DUC Dilemma & 2022 Oil Market Outlook: A Thread

Despite the run-up in energy prices over the last year, we’re likely in the early innings of an o&g bull market. Here’s why we think 2022 could be another stellar year for oil and gas equities 🧵

Despite the run-up in energy prices over the last year, we’re likely in the early innings of an o&g bull market. Here’s why we think 2022 could be another stellar year for oil and gas equities 🧵

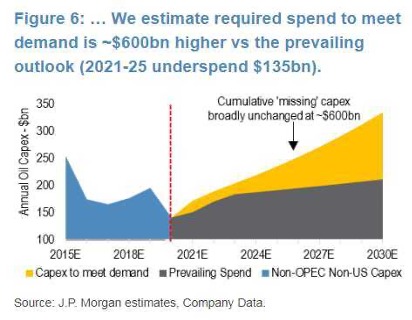

(2/19) The macroeconomic backdrop for oil is compelling. Hostile policies directed at producers and un-economic “ESG” mandates are restricting capital, which is lowering supply, raising prices and causing a lot of pain for consumers, particularly in Europe:

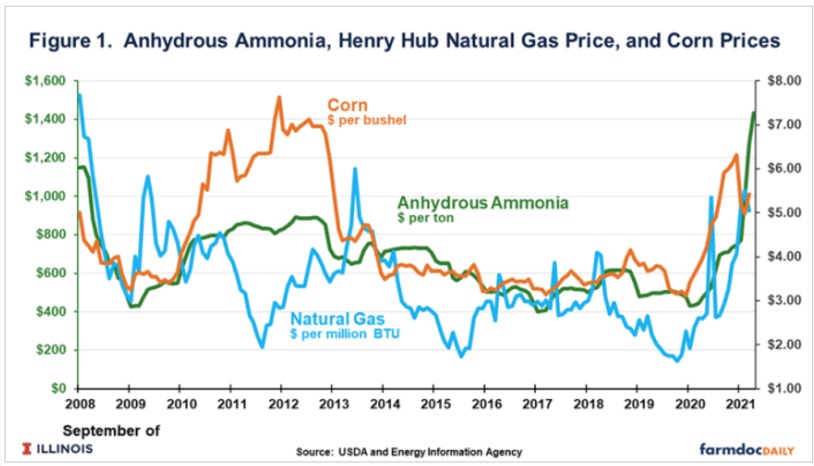

(3/19) The effects of all-time high gas prices are reverberating across the globe. Several countries such as China and Kosovo have mandated blackouts, and others, such as Germany, have seen their power grids fail spontaneously newsrnd.com/life/2022-01-0…

(4/19) Gas is a primary input in ammonia, used in fertilizer to grow crops, and so higher gas prices are linked with rising food prices. Historically, the latter has been followed by periods of political turbulence - which may drive energy prices even higher!

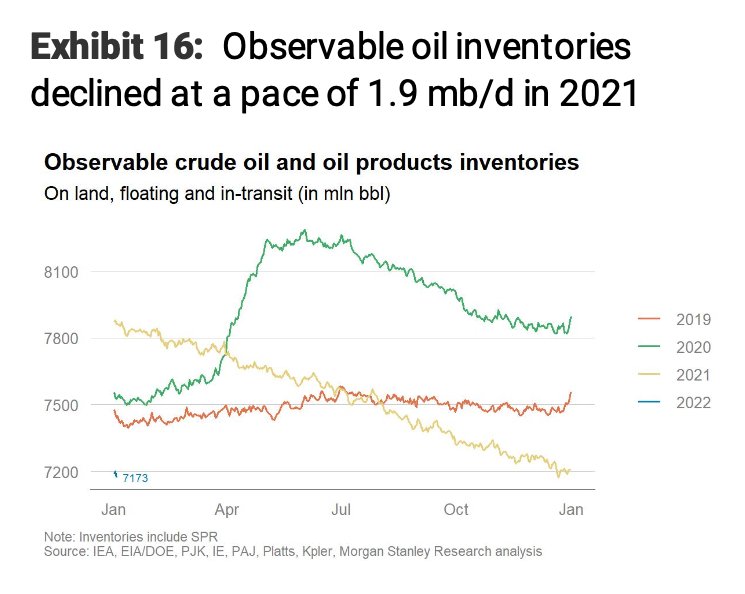

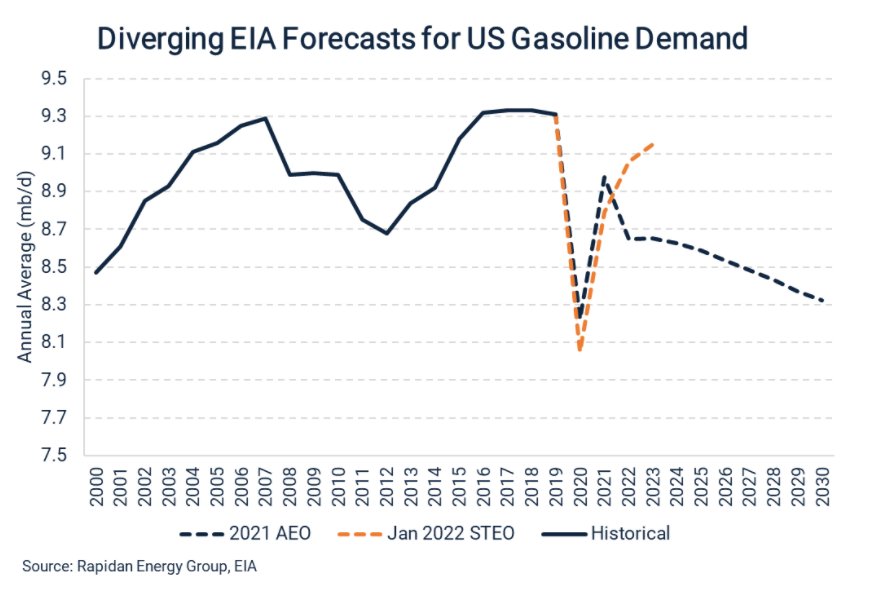

(5/19) Despite the “energy transition” and soaring prices, oil demand continues to surprise to the upside. This can be attributed to the economic reopening, suburbanization, the burning of relatively cheaper oil for power generation, and improving standards of living globally

(6/19) Lower supply and higher demand may contribute to even higher oil prices in 2022 and onwards. Narrative and sentiment are following price, with oil and gas company management teams warming up to the idea of new drilling this year

(7/19) But the issue of insufficient investment exploration and production activity has compounded for some time now, and soaring oil and gas prices we’re seeing may be an early manifestation of a much larger issue

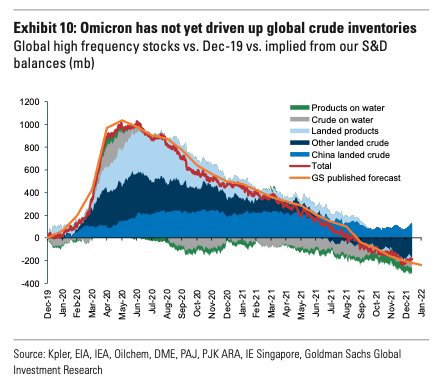

(9/19) And the Omicron variant, and related travel restrictions, have done little cool demand, unlike prior Covid waves

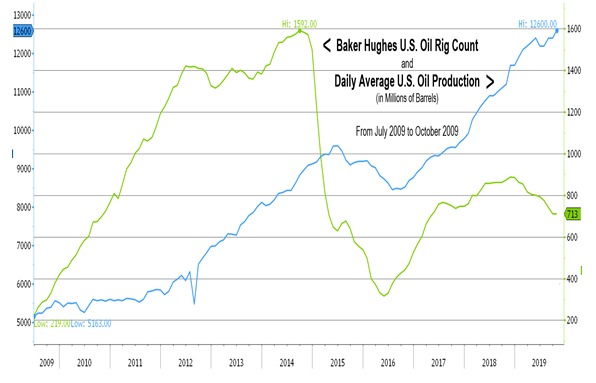

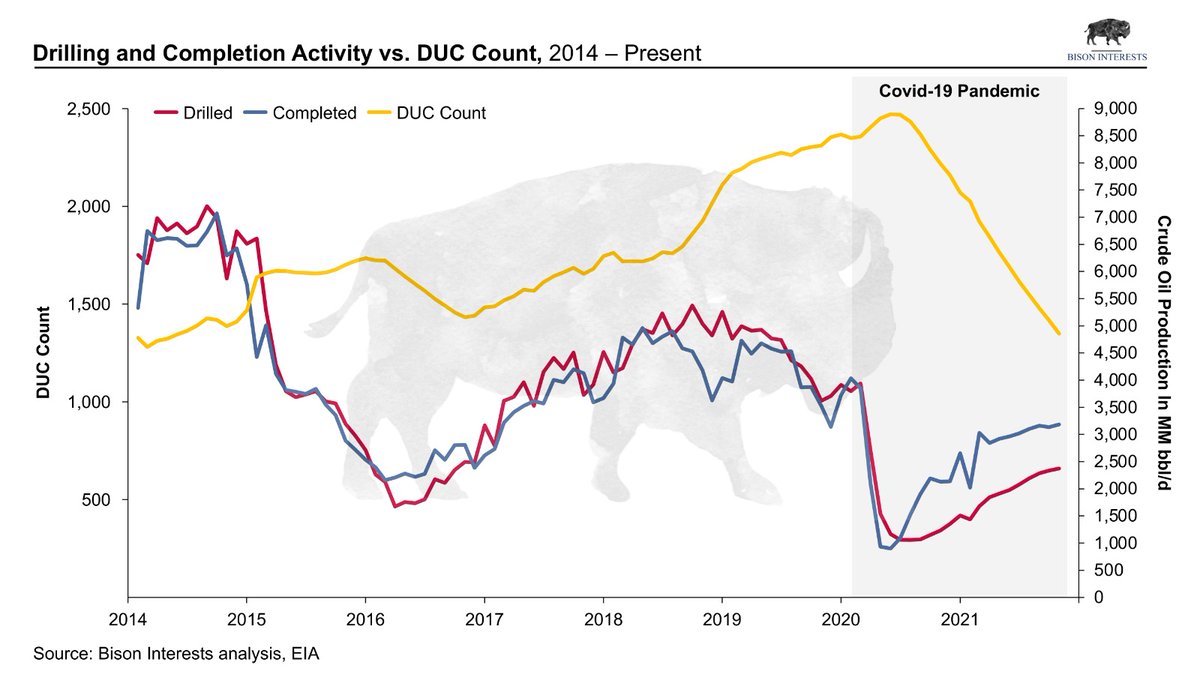

(10/19) US production may struggle to recover to pre-pandemic levels, and inventories may get to critically low levels, without substantially higher levels of drilling and development activity. This is the “DUC Dilemma”

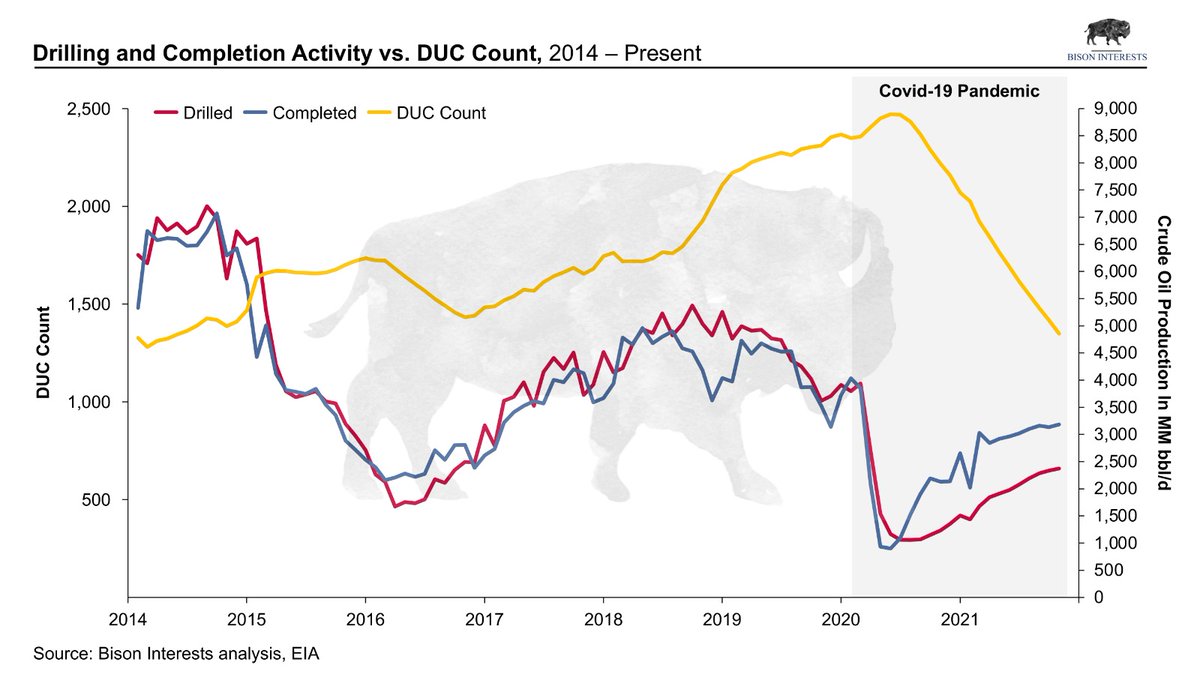

(11/19) A DUC is a well that has been drilled but has not yet been completed. These exist because a shale well is brought onto production in two distinct phases 1) the well is first drilled using a drilling rig, and 2) the well is then “completed” using a frac spread

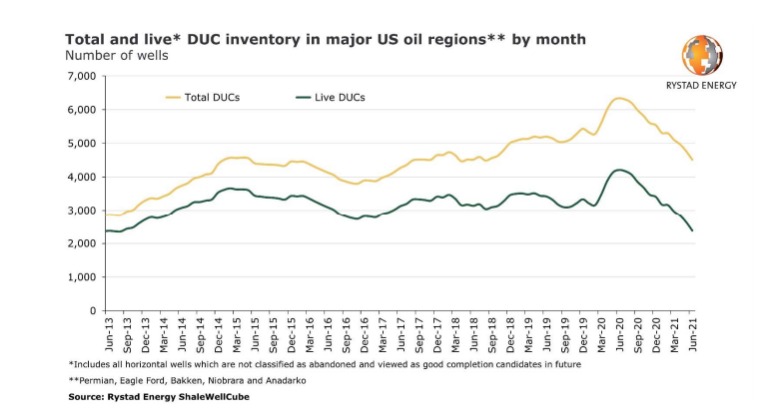

(12/19) DUCs are a form of oilfield working capital, and a steady inventory is needed to maintain and grow output overtime. Since the onset of the pandemic, completion activity has outpaced new drilling, and DUC inventory has languished

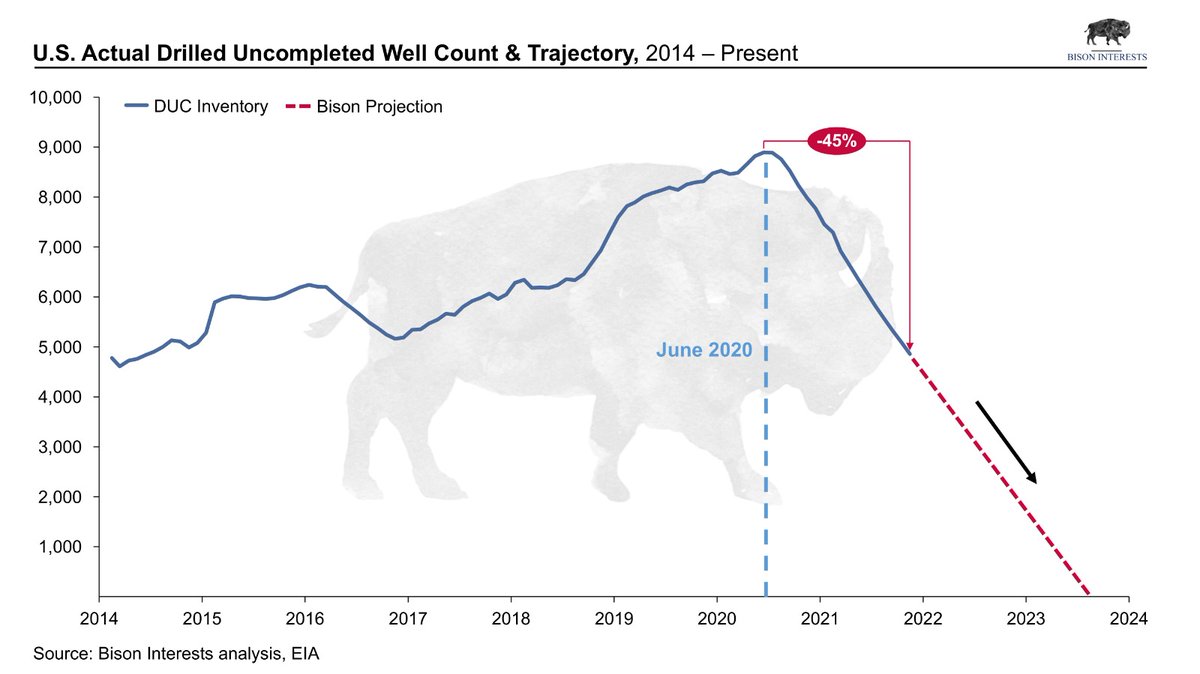

(13/19) Producers have recently prioritized well completion over new drilling, allowing them to hold production steady with less capital. This is clearly unsustainable, and without increased drilling, the inventory of DUCs may reach dangerously low levels by mid-2023 or sooner

(14/19) Historically, 95% of wells drilled have been completed within 2 years, and so DUCs older than 2 years are considered “dead” and unlikely to be completed. DUC inventory shortages may be worse than reported, as most conventional sources fail to make this distinction

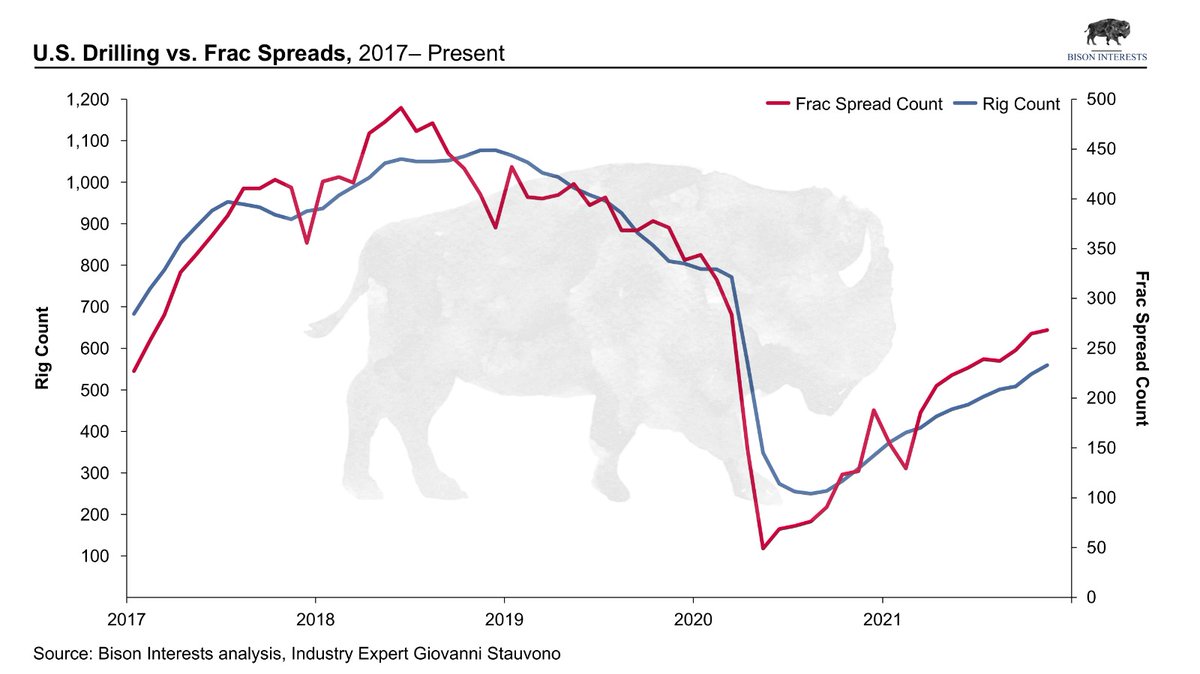

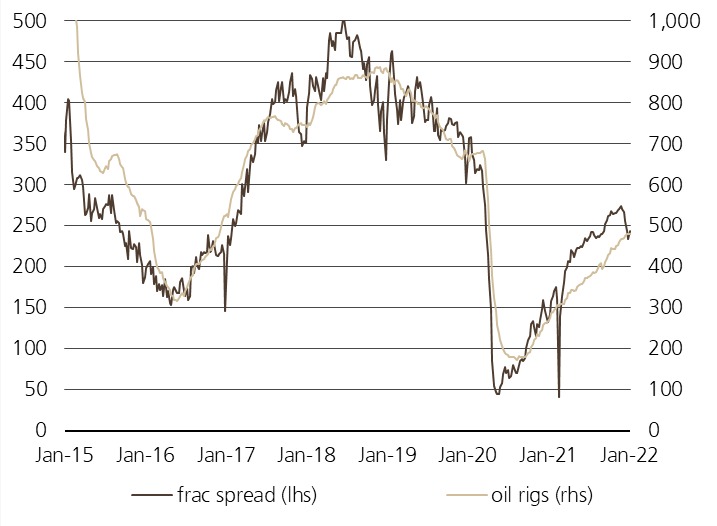

(15/19) The relative supply of rigs to frac spreads can be a leading indicator of changes in DUC inventory. Recently, frac spreads have increased relative to rigs, which coincides with the post-pandemic period in which DUC inventory has been falling

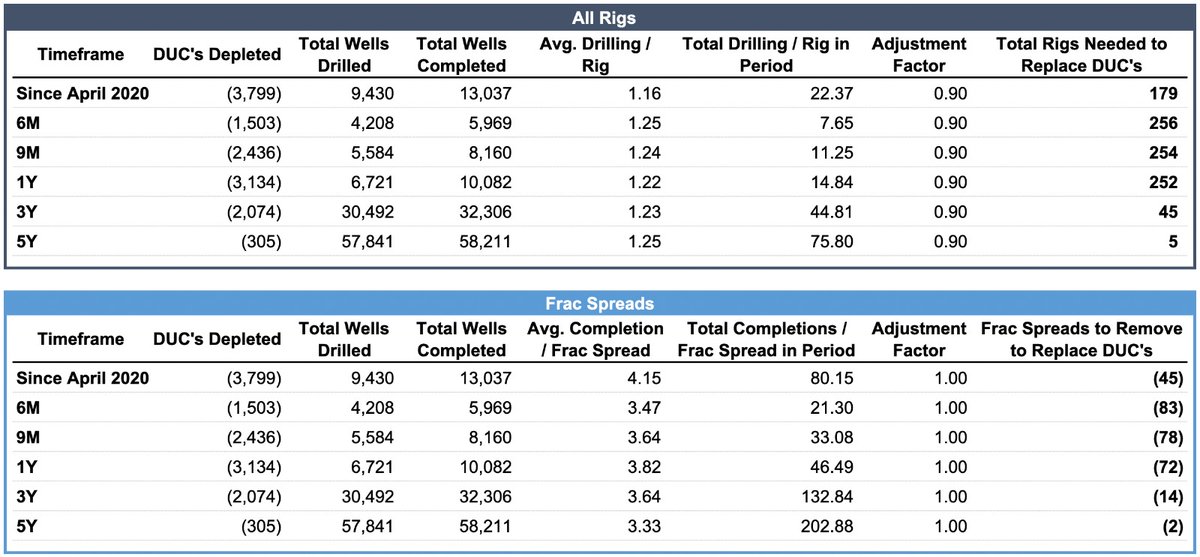

(16/19) We tried to determine how many drilling rigs would need to be added, or how many frac spreads would need to be removed, to keep DUC inventories from falling. We estimate that we need to add ∼180 rigs or remove ∼45 frac spreads to restore DUCs depleted since April 2020

(17/19) And we have already seen early validation of our analysis, with the frac spread count falling and the rig count rising recently, despite rising oil prices

(18/19) Many more rigs are required just to keep DUC inventories flat. This may take time to resolve, as there is substantial lead time needed for rigs to be refurbished and/or re-activated, transported to the appropriate well pad, and equipped with scarce OCTG

(19/19) The US oil rig count may not reach necessary levels in 2022. Combined with lower production, restrictive policy and higher-than-expected demand, this may send oil prices much higher. You can read our full white paper here: bisoninterests.com/content/f/biso…

• • •

Missing some Tweet in this thread? You can try to

force a refresh