China is trying to sell a lot of LNG into the spot market, indicating the world's top importer is well-stocked 🇨🇳

Sinopec issued a sales tender offering up to 45 cargoes for 2022 delivery (They usually buy)

The surprise move may spur bearish sentiment

bloomberg.com/news/articles/…

Sinopec issued a sales tender offering up to 45 cargoes for 2022 delivery (They usually buy)

The surprise move may spur bearish sentiment

bloomberg.com/news/articles/…

So why is China doing this now? A few ideas:

> Sinopec has a long-term purchase agreement for 2 million tons of LNG a year from Qatar that started this year, which may give them excess supply

> Covid measures seen having a larger impact on demand

> Testing price levels

> Sinopec has a long-term purchase agreement for 2 million tons of LNG a year from Qatar that started this year, which may give them excess supply

> Covid measures seen having a larger impact on demand

> Testing price levels

This is the first time Sinopec -- traditionally a buyer -- has issued such a large sales tender offering to resell LNG cargoes

To be sure, it isn’t clear how many cargoes Sinopec actually plans to sell via its tender, and the firm may decide not to award any shipments at all

To be sure, it isn’t clear how many cargoes Sinopec actually plans to sell via its tender, and the firm may decide not to award any shipments at all

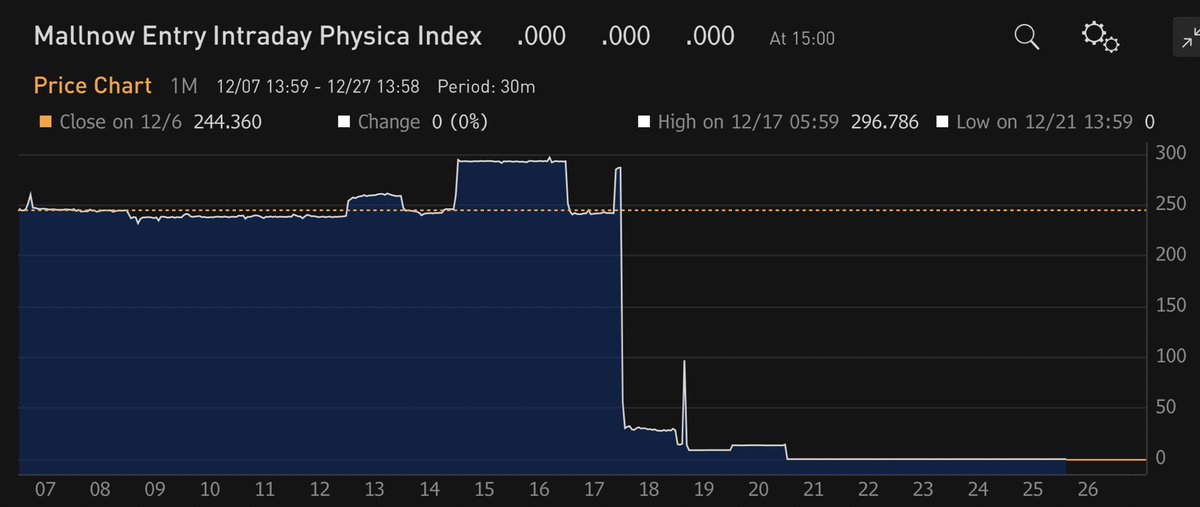

Market reaction: European natural gas prices slumped

Sinopec's large sales tender means more gas could come to Europe, helping to ease pressure from its abnormally low inventories and curtailed supplies from top exporter Russia

bloomberg.com/news/articles/…

Sinopec's large sales tender means more gas could come to Europe, helping to ease pressure from its abnormally low inventories and curtailed supplies from top exporter Russia

bloomberg.com/news/articles/…

China’s Sinopec issuing an LNG sales tender like

• • •

Missing some Tweet in this thread? You can try to

force a refresh