🧵Thread on Warrants, Share Buybacks & Right Issues

🧵Let's unroll:

What are Warrants?

Equity warrants are instruments that bestow upon the holder of the instrument the right to buy a particular stock at a predetermined price within a stipulated time frame.

🧵Let's unroll:

What are Warrants?

Equity warrants are instruments that bestow upon the holder of the instrument the right to buy a particular stock at a predetermined price within a stipulated time frame.

Who can apply?

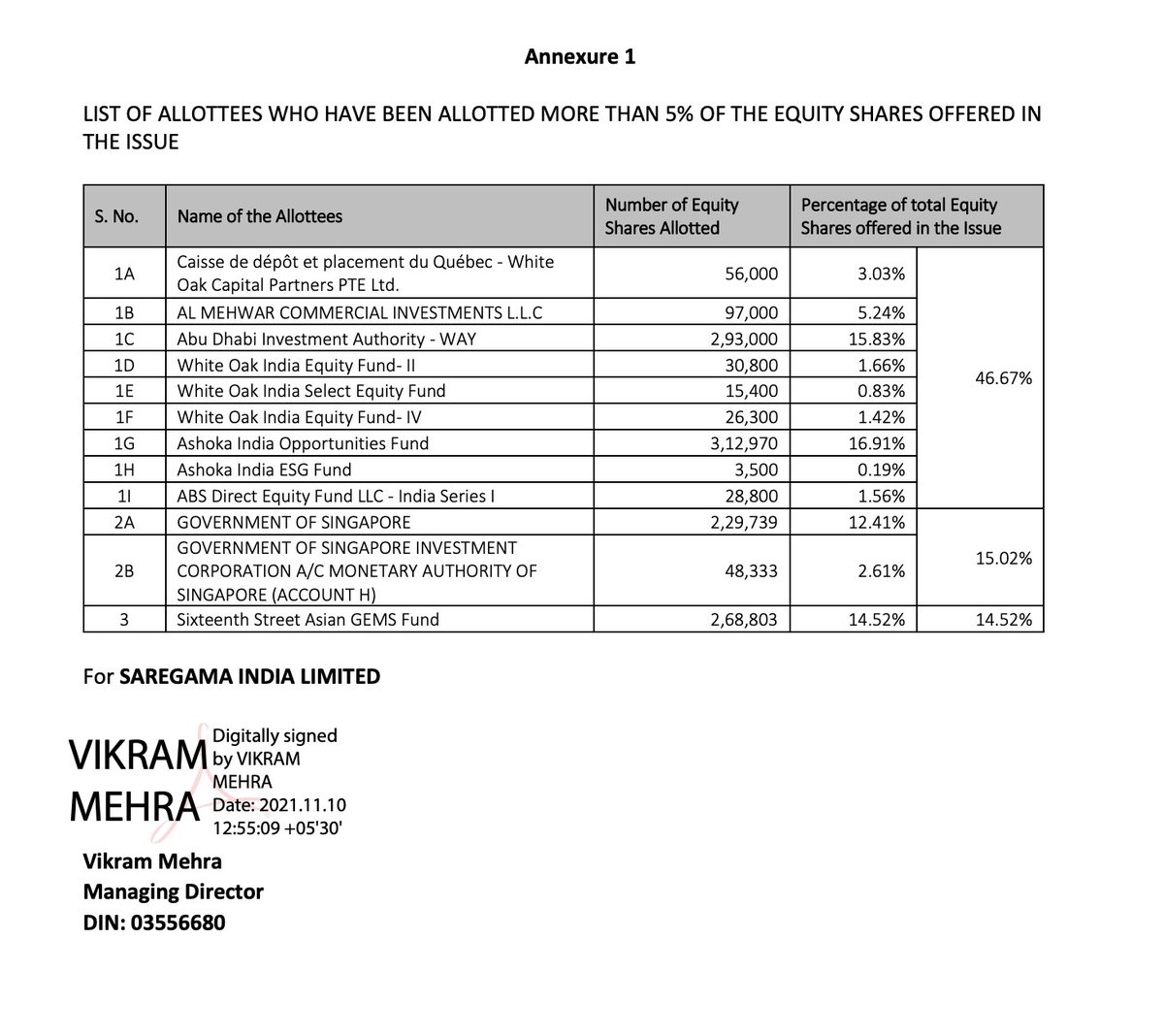

Warrants are issued by the way of preferential allotment to promoters, institutional investors, and other strategic investors.

Warrants are issued by the way of preferential allotment to promoters, institutional investors, and other strategic investors.

How to apply?

Warrants are issued by the way of preferential allotment to promoters, institutional investors, and other strategic investors.

In case the warrants are not exercised, the entire upfront payment is forfeited.

Warrants are issued by the way of preferential allotment to promoters, institutional investors, and other strategic investors.

In case the warrants are not exercised, the entire upfront payment is forfeited.

Who determines the price?

The price of warrants conversion is determined based on the SEBI guidelines.

The price of warrants conversion is determined based on the SEBI guidelines.

Voting Rights:

Since warrants are not equity shares, they do not carry any dividend or voting rights. It is only after warrants are converted into equity shares does the investor gain dividend and voting rights.

Since warrants are not equity shares, they do not carry any dividend or voting rights. It is only after warrants are converted into equity shares does the investor gain dividend and voting rights.

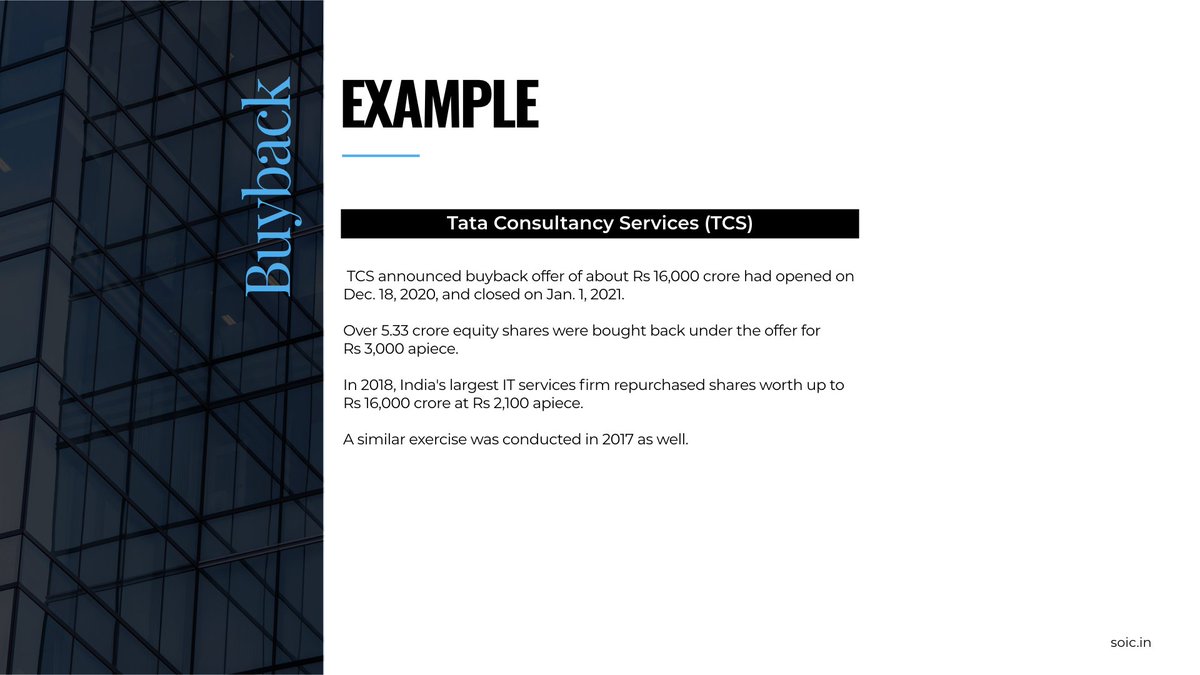

What is a share buyback?

A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given

A buyback of shares is buying back of own shares by a company that was issued earlier. It is a corporate action event wherein a company makes a public announcement for the buyback offer to acquire the shares from existing shareholders within a given

timeframe. The company announces an offer price for the buyback that is generally higher than the current market price.

Reasons for buyback:

• When there is excess cash but not enough projects

• To invest in

• Tax-efficient method of rewarding shareholders

Strengthen promoter holding in the company

• When there is excess cash but not enough projects

• To invest in

• Tax-efficient method of rewarding shareholders

Strengthen promoter holding in the company

What is a rights issue?

A rights issue is a primary market offer to the existing shareholders to buy additional shares of the company on a pro-rata basis within a specified date at a discounted price than the current market price.

A rights issue is a primary market offer to the existing shareholders to buy additional shares of the company on a pro-rata basis within a specified date at a discounted price than the current market price.

It is important to note that the rights issue offer is an invitation that provides an opportunity for existing shareholders to increase their shareholding. It is a right that a shareholder may or may not choose to exercise and not an obligation to buy the shares.

Eligibility:

The rights issue is only open to existing shareholders of the company and not the general public. A company announces record date in case of a rights issue.

The rights issue is only open to existing shareholders of the company and not the general public. A company announces record date in case of a rights issue.

To be eligible to qualify as an existing shareholder for the rights issue, one must own the shares of the company as on the record date.

Benefits for the company:

1. Rights issue is the fastest mode of raising capital for the company.

2. It is a low-cost affair for the company as company can save on the underwriters fees, advertisement expenses.

1. Rights issue is the fastest mode of raising capital for the company.

2. It is a low-cost affair for the company as company can save on the underwriters fees, advertisement expenses.

3. The confidence of the existing shareholders is retained by making the discounted offer to existing owners as payback for being part of the company.

4. The company can raise additional funds without increasing the debt burden.

4. The company can raise additional funds without increasing the debt burden.

Benefits to the shareholders:

1. Rights issues provide an opportunity for existing shareholders to increase their stake in the company at a lesser price than the current market price.

1. Rights issues provide an opportunity for existing shareholders to increase their stake in the company at a lesser price than the current market price.

2.The rights issue retains the control of the company with existing shareholders when subscribed by the existing shareholders without renouncing their rights to outsiders.

• • •

Missing some Tweet in this thread? You can try to

force a refresh