#NFTs: A Nascent Investable Asset Class With 10X Potential

My investment thesis via a long🧵

accelerateshares.com/blog/nfts-a-na…

1/

My investment thesis via a long🧵

accelerateshares.com/blog/nfts-a-na…

1/

It isn’t every day that a piece of art, specifically digital art, sells for a lofty eight-figure sum.

Last spring, Everydays: The First 5000 Days, a digital work of art by digital artist Beeple, sold as an NFT for $69.3 million (paid for with 42,329 Ether).

2/

Last spring, Everydays: The First 5000 Days, a digital work of art by digital artist Beeple, sold as an NFT for $69.3 million (paid for with 42,329 Ether).

2/

The $69.3 million price tag for Everydays registers on the list of most expensive artworks by living artists, establishing digital artist Beeple amongst legendary artists.

The fact that an NFT, or non-fungible token, sold for nearly $70 million had everyone asking…

3/

The fact that an NFT, or non-fungible token, sold for nearly $70 million had everyone asking…

3/

NFT is an acronym for non-fungible token. Technically speaking, the majority of NFTs are ERC-721 tokens on the Ethereum blockchain.

These tokens are “non-fungible”, indicating that each token represents a unique digital asset.

4/

These tokens are “non-fungible”, indicating that each token represents a unique digital asset.

4/

NFTs are a new type of crypto asset that combine art with elements of blockchain and social networks.

They derive value based on aesthetics, social proof, membership, network effects, brand building and culture.

5/

They derive value based on aesthetics, social proof, membership, network effects, brand building and culture.

5/

NFTs allow users to not just participate in, but to own Web3.

Given their potential extensive use in digital worlds, NFTs provide a “pure-play” exposure to the metaverse.

6/

Given their potential extensive use in digital worlds, NFTs provide a “pure-play” exposure to the metaverse.

6/

Web3 represents the next era of the internet, via decentralized networks, driven by tokens traded on blockchains.

7/

7/

The ethos of Web3 is two-fold:

A) Organizations are decentralized, with no central ownership

B) Networks are owned by the users and the network value accrues to the users, not multinational corporations or venture capitalists

8/

A) Organizations are decentralized, with no central ownership

B) Networks are owned by the users and the network value accrues to the users, not multinational corporations or venture capitalists

8/

The metaverse is a segment of Web3 and refers to virtual worlds of the decentralized internet.

In Web3 and the metaverse, one’s identity will be inextricably linked to one’s NFTs and crypto wallet.

9/

In Web3 and the metaverse, one’s identity will be inextricably linked to one’s NFTs and crypto wallet.

9/

If one’s digital identity is their virtual representation, then metaverse participants will likely invest vast sums of money into their avatars and digital assets.

10/

10/

Web3 will utilize the Ethereum blockchain as its main infrastructure. Therefore, ether (Ethereum’s associated token) will represent a leveraged play on Web3’s growth.

Since NFTs are denominated in ether, NFTs represent a leveraged play on the growth of Ethereum.

11/

Since NFTs are denominated in ether, NFTs represent a leveraged play on the growth of Ethereum.

11/

Ergo, NFTs represent a double-leveraged bet on Web3. If you believe in the future of Web3, then NFTs are the best way to gain exposure to its potential.

12/

12/

Why Should Anyone Care About NFTs?

When people think about NFTs, the initial point that comes to mind is the eye-popping price tag that some of the more popular NFT collections secure for what appears to be “just a jpeg”.

13/

When people think about NFTs, the initial point that comes to mind is the eye-popping price tag that some of the more popular NFT collections secure for what appears to be “just a jpeg”.

13/

NFTs have become a cultural phenomenon, with countless actors, entertainers and athletes proudly “flossing” their collections.

14/

14/

Celebrities such as Jimmy Fallon, Eminem, Snoop Dogg, Steph Curry, Serena Williams and Jay-Z have recently acquired sought-after NFTs including CryptoPunks or Bored Ape Yacht Club, costing well into 6-figures.

15/

15/

Popular NFT holders have cumulative social media followings into the 100s of millions. This exposure in and of itself is highly accretive to these specific collections, and it accrues to holders of all tokens in that collection.

16/

16/

NFTs have become the default way to display social proof in the digital age. They confer wealth, status and social influence.

17/

17/

In the era of Web3, one’s digital identity becomes more important than one’s physical identity. And NFTs present the most straightforward way to burnish your Web3 reputation, somewhat analogous to a digital Lamborghini or an MBA.

18/

18/

As such, the most sought-after NFTs have become Veblen goods, in which demand increases as the price increases. Who doesn’t want to be in the same hyper-exclusive club as Eminem and Snoop Dogg?

19/

19/

The small handful of “blue chip” NFT collections are limited in supply + have high demand. Top NFT collections now amount to billions of $ of value

Economics 101 indicates that rare, sought-after assets with steadily increasing demand tend to experience an increase in price

20/

Economics 101 indicates that rare, sought-after assets with steadily increasing demand tend to experience an increase in price

20/

Aside from flossing, non-fungible tokens represent digital art that is by definition, unique. While a digital image can be copied an infinite number of times, an NFT can only be owned by one collector.

21/

21/

While those unfamiliar with the space think one can simply right-click-save on a digital artwork, true ownership in this scenario is not transferred, just as one does not own the Mona Lisa if a photo of it is taken.

22/

22/

Holders of replicas do not confer the many benefits of NFT ownership, including the ability to sell it.

However, those right-click-savers increase the value of the original artwork by inadvertently promoting it.

23/

However, those right-click-savers increase the value of the original artwork by inadvertently promoting it.

23/

Every time you wear a Nike Swoosh, you increase the value of the brand (without owning it). The beauty of Web3 is that the value increase goes to its users.

24/

24/

NFTs have resolved the centuries-old problem of the art market – provenance and authenticity.

In the physical art world, even the most highly valued artworks are tainted with the possibility of being well-crafted counterfeits.

25/

In the physical art world, even the most highly valued artworks are tainted with the possibility of being well-crafted counterfeits.

25/

The Salvator Mundi, a painting sold for a record-breaking $450mm in 2017 to a Saudi prince, has been marred with allegations that it was not actually painted by Leonardo da Vinci. Non-fungible tokens have their current ownership can be mathematically proven via blockchain

26/

26/

Historically, physical art has been relatively illiquid, with the majority of works for sale through galleries and auction houses with exorbitant commissions. NFTs, traded on the Ethereum blockchain, have resolved the illiquidity problem behind physical art.

27/

27/

Digital works can now be highly liquid. Popular NFT collections trade millions of dollars per day, with accurately priced pieces selling in mere minutes. Increased liquidity and marketability can make the artwork more valuable by eliminating the illiquidity discount.

28/

28/

Over the past 50 years, time and time again, it has been proven that humans prefer digital media over physical media. People prefer Netflix over VHS tapes, Spotify over the record player, and email over phone calls.

29/

29/

Over time, each media has transitioned from physical to digital due to universal cultural preference. Art will be no different, and it is only a matter of time before the digital art market exceeds that of its physical counterpart (and likely by an order of magnitude).

30/

30/

Digital media is simpler to collect, given storage is effectively unlimited and physical space is not a limiting factor. In addition, digital media has flipped the security concerns regarding ownership of digital assets.

31/

31/

If one has a highly valued artwork hanging at home, a significant investment in physical security would be required. If one prints out a highly valued NFT and hangs it at home, the theft risk of the physical copy is minimal given the physical print is seemingly worthless

32/

32/

As long as the NFT is appropriately stored on a hardware wallet, it should be safe. In addition, there is no need to worry about damage or depreciation of digital art. As digital music and movies, digital art is far more practical than its physical brethren.

33/

33/

Aside from speculative value, which has accrued to those holders who bought into sought-after collections early, some NFT collections can generate substantial income for their owners.

34/

34/

Specifically, some NFT holders are often rewarded with token airdrops or advantageous access to new, valuable projects. These unexpected financial rewards are analogous to dividends for NFT holders.

35/

35/

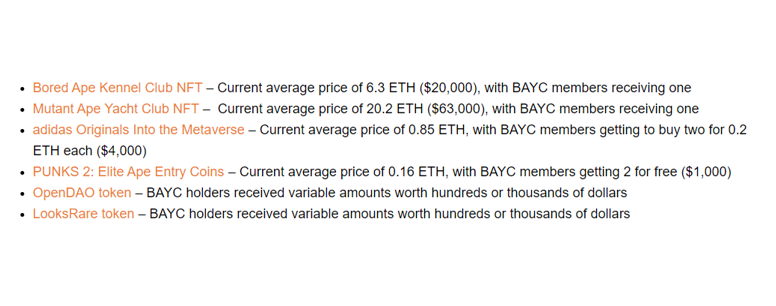

For example, an owner of a Bored Ape Yacht Club NFT (BAYC) have been rewarded with the following “special dividends” through airdrops and special access provided through owning the BAYC NFT:

36/

36/

Over the past 7 months, a Bored Ape Yacht Club owner has received nearly $100,000 of “special dividends”, via airdrops or early access. However, these perks do not take into account the highly-anticipated potential APE token of the DAO that will one day own rights to BAYC

37/

37/

While not nearly as lucrative as BAYC, high-quality NFT collections typically reward their holders with financial perks.

Where else in markets can you find a yield like that? It can pay to be an NFT holder.

38/

Where else in markets can you find a yield like that? It can pay to be an NFT holder.

38/

In addition to airdrops and exclusive access opportunities, high-quality NFTs grant owners rights over the intellectual property. Ownership rights allow an individual to capitalize on the token collection’s brand value by building a company or an organization around an NFT.

39/

39/

Instead of building a brand from scratch, a company can piggyback on a global NFT community by acquiring a token and building off the head start of global recognition that it provides. Alternatively, NFT holders may license their IP to other builders or creators.

40/

40/

When an asset is widely held within a community, members have a collective incentive to increase the value of their shared asset. Specifically, shareholder-employees within a corporation work together to increase the value of their collective stake.

41/

41/

Similarly, NFT holders within a collection form a tight community to increase the value of their tokens. Ownership of one NFT within a 10,000 token collection implies that there are 9,999 others who are incentivized to increase the value of your asset.

42/

42/

Given the shared economic incentive along with the social proof and dedication to the collective culture, NFT collections have created loyal and influential social networks. These social networks gather on Discord, Twitter and at in person events.

43/

43/

The new social networks formed of Web3 pose such a threat to the incumbents that Facebook, a nearly $1-trillion company, freaked out, changed its name to Meta Platforms and completely transformed its vision to “help bring the metaverse to life.”

44/

44/

Meta CEO Mark Zuckerberg likely did not take this decision lightly – it appears analogous to when Facebook pivoted from desktop to mobile. Mobile was (is) big.

45/

45/

Web3 could become increasingly more significant and the most popular NFT collections may become the Googles, Amazons and Facebooks of Web3.

46/

46/

We Are Still Early

On the user adoption curve, Web3 in 2022 is analogous to the internet in 1992 or cryptocurrency in 2013. The popularity of NFTs, since they represent “pure play” exposure to Web3, indicates where we are on the growth curve of the technology.

47/

On the user adoption curve, Web3 in 2022 is analogous to the internet in 1992 or cryptocurrency in 2013. The popularity of NFTs, since they represent “pure play” exposure to Web3, indicates where we are on the growth curve of the technology.

47/

According to Google Trends, current user search interest in NFTs matches that of bitcoin in 2013.

48/

48/

Currently, there are fewer than 1 million NFT users, roughly equivalent to the number of bitcoin wallets in 2013. The number of cryptocurrency wallets has surged from approximately 1 million in 2013 to more than 220 million today.

49/

49/

If NFT adoption follows bitcoin, then the potential for 100x growth in users exists. If the user base grows 100x, with a fixed number of blue-chip NFT collections available, prices will likely increase markedly.

50/

50/

NFTs began to emerge as an asset class mere months ago, with the market growing from practically nothing at the start of 2021 to an estimated $41 billion by the end of the year.

51/

51/

NFT trading volume on OpenSea, the leading NFT exchange, has surged to more than $3 billion per month from near zero one year ago. It is safe to say that things are moving quickly in this new asset class.

52/

52/

Nonetheless, the NFT market is dominated by retail, with effectively nil institutional participation.

Institutional investors have not yet entered the NFT space.

53/

Institutional investors have not yet entered the NFT space.

53/

Analogous to bitcoin in 2013, enterprising investors who enter the market in its nascent stages have the potential for significant upside returns by allocating before large investors enter the market, pushing up prices.

54/

54/

Due to a lack of professional investors, the NFT market remains highly inefficient

55/

55/

Key Risks

Non-fungible tokens are crypto-assets that trade on a blockchain, and given the nascent market for these tokens, trading them and storing them can be technically challenging.

56/

Non-fungible tokens are crypto-assets that trade on a blockchain, and given the nascent market for these tokens, trading them and storing them can be technically challenging.

56/

Specifically, security is of major concern when dealing with tokens.

As such, one should certainly store valuable NFTs on a hardware wallet such as Ledger or Trezor. An NFT investor should never give out a seed phrase, private keys or passwords.

57/

As such, one should certainly store valuable NFTs on a hardware wallet such as Ledger or Trezor. An NFT investor should never give out a seed phrase, private keys or passwords.

57/

An NFT investor should never click on any links sent to them through apps such as Discord and exercise extreme caution when connecting your wallet to a website.

58/

58/

When considering allocating to the asset class, remember that NFTs are incredibly risky and tremendously volatile. NFTs are one of the highest risk assets in the market and could readily go to zero. Do not risk more than you can lose when allocating to NFTs.

59/

59/

Conclusion

When I first heard of bitcoin in 2013, I brushed it off as inconsequential. People are stubborn by nature and tend to be skeptical of new things. I certainly was.

60/

When I first heard of bitcoin in 2013, I brushed it off as inconsequential. People are stubborn by nature and tend to be skeptical of new things. I certainly was.

60/

However, #bitcoin taught me an important lesson. I did not “see the light” and buy bitcoin until 2017 after it had already risen 4x from when I first ignored it. This costly lesson taught me to be open-minded about new asset classes.

/61

/61

I learned that high-upside investments sometimes require a leap of faith, given there is no previous experience or familiar precedents to compare them to.

/62

/62

Nonetheless, I see a clear analog between bitcoin in 2013 and NFTs in 2022. I do not want to make the same mistake twice.

/63

/63

NFTs are a rapidly growing asset class exploding in popularity. Nonetheless, the market is still at a very early stage. We believe that a diversified portfolio of NFTs has high return potential, albeit, with very high risk, that can be obtained in an uncorrelated fashion

/64

/64

Thus far, NFT prices have been driven by variables independent of the drivers of traditional asset classes, therefore exuding diversification benefits. When considering diversifying your investment portfolio with an NFT allocation, it should likely be below 1%

/65

/65

NFTs are an early stage, emerging and exciting alternative asset class with 10x potential but extreme risk. Proceed with cautious optimism.

If you enjoyed this thread (and made it this far!), please retweet 🙏

/66

If you enjoyed this thread (and made it this far!), please retweet 🙏

/66

• • •

Missing some Tweet in this thread? You can try to

force a refresh