com/gabavineb/status/1472943529332654081?s=20

19) With the increased uncertainties, YT-wMEMO and OT-wMEMO have been fluctuating much more wildly as well. As such, there are more opportunities for Peepo and Wojak to enter at very favourable prices

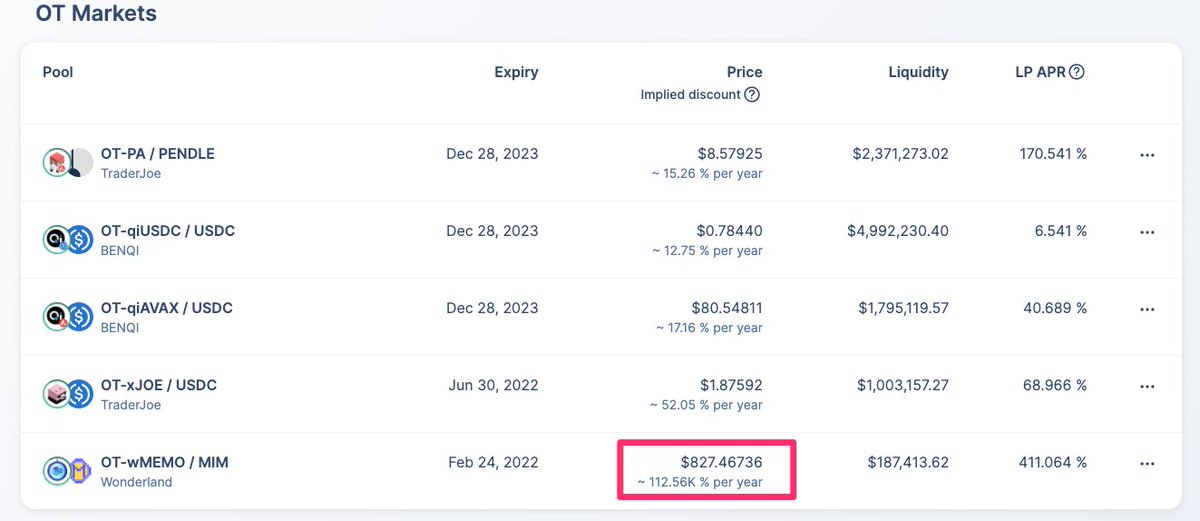

20) Bonus tip: for the more savvy apes, you could provide liquidity to YT-wMEMO and OT-wMEMO pools for swap fees and PENDLE incentives too

21) To help fellow apes (and frogs) out there, I have made this calculator for these 2 strategies, which you could just plug in the current prices and your assumption on MEMO’s rebase rewards rate to see the potential returns

docs.google.com/spreadsheets/d…

docs.google.com/spreadsheets/d…

22) So, are you team Peepo or team Wojak?

• • •

Missing some Tweet in this thread? You can try to

force a refresh